Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

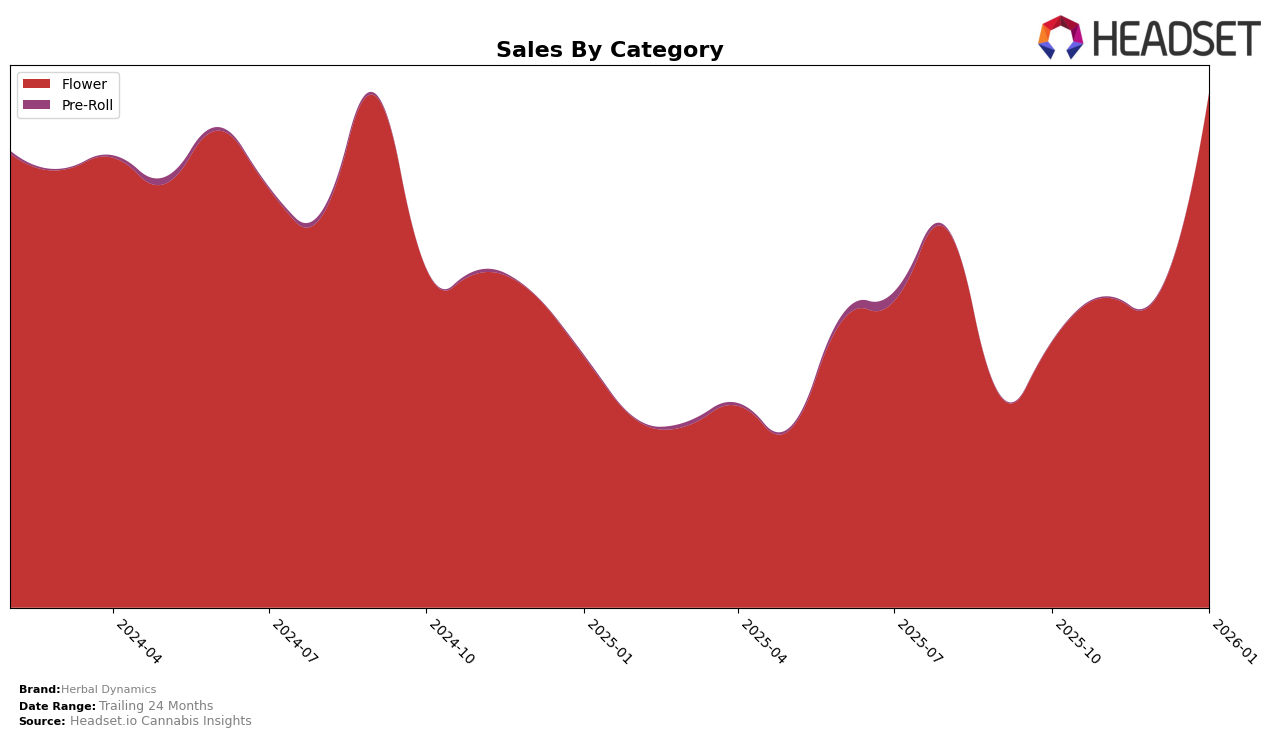

Herbal Dynamics has shown significant movement in the Oregon market, particularly in the Flower category. Starting from a rank of 51 in October 2025, the brand made a notable leap to rank 18 by January 2026. This upward trajectory indicates a growing presence and acceptance among consumers in Oregon, especially considering the substantial increase in sales from October 2025 to January 2026. The brand's ability to break into the top 30 by January 2026 highlights its success and potential for continued growth in this competitive category.

While Herbal Dynamics has made strides in Oregon, it's important to note that the brand did not appear in the top 30 rankings for any other states or provinces during this period. This absence suggests that their current market strategy is heavily focused on Oregon, or that they face more competition in other markets. The lack of presence in other states could be seen as a missed opportunity, or it might indicate that the brand is still in the process of expanding its reach beyond Oregon. Nonetheless, the impressive performance in Oregon provides a solid foundation for potential future growth in other regions.

Competitive Landscape

In the competitive landscape of the Oregon flower category, Herbal Dynamics has experienced notable fluctuations in its market position from October 2025 to January 2026. Starting at rank 51 in October, Herbal Dynamics improved to 36 in November but then slipped to 45 in December before climbing to 18 by January. This upward trajectory in January suggests a strategic adjustment or successful marketing effort, as they managed to surpass brands like Noble Farms, which rose from 99 to 19 in the same period, and BJ's A-Grade, which maintained a steady presence in the top 20 by January. Meanwhile, Mother Magnolia Medicinals consistently held a strong position at rank 16 in both December and January, indicating a robust competitive edge. The absence of Millerville Farms from the rankings until December, where they debuted at 57 and quickly moved to 17, highlights a potential new contender Herbal Dynamics must watch closely. Overall, Herbal Dynamics' ability to regain a top 20 position by January amidst these dynamic shifts underscores its resilience and adaptability in the Oregon market.

Notable Products

In January 2026, Velvet Glove (Bulk) from Herbal Dynamics emerged as the top-performing product, reclaiming the number one rank with impressive sales of 2679 units. Ice Cream Cake (Bulk) maintained its strong performance, securing the second position after being the leader in December 2025. Golden Pineapple (Bulk) made a notable debut in the rankings at the third spot, reflecting a strong market entry. GMO Jungle Cake (Bulk) slipped to fourth place, showing a decline from its consistent third-place standing in previous months. Frosted Flakez (Bulk) re-entered the rankings at fifth place, despite not being ranked in November and December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.