Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

O'Geez (WA) has shown a consistent presence in the Arizona edible market, maintaining a steady ranking of 26th position across several months, despite a slight dip to 27th in December 2025. This stability is underscored by a notable upward trend in sales, with a significant increase from November 2025 to February 2026. In contrast, their performance in Illinois is less prominent, as they failed to break into the top 30 edible brands in the first three months of 2026, only appearing in the rankings in February at 53rd place. This indicates a potential area for growth and increased market penetration in Illinois.

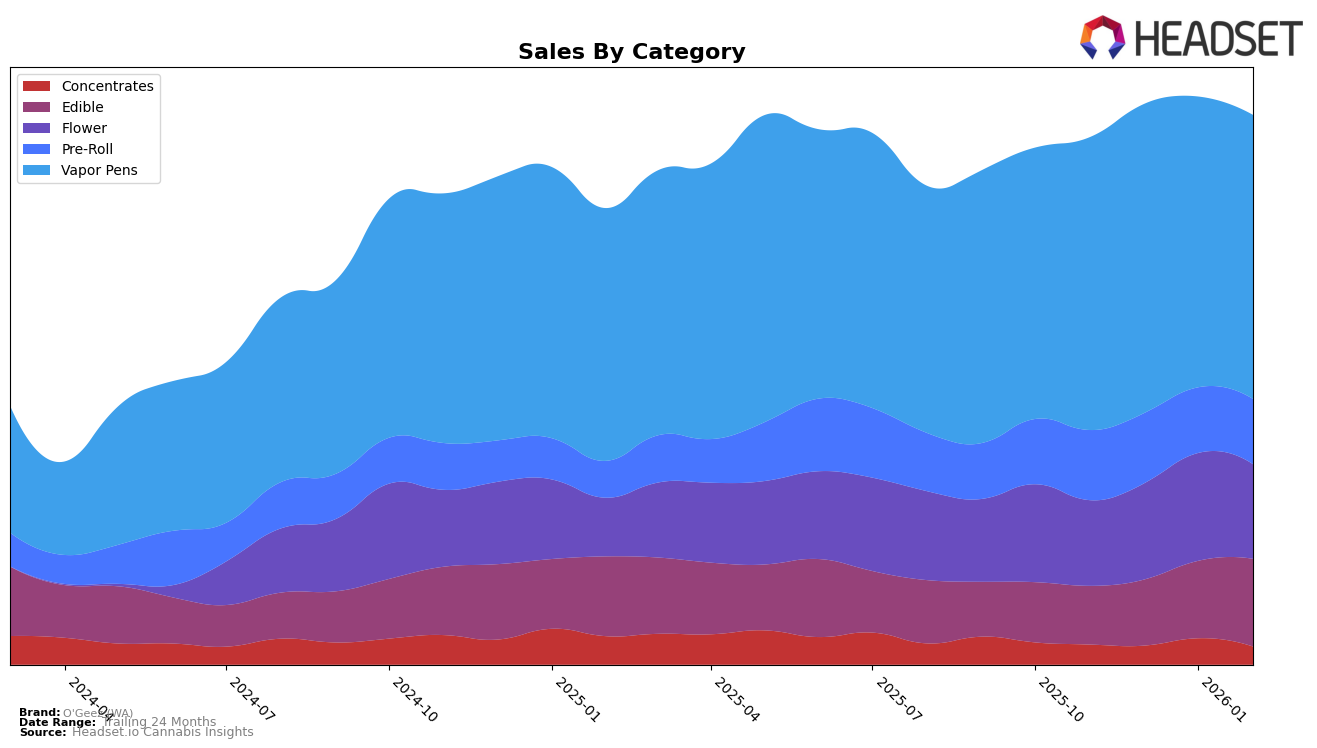

In their home state of Washington, O'Geez (WA) has shown varied performance across different product categories. The brand has made significant strides in the vapor pen category, improving its ranking from 22nd to 19th from November 2025 to February 2026. This upward movement is supported by consistently high sales figures, although there was a slight dip in February 2026. However, in the concentrates category, the brand experienced fluctuations, with a peak in January 2026 at 63rd before dropping to 77th in February. The flower and pre-roll categories have seen a more stable performance, with gradual improvements in rankings, particularly in pre-rolls, where they climbed from 53rd to 45th over the same period.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, O'Geez (WA) has shown a gradual improvement in its ranking from November 2025 to February 2026. Starting at rank 22 in November and December, O'Geez (WA) climbed to rank 19 by February, indicating a positive trend in market presence. This upward movement is noteworthy, especially when compared to brands like Forbidden Farms and Oleum Extracts (Oleum Labs), which experienced fluctuations and a general decline in sales during the same period. Buddies and Slusheez also faced challenges, with Buddies dropping from rank 15 to 17 and Slusheez slipping slightly from 17 to 18. O'Geez (WA)'s ability to improve its rank amidst these shifts suggests a strengthening foothold in the market, potentially driven by strategic marketing or product differentiation that resonates with consumers.

Notable Products

In February 2026, the top-performing product from O'Geez (WA) was the CBD/THC 1:1 Strawberries & Cream Gummies 10-Pack, maintaining its position at rank 1 with sales of 8,558 units. The 9lb Hammer Distillate Cartridge remained steady at rank 2, showing consistent demand from the prior month. The Granddaddy Purple Distillate Disposable held its ground at rank 3, demonstrating stable popularity. Pineapple Express Distillate Cartridge continued to secure the 4th position, while the Alaskan Thunder Fuck Distillate Disposable entered the rankings at 5th place. These rankings indicate a strong preference for edibles and vapor pens among consumers, with minimal shifts in product popularity from previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.