Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

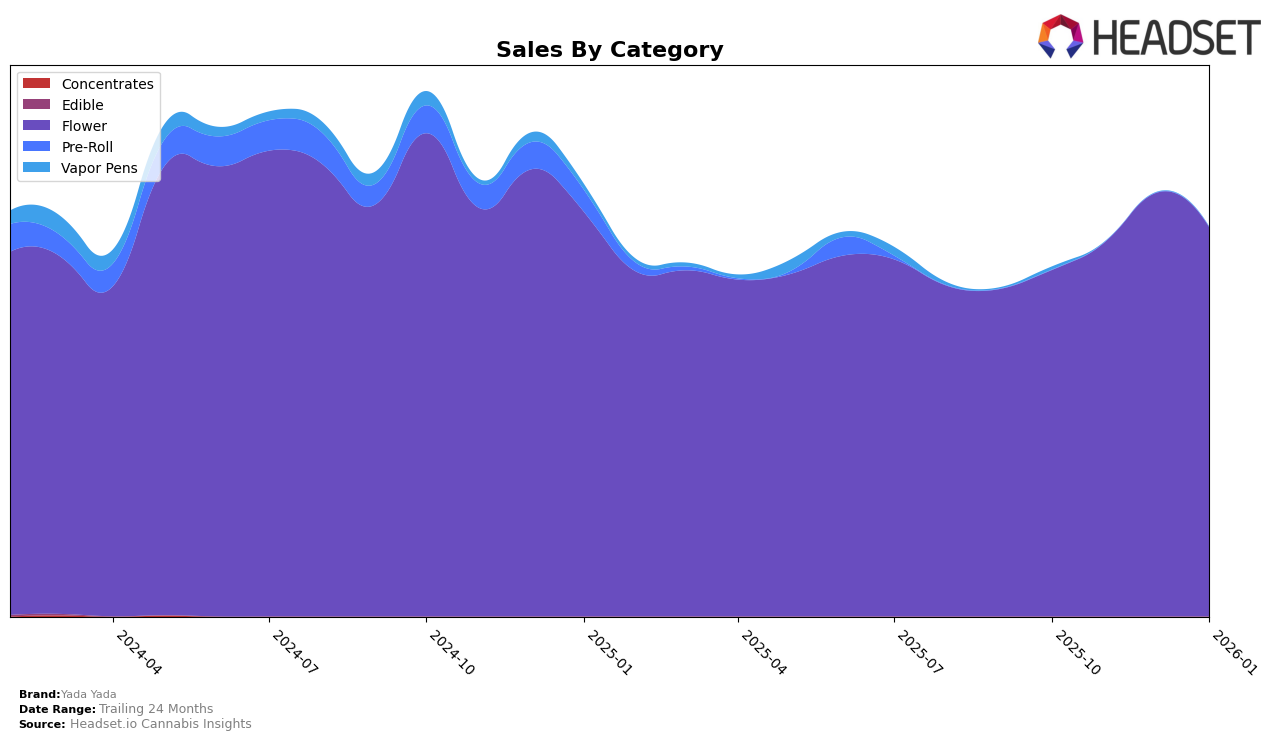

Yada Yada's performance in the California market has shown a positive trajectory in the Flower category over the past few months. Starting from October 2025, the brand was ranked 25th, and by January 2026, it had climbed to the 19th position, maintaining this rank since December 2025. This upward movement is indicative of growing consumer interest and possibly effective market strategies. Notably, the brand's sales figures reflect this trend, demonstrating a substantial increase from October to December 2025, before experiencing a slight decline in January 2026. Such fluctuations in sales could be attributed to seasonal demand or competitive dynamics within the state.

While Yada Yada has made significant strides in California, its absence from the top 30 rankings in other states or provinces suggests areas for potential growth or challenges in expanding its market presence. The consistent improvement in California, however, highlights the brand's stronghold in this particular region. For stakeholders and potential investors, understanding the factors behind Yada Yada's success in California could provide insights into replicating such performance in other markets. Additionally, analyzing the competitive landscape and consumer preferences in other states could offer opportunities for strategic expansion.

Competitive Landscape

In the competitive landscape of the California Flower category, Yada Yada has shown a notable upward trend in its rankings and sales from October 2025 to January 2026. Yada Yada improved its rank from 25th in October 2025 to 19th by December 2025, maintaining this position into January 2026. This upward trajectory in rank is complemented by a significant increase in sales, peaking in December 2025. When compared to competitors, West Coast Cure also improved its rank, moving from 24th to 18th, while Connected Cannabis Co. experienced a decline, dropping from 12th to 17th over the same period. Meanwhile, Maven Genetics and Decibel Gardens showed fluctuating ranks, with Decibel Gardens making a notable jump to 20th in January 2026. These dynamics suggest that Yada Yada is effectively capturing market share and positioning itself as a strong contender in the California Flower market.

Notable Products

In January 2026, the top-performing product for Yada Yada was Gush Mints Pre-Ground (14g) in the Flower category, securing the first rank with sales of 3,389 units. Governmint Oasis Ground Flower (3.5g) climbed to the second position, showing a significant increase from its previous third place in November 2025. Glitter Bomb Preground (3.5g) took the third spot, marking its entry into the top rankings for the first time since November. Chapel Of Love Shake (3.5g) and Gush Mints Shake (14g) rounded out the top five, both making notable debuts in the rankings this month. These shifts highlight a dynamic change in consumer preferences towards pre-ground and shake products from Yada Yada.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.