Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

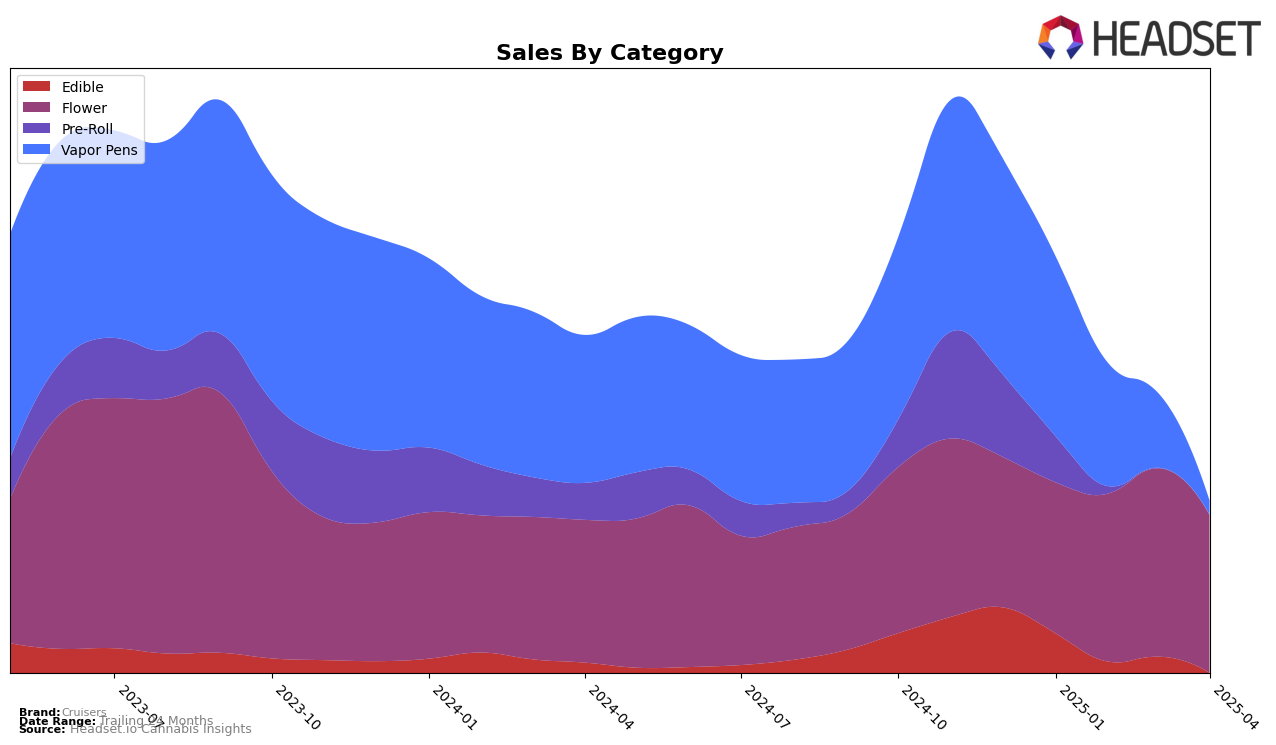

In the state of California, Cruisers has shown varied performance across different cannabis categories. For Edibles, the brand started the year strong with a rank of 24 in January 2025 but slipped out of the top 30 by April. This decline might indicate a need for strategic adjustments in their edible offerings or marketing approach. In contrast, their Flower category maintained a relatively stable presence in the rankings, peaking at 21 in February before settling at 25 by April, suggesting a consistent demand for their flower products. The Pre-Roll category, however, saw Cruisers ranked only in January, at 36, before disappearing from the top 30, which could be a concern for the brand if this segment is crucial to their overall strategy.

The Vapor Pens category presented a notable fluctuation for Cruisers in California. Starting the year at rank 20, the brand experienced a significant decline, ending up at 94 by April. This downward trend hints at potential issues such as increased competition or a shift in consumer preferences that Cruisers needs to address. Despite this decline, the brand's Flower sales showed a positive trajectory, with March recording the highest sales for the year, indicating that while some categories face challenges, others continue to thrive. This mixed performance highlights the importance of category-specific strategies to maintain and improve their market position.

Competitive Landscape

In the competitive landscape of the California flower category, Cruisers has experienced notable fluctuations in its ranking and sales performance. Starting the year at the 30th position in January 2025, Cruisers made a significant leap to 21st in February, driven by a surge in sales. However, it faced a slight decline in March and April, settling at the 25th position by April. This movement is indicative of a competitive market where brands like West Coast Cure and Jungle Boys have maintained relatively stable positions, with West Coast Cure consistently ranking in the top 20 until April. Meanwhile, Astronauts (CA) and Heirbloom by CBX have shown varying trajectories, with Heirbloom by CBX making a notable climb from the 45th position in January to the 27th in April. These dynamics suggest that while Cruisers has the potential for upward mobility, it faces stiff competition from brands that are either maintaining or improving their market positions.

Notable Products

In April 2025, the top-performing product for Cruisers was Motorbreath #15 (3.5g) in the Flower category, achieving the number one rank with sales of 3,250 units. Rainbow Cookies (3.5g), also in the Flower category, secured the second position, showing strong performance. Lemon Jack Distillate Cartridge (1g) in the Vapor Pens category, which was previously ranked first in March, slipped to third place in April. Candy Runtz (14g) and Tropicanna Cookies (3.5g), both in the Flower category, rounded out the top five, holding the fourth and fifth positions respectively. Notably, Lemon Jack Distillate Cartridge experienced a significant drop from its peak performance in March, indicating a shift in consumer preference back towards Flower products in April.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.