Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

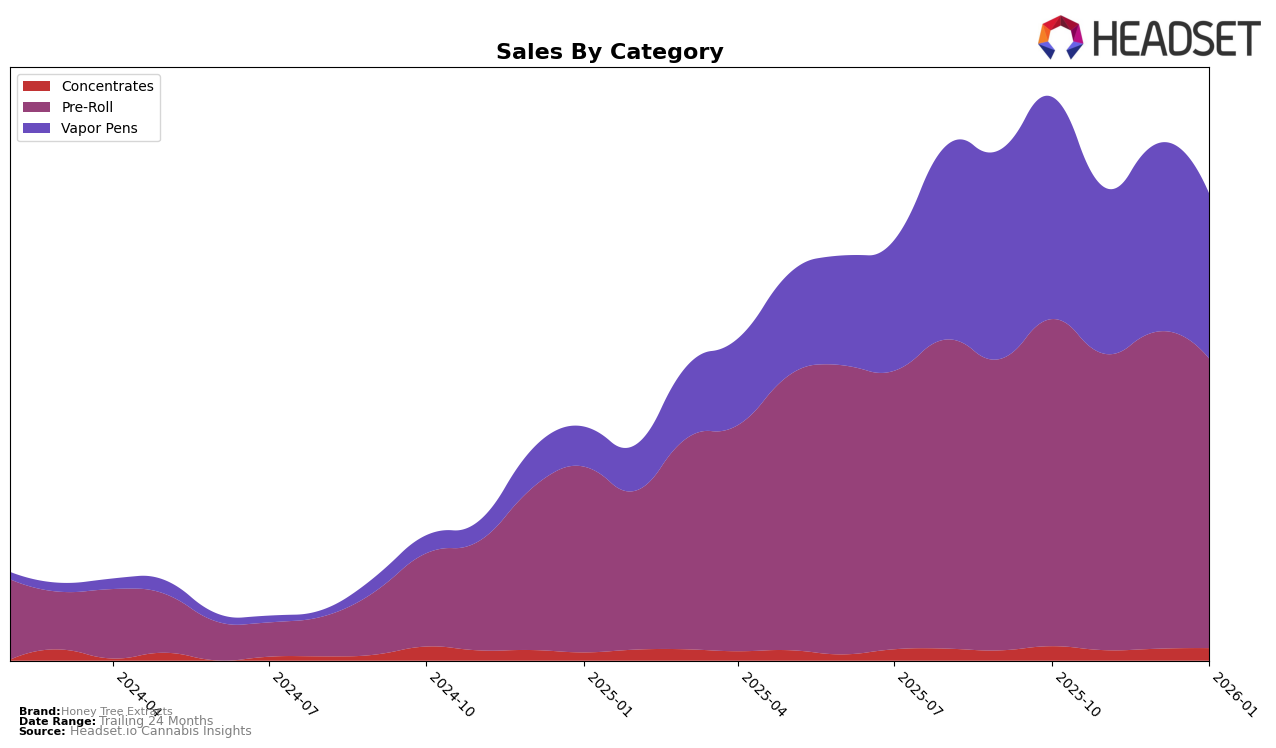

In the state of Washington, Honey Tree Extracts has demonstrated varied performance across different product categories. In the Concentrates category, their ranking has consistently remained outside the top 30, with positions fluctuating between 72nd and 80th from October 2025 to January 2026. This indicates a challenge in gaining a significant foothold in this segment. Conversely, in the Pre-Roll category, Honey Tree Extracts has maintained a strong presence, consistently ranking within the top 11 throughout the same period. This suggests a stable demand and possibly a loyal customer base for their pre-roll products.

For the Vapor Pens category in Washington, Honey Tree Extracts has shown a slight downward trend in rankings, slipping from 26th in October 2025 to 30th by January 2026. Although they remain within the top 30, this movement might indicate increasing competition or shifting consumer preferences in the vapor pen market. Notably, the Pre-Roll category continues to outperform other categories, highlighting a potential area of strategic focus for Honey Tree Extracts to capitalize on their existing strengths and market position.

Competitive Landscape

In the competitive landscape of the Washington Pre-Roll market, Honey Tree Extracts has experienced fluctuating rankings over the past few months, indicating a dynamic positioning among its peers. Starting at rank 9 in October 2025, Honey Tree Extracts saw a slight dip to rank 11 in November, briefly climbing back to rank 10 in December, only to return to rank 11 in January 2026. This movement suggests a competitive struggle to maintain a stable position in the top tier. Notably, The Happy Cannabis consistently outperformed Honey Tree Extracts, holding a steady rank of 9 from November through January, which could point to a more loyal customer base or stronger market strategies. Meanwhile, Equinox Gardens also showed resilience, recovering from a dip to rank 11 in December to reclaim rank 10 in January, directly competing with Honey Tree Extracts for market share. This competitive environment highlights the need for Honey Tree Extracts to innovate and strengthen its market presence to regain and sustain a higher ranking.

Notable Products

In January 2026, the top-performing product from Honey Tree Extracts was Honey Stixx - God's Gift x Permafrost Infused Pre-Roll 2-Pack (1g), maintaining its leading position from the previous two months with sales reaching 3548 units. The Honey Stixx - Peach Crescendo x Strawberry Banana Infused Pre-Roll 2-Pack (1g) retained its second-place rank, showing a consistent rise in sales figures from November and December. Honey Stixx - ChemDawg x Durban Cookies HTE Batter Infused Pre-Roll 2-Pack (1g) climbed back to third place after dropping out of the rankings in December. The Honey Stixx - Pineapple Express x Maui Wowie Infused Pre-Roll 2-Pack (1g) slipped from its previous top rank in October to fourth place by January. Lastly, Honey Stixx - Bubba Kush x Northern Lights Infused Pre-Roll 2-Pack (1g) re-entered the rankings at fifth place, showing a slight dip in sales compared to November.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.