Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

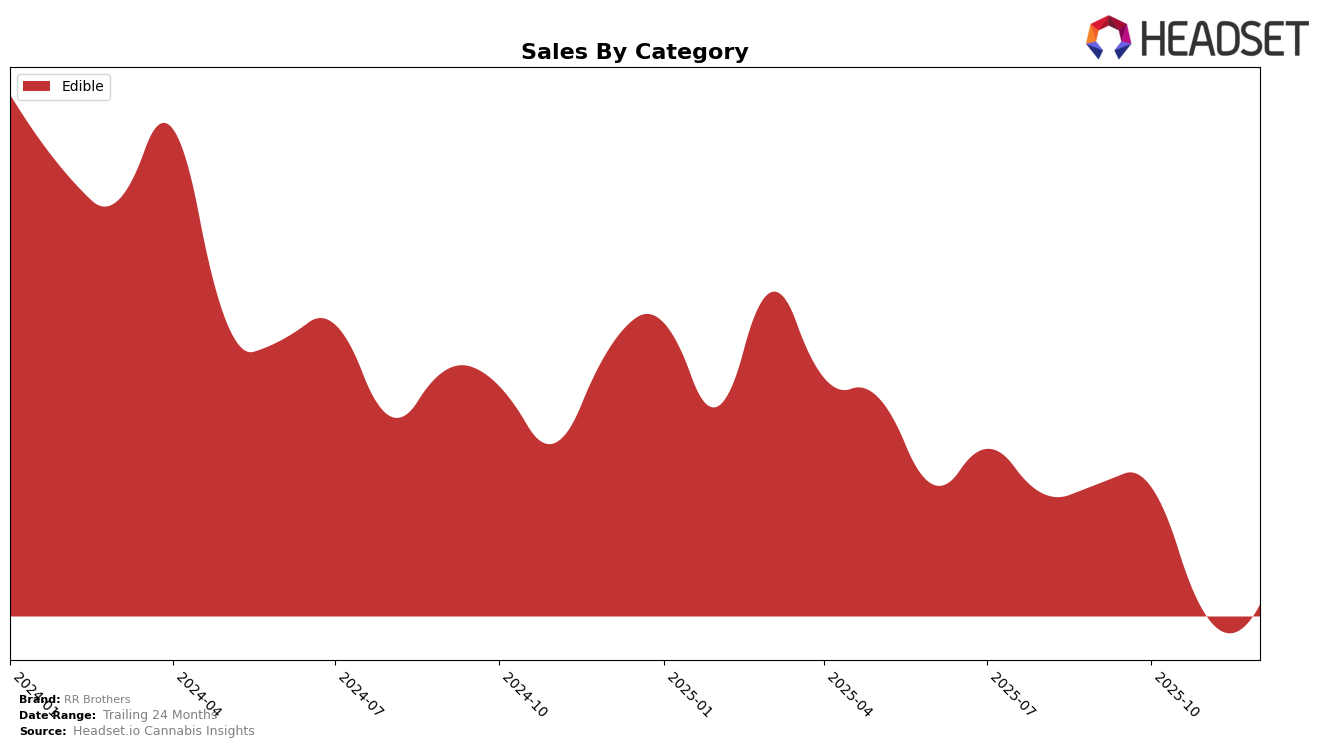

In the state of Arizona, RR Brothers has shown some interesting dynamics in the Edible category over the last few months of 2025. Starting in September, they were ranked 26th, and by October, they had improved their position slightly to 24th. However, November saw a drop to 33rd, indicating a potential challenge in maintaining consistent performance. By December, they managed to climb back to 30th, suggesting some recovery or strategic adjustments. This fluctuation highlights the competitive nature of the Edible category in Arizona, where maintaining a top 30 position can be difficult. It's also notable that their sales figures saw a significant dip in November, which could have contributed to the drop in ranking.

For RR Brothers, the journey through the last quarter of 2025 in Arizona's Edible category underscores the importance of market adaptability and strategic planning. The brand's ability to bounce back to the 30th position by December, after not being in the top 30 in November, is a testament to their resilience. However, it also raises questions about what specific factors led to these fluctuations. Was it a change in consumer preferences, increased competition, or perhaps internal changes within the company? The data suggests that while RR Brothers has the potential to perform well, maintaining a steady upward trajectory in such a competitive market requires ongoing effort and perhaps a deeper dive into the factors influencing these rankings.

Competitive Landscape

In the competitive landscape of the Arizona edible cannabis market, RR Brothers has experienced notable fluctuations in its ranking and sales over the last few months of 2025. Initially ranked 26th in September, RR Brothers climbed to 24th in October, only to drop to 33rd in November, before recovering slightly to 30th in December. This volatility is contrasted by the steady performance of competitors like iLava, which consistently held the 27th rank throughout the same period, and Dream Edibles, which improved its position from 33rd in September to 29th in December. Despite the ranking challenges, RR Brothers' sales trajectory shows a recovery in December after a significant dip in November, suggesting potential for regaining market share. Meanwhile, Pucks experienced a decline, dropping from 31st to 33rd, which may present an opportunity for RR Brothers to capitalize on shifting consumer preferences. The competitive dynamics in this market underscore the importance of strategic positioning and adaptability for RR Brothers to maintain and enhance its market presence.

Notable Products

In December 2025, Indica Grape Gummies (100mg) emerged as the top-performing product for RR Brothers, maintaining its position as the number one ranked product from November, with sales reaching 236 units. The THC/CBN 2:1 Blueberry Grape Gummies (100mg THC, 50mg CBN) climbed to the second spot, improving from its third-place ranking in November. Hybrid Cherry Gummies (100mg) dropped to the third position, continuing its downward trend from the previous months. Sativa Mango Gummies 10-Pack (100mg) ranked fourth, showing an improvement from fifth place in November. The CBD/THC/CBN/CBG 1:1:1:1 Peach Mango Gummies (100mg CBD, 100mg THC, 100mg CBN, 100mg CBG) saw a notable decline, falling to fifth place after not being ranked in November.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.