Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

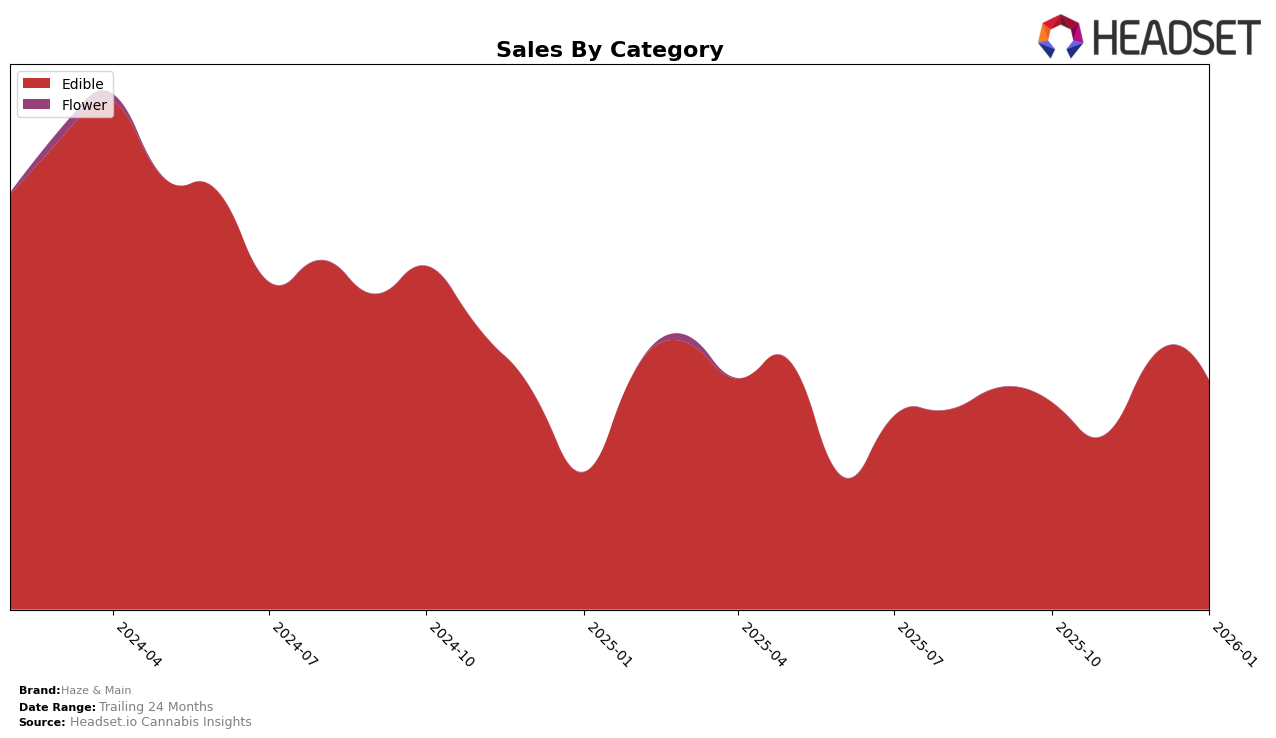

Haze & Main has shown varied performance across different states and categories, with notable fluctuations in ranking positions over the recent months. In the Arizona market, the brand's presence in the Edible category has been relatively stable, maintaining a position within the top 30 brands. Specifically, Haze & Main ranked 24th in October and November 2025, improved slightly to 22nd in December, but then dropped to 25th in January 2026. This movement suggests a competitive environment in Arizona's Edible category, where Haze & Main has managed to sustain visibility but faces challenges in climbing higher in the rankings. The fluctuation in sales figures, particularly the increase from November to December, indicates a potential seasonal boost or successful promotional effort during that period.

Despite these ranking fluctuations in Arizona, Haze & Main's consistent presence in the top 30 suggests a steady consumer base and brand recognition. However, the drop to 25th in January highlights the need for strategic adjustments to regain and potentially improve their standing. The absence of data for other states or categories implies that Haze & Main might not be as competitive or widely recognized outside the Arizona Edible market, indicating potential areas for growth and expansion. This could be an opportunity for the brand to explore new strategies or product innovations to capture a larger market share in different regions or categories.

Competitive Landscape

In the competitive landscape of the Arizona edible market, Haze & Main has experienced notable fluctuations in its ranking and sales performance from October 2025 to January 2026. Starting at 24th place in October and November, Haze & Main improved to 22nd in December, only to drop to 25th in January. This volatility contrasts with the steady performance of BITS, which consistently held the 23rd rank throughout the same period, indicating a stable consumer base. Meanwhile, Kushy Punch re-entered the top 25 in December and January, suggesting a resurgence in popularity. Despite these shifts, Haze & Main's sales peaked in December, surpassing competitors like iLava and O'Geez (WA), though it faced a decline in January. These dynamics highlight the competitive pressures and opportunities for Haze & Main to strategize for sustained growth in this evolving market.

Notable Products

In January 2026, the top-performing product for Haze & Main was the Milk Chocolate Bar 10-Pack (100mg), maintaining its first-place ranking consistently since October 2025 with sales of 2,366 units. The Dark Chocolate Fubar Bar 10-Pack (1000mg) also held steady at the second position throughout the months. The Dark Plain Chocolate Bar (100mg) remained in third place in January, having briefly dropped to fourth in November 2025. Meanwhile, the Dark Chocolate 10-Pack (100mg) stayed in fourth place, showing a slight dip in sales compared to December 2025. Lastly, the Dark Chocolate Bar 10-Pack (500mg) consistently ranked fifth, with a notable decrease in sales over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.