Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

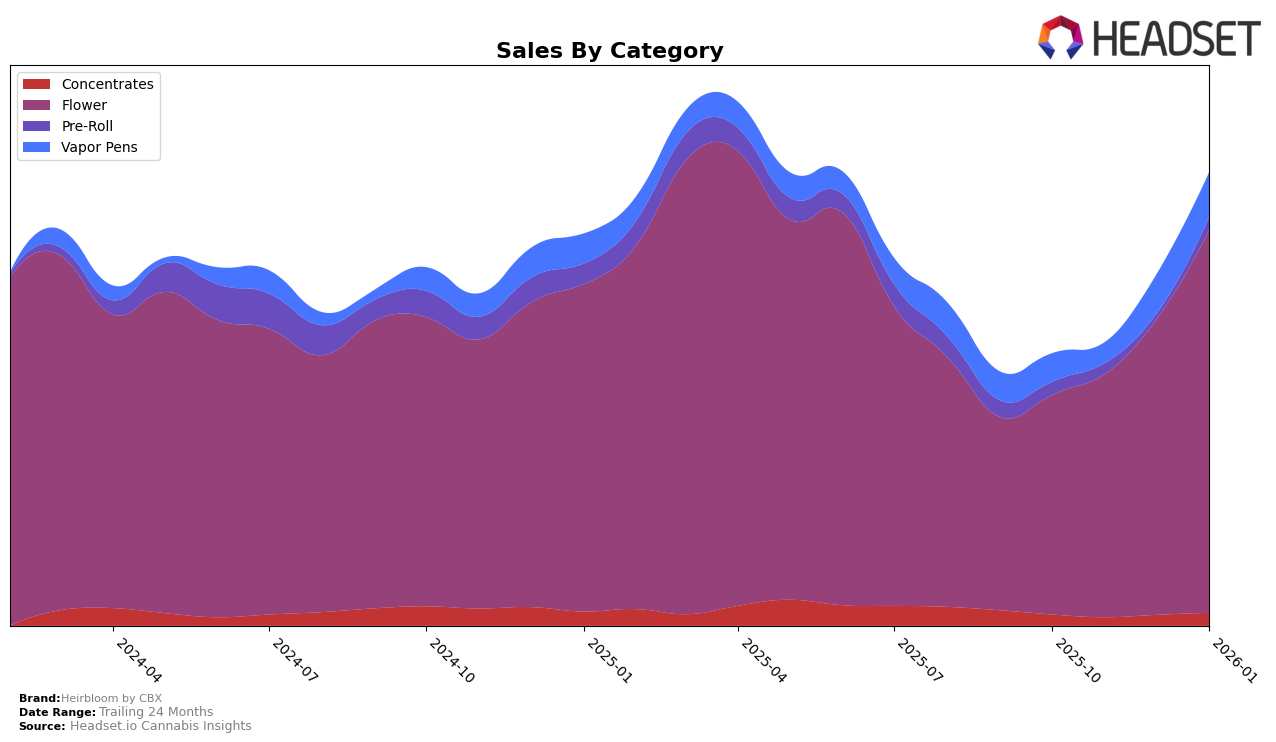

Heirbloom by CBX has shown varied performance across different product categories in California. In the Concentrates category, the brand experienced a gradual improvement in rankings, moving from 79th place in October 2025 to 71st by January 2026, indicating a positive upward trend. This improvement is reflected in their sales figures, which rose from $17,851 in November 2025 to $27,103 in January 2026. In contrast, their presence in the Vapor Pens category only emerged in December 2025, debuting at 96th place and subsequently improving to 86th by January 2026, showing potential for growth in this segment. However, the fact that they were not in the top 30 brands before December suggests room for significant improvement.

In the Flower category, Heirbloom by CBX has demonstrated a strong and consistent upward trajectory in California. Starting at 52nd place in October 2025, the brand climbed to 28th by January 2026, marking a notable rise in their market standing. This progression is underlined by a substantial increase in sales, with January 2026 figures reaching $819,793. The consistent improvement in rankings and sales in the Flower category highlights their growing influence and acceptance among consumers. However, the absence of top 30 rankings in other states or provinces could indicate a focus on the California market, suggesting potential opportunities for expansion elsewhere.

Competitive Landscape

In the competitive landscape of the California flower category, Heirbloom by CBX has demonstrated a significant upward trajectory in both rank and sales over the past few months. Starting from a rank of 52 in October 2025, Heirbloom by CBX climbed to 28 by January 2026, showcasing a remarkable improvement. This upward shift is notable when compared to competitors like Soma Rosa Farms, which maintained a relatively stable rank around the mid-20s, and Almora Farms, which hovered around the 30s. Meanwhile, Traditional Co. saw a slight improvement, ending at rank 26, and Smoken Promises experienced a decline, dropping to rank 29 by January 2026. The sales growth of Heirbloom by CBX, which saw a substantial increase from October to January, suggests a strong consumer response and effective market strategies, positioning it as a rising contender in the competitive California flower market.

Notable Products

In January 2026, the top-performing product from Heirbloom by CBX was Durban Poison (3.5g) in the Flower category, reclaiming its first-place rank from October and November after a dip to third in December, with impressive sales of 3646. Green Crack (3.5g) maintained a strong performance, holding the second position, a rise from its fourth-place rank in December, showing a significant recovery. Master Kush (3.5g) dropped to third place after leading in December, indicating competitive dynamics among the top products. Bubba Kush (3.5g) entered the rankings at fourth place, demonstrating a notable entry into the top tier. Super Silver Haze (3.5g) fell to fifth place from second in December, suggesting a shift in consumer preferences or competitive pressures within the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.