Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

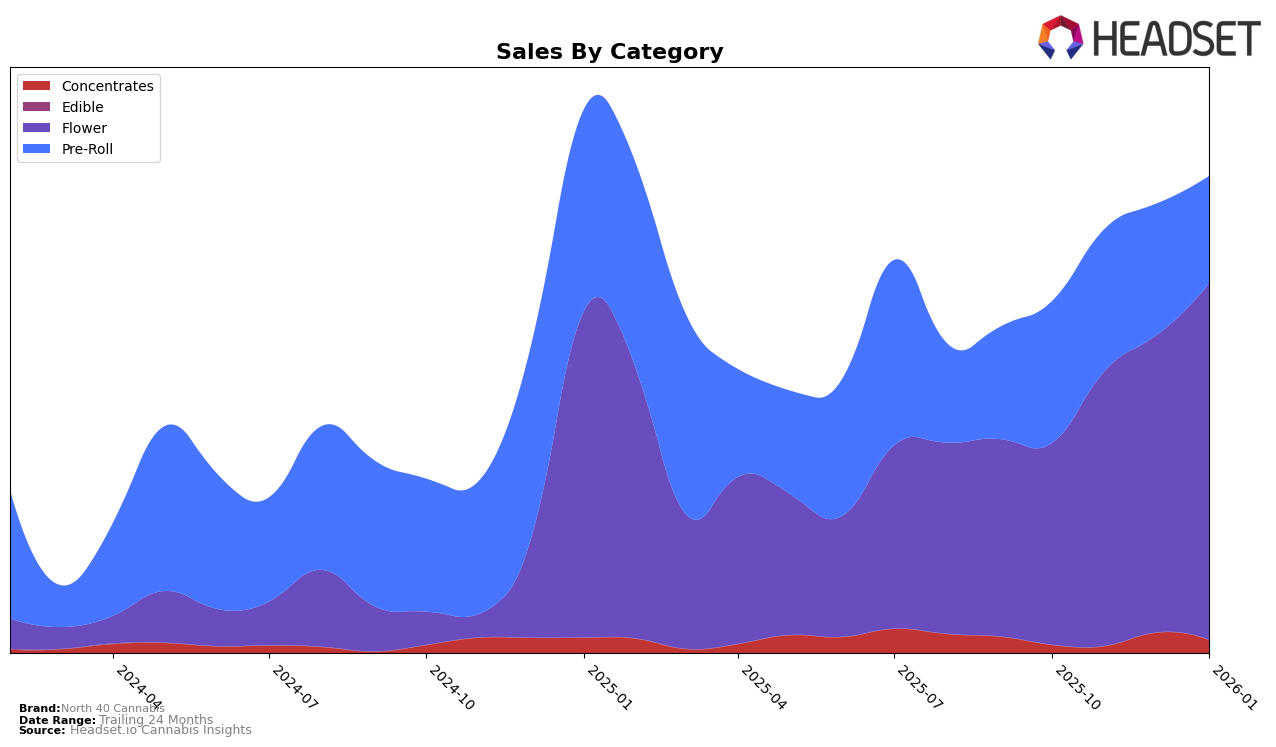

North 40 Cannabis has shown a notable upward trajectory in the Flower category within Saskatchewan. Climbing from the 23rd position in October 2025 to 11th by January 2026, this movement reflects a significant strengthening of their market presence. This improvement is supported by a steady increase in sales, culminating in a notable figure by the beginning of 2026. Such progress suggests that North 40 Cannabis is effectively capturing consumer interest and expanding its footprint in the Flower category, which could indicate strategic initiatives or product offerings resonating well with the local market.

Conversely, the Pre-Roll category tells a different story, as North 40 Cannabis experienced fluctuations in their rankings over the same period. Starting at 23rd in October 2025, they briefly improved to 21st by December, before slipping back to 24th in January 2026. This inconsistency, paired with a decline in sales, suggests challenges in maintaining momentum in this segment. The brand's presence in the top 30, albeit at a lower rank, indicates ongoing competition and potential areas for improvement. Monitoring how North 40 Cannabis addresses these challenges in the Pre-Roll category could provide insights into their strategic adjustments moving forward.

Competitive Landscape

In the competitive landscape of the Flower category in Saskatchewan, North 40 Cannabis has demonstrated a notable upward trajectory in rankings from October 2025 to January 2026. Starting at rank 23 in October, North 40 Cannabis climbed to rank 11 by January, showcasing a significant improvement in market positioning. This upward movement is particularly impressive when compared to competitors such as Pure Sunfarms, which maintained a steady rank of 10 throughout the same period, and Red Barn, which fluctuated but remained close to its initial position. Meanwhile, Divvy made a dramatic leap from being unranked in November to securing the 8th position in December, although it slightly declined to 9th in January. Bake Sale also showed competitive resilience, improving from 26th to 13th over the four months. North 40 Cannabis's consistent sales growth, culminating in a January sales figure that rivals those of its higher-ranked competitors, underscores its strengthening presence in the Saskatchewan market.

Notable Products

In January 2026, the top-performing product from North 40 Cannabis was LSC x North 40 - Sunny Skies Pre-Roll (1g), maintaining its lead from December with a notable sales figure of 1936 units. Lemon Haze (3.5g) rose to the second position, improving from its consistent third-place ranking in the previous two months. El Gordo Pre-Roll 3-Pack (1.5g) returned to the rankings in third place after being unranked in November and December. Saskatchewan Platinum (7g) secured the fourth spot, showing a slight decline from its first-place position in October. LSC x North 40 - Starry Skies Pre-Roll (1g) experienced a drop to fifth place from its second-place standing in December, indicating a shift in consumer preference within the pre-roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.