Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

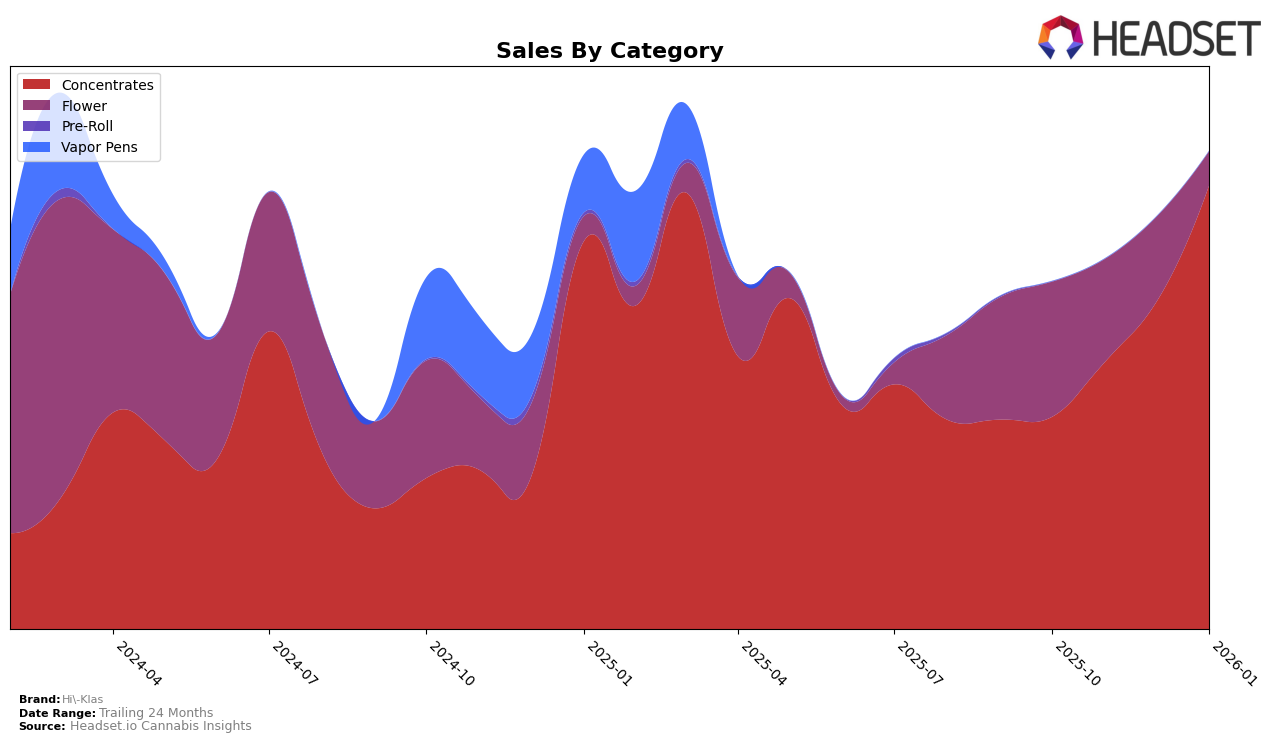

Hi-Klas has shown notable progress in the Concentrates category in Arizona, where it has climbed steadily from a rank of 23 in October 2025 to 14 by January 2026. This upward trajectory is supported by a significant increase in sales, which jumped from $42,342 in October to $88,787 in January. The consistent rise in both rank and sales indicates a strong foothold in the Concentrates market, suggesting effective strategies that resonate with consumers in this category. However, the Flower category tells a different story, as Hi-Klas did not make it into the top 30 rankings by January 2026, indicating potential challenges or competitive pressures in this segment.

The absence of Hi-Klas from the top 30 brands in the Flower category by January 2026 in Arizona could be a point of concern, especially since it started at rank 60 in October 2025 and gradually slipped to 66 by December before disappearing from the top rankings. This decline, coupled with decreasing sales figures from $26,965 in October to $16,944 in December, suggests that Hi-Klas may need to reassess its approach in the Flower category to regain market presence. The contrasting performance across categories highlights the brand's strengths in Concentrates while also pointing out areas for potential improvement in the Flower market.

Competitive Landscape

In the competitive landscape of the concentrates category in Arizona, Hi-Klas has shown a notable upward trajectory in both rank and sales over the past few months. Starting from a rank of 23 in October 2025, Hi-Klas improved to 14 by January 2026, reflecting a strategic gain in market position. This positive trend is underscored by a significant increase in sales, with January figures nearly doubling those of October. In comparison, 22Red also experienced a substantial rise, moving from rank 29 to 13, indicating a competitive push in the same period. Meanwhile, Curaleaf maintained a stable presence, hovering around the 11th to 13th ranks, while Sweet Science held steady at 16th. Notably, Dr. Greenthumb's made a remarkable leap from being outside the top 20 to securing the 15th spot by January, showcasing a dynamic shift in the market. These movements highlight Hi-Klas's competitive resilience and growth potential in a rapidly evolving market.

Notable Products

In January 2026, KY Jealous Sugar (1g) emerged as the top-performing product for Hi-Klas, maintaining its number one rank from November 2025 and achieving a notable sales figure of 899 units. Platinum Yeti Sugar (1g) entered the rankings strongly at second place with 779 units sold. The Chauffeur Budder (1g) followed closely in third place, marking its first appearance in the rankings. Biohazard Budder (1g), which was ranked first in December 2025, dropped to fourth place in January 2026. Gastro Pop Budder (1g) rounded out the top five, maintaining its fifth-place position from December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.