Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

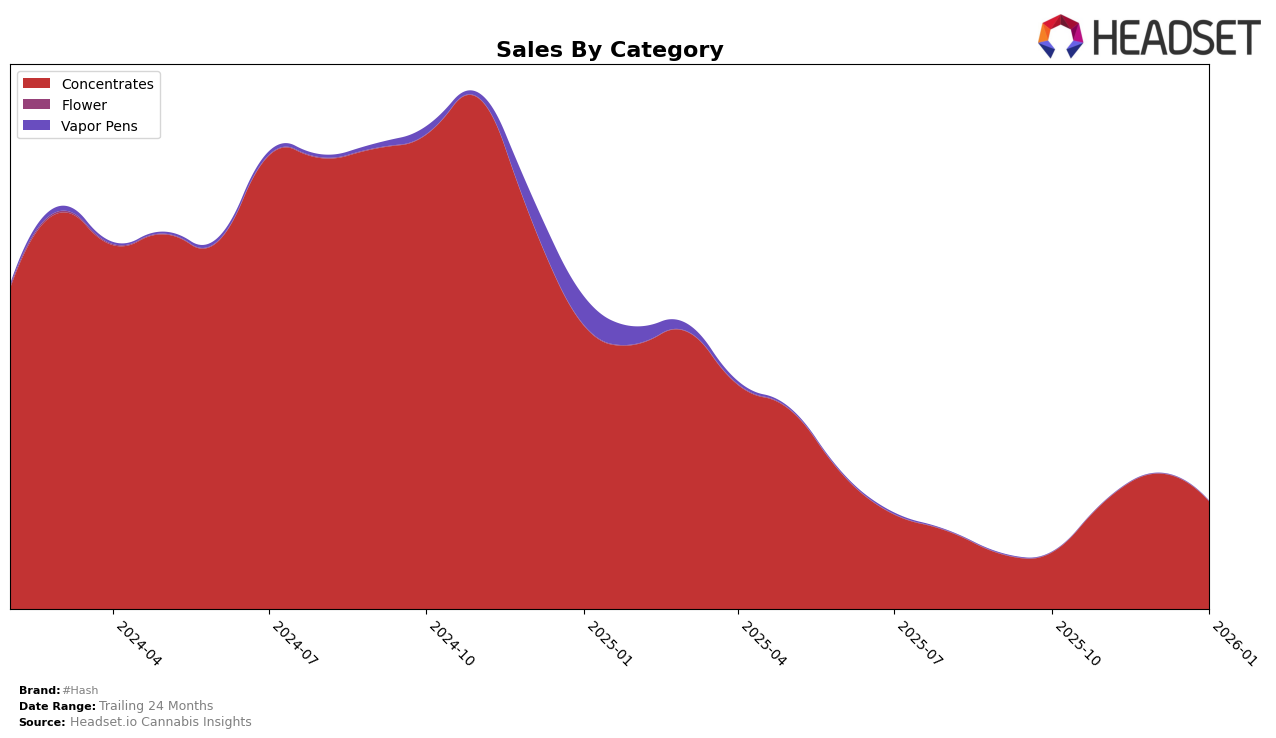

#Hash has shown varying performance across different states in the Concentrates category. In Illinois, the brand has experienced fluctuations in its rankings, moving from 35th in October 2025 to 28th in November, then slipping to 31st in December, and further down to 37th by January 2026. This indicates a challenging market environment or potential competition affecting its standing. In contrast, New York has been a more favorable market for #Hash, with consistent top 10 rankings, peaking at 5th in November 2025. This strong performance in New York suggests a significant consumer demand and brand recognition in the state.

In Maryland, #Hash made a notable entry into the top 30 in January 2026, securing the 28th position, which could indicate a growing presence or recent marketing efforts paying off. Meanwhile, in Ohio, the brand has maintained a relatively stable presence, staying within the top 20 over the observed months, showing a consistent consumer base. The absence of rankings in some months for Illinois and Maryland suggests challenges in maintaining a competitive edge in those markets, which could be an area of focus for future strategy. Overall, #Hash's performance varies significantly by state, highlighting the importance of tailored approaches to different regional markets.

Competitive Landscape

In the competitive landscape of New York's concentrates market, #Hash has demonstrated a remarkable upward trajectory in brand rank and sales over the past few months. Starting from a rank of 15 in October 2025, #Hash surged to the 5th position by November, maintaining a strong presence in the top 10 through January 2026. This ascent is noteworthy, especially when compared to competitors like Hudson Cannabis, which consistently held a top 5 position but saw a decline in sales from November to January. Meanwhile, Blotter and New York Honey (NY Honey) have shown stable yet less dynamic movements in rank, with Blotter fluctuating between 6th and 7th place, and NY Honey hovering around the 7th to 9th positions. Interestingly, UMAMII has been climbing steadily, reaching 8th place by January, suggesting a potential future challenge to #Hash's position. These shifts highlight #Hash's competitive edge in capturing market share and increasing sales, positioning it as a formidable player in the concentrates category.

Notable Products

In January 2026, the top-performing product from #Hash is Strawberry OG Cookies Crumble (1g) in the Concentrates category, securing the first rank with impressive sales of 492 units. Following closely is Strawberry OG Cookies Budder (1g), which holds the second position with notable sales figures. Orange Cookies Sugar Wax (1g) ranks third, showing strong market presence in the Concentrates category. Chem OG Budder (1g) and Mendo Breath Budder Wax (1g) round out the top five, ranking fourth and fifth respectively. This January ranking marks a significant debut for these products, as they were not ranked in the previous months of October, November, or December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.