Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

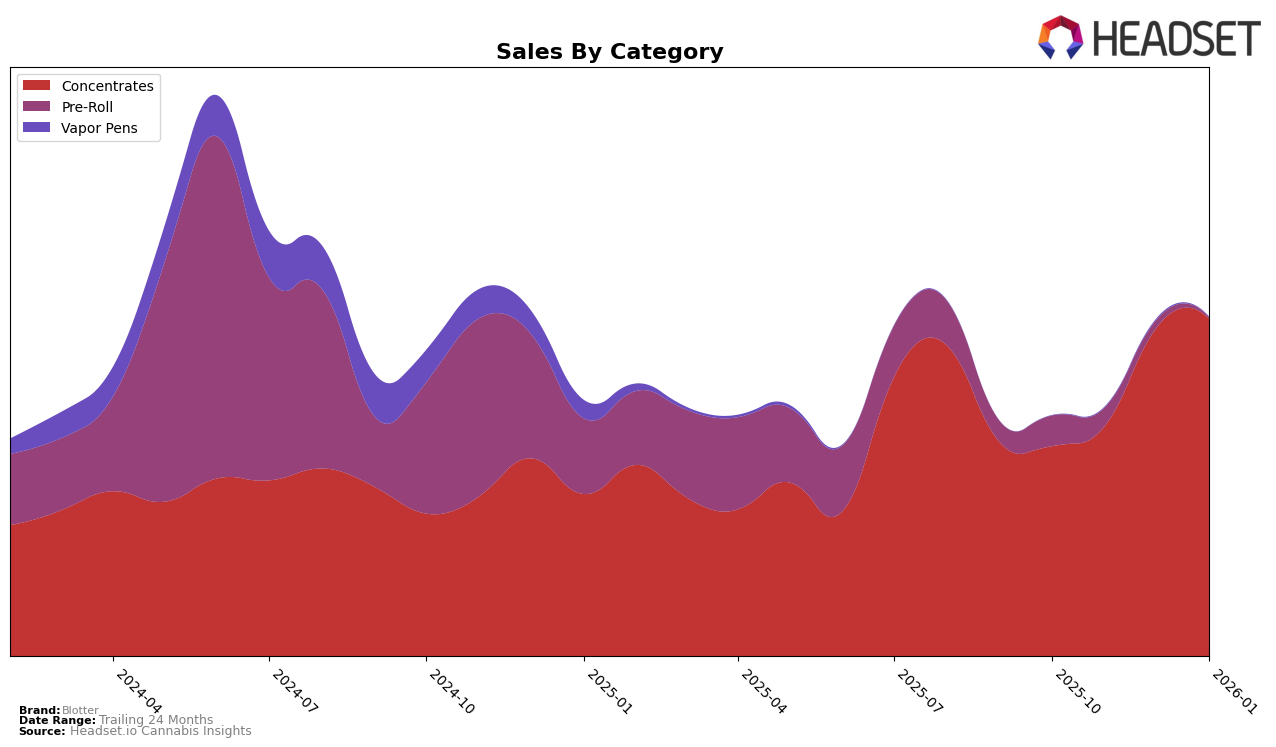

Blotter has shown a consistent presence in the New York concentrates market, maintaining a steady rank between 6th and 7th place from October 2025 through January 2026. This stability suggests a strong foothold in the market, with a slight improvement in January 2026 as they climbed back to the 6th position. The brand's performance in this category indicates a robust demand for their concentrates, as evidenced by a noticeable increase in sales from October to January, with January sales reaching $233,935. This upward trend in sales showcases Blotter's ability to capture consumer interest and maintain a competitive edge in the concentrates category.

It is noteworthy that Blotter's presence in other states or categories is not mentioned, indicating that they may not have secured a top 30 position in those markets. This could either be a strategic focus on the New York concentrates market or a potential area for growth and expansion into other regions or product categories. The absence of rankings in other states could be seen as a challenge for Blotter to diversify its market presence and explore opportunities beyond its current stronghold. Understanding the dynamics of different markets could provide Blotter with insights into potential areas for expansion and increased brand visibility.

Competitive Landscape

In the competitive landscape of New York's concentrates category, Blotter has maintained a relatively stable position, ranking between 6th and 7th from October 2025 to January 2026. Despite a slight dip in November 2025, Blotter's sales have shown a positive trend, increasing from October to January. This stability is notable given the dynamic shifts among competitors. Hudson Cannabis consistently ranks higher, maintaining a top 5 position, although its sales saw a decline in January 2026. Meanwhile, Nyce has shown strong performance, climbing to 4th place by January 2026, with sales significantly surpassing Blotter's. #Hash also emerged as a strong competitor, jumping from 15th in October to 7th by January, indicating a rapid increase in market presence. UMAMII has shown consistent improvement in rank, suggesting a growing market share. Blotter's ability to maintain its rank amidst these shifts highlights its resilience, but the brand may need to innovate or increase marketing efforts to climb higher against these aggressive competitors.

Notable Products

In January 2026, Trop Cherry Cured Resin Sap (1g) maintained its position as the top-performing product for Blotter, with notable sales of 1012 units. Chem Dawg Live Resin Sugar (1g) rose to second place, showing a steady increase from third place in December 2025. Hybrid THCA Diamond Powder (1g) consistently held the third position, matching its December ranking with 510 units sold. New entrants Mac N Peaches Live Resin Sugar (1g) and Sundae Driver Live Resin Sugar (1g) secured the fourth and fifth spots, respectively, indicating a strong debut in the rankings. These shifts highlight a dynamic change in consumer preferences towards various concentrate products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.