Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

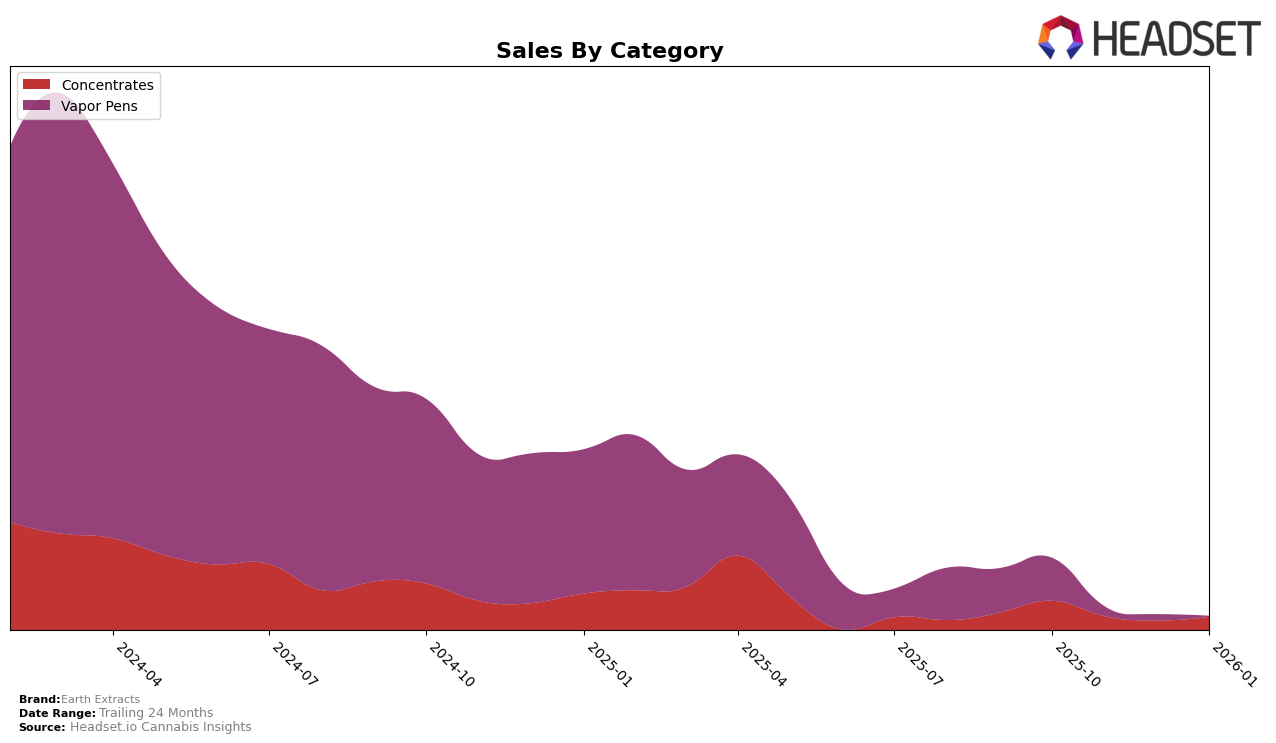

Earth Extracts has shown varied performance across different categories in Arizona. In the Concentrates category, their ranking fluctuated over the months, starting at 18th in October 2025, dipping to 27th by December, and then slightly recovering to 22nd in January 2026. This movement indicates some instability in their market position, although the slight recovery in January suggests potential resilience. Conversely, in the Vapor Pens category, Earth Extracts did not manage to break into the top 30 rankings at all, with their position slipping from 39th in October to 49th by January. This consistent decline in ranking might be a concern for the brand as it indicates a struggle to maintain competitiveness in this category.

From a sales perspective, Earth Extracts experienced a noticeable decline in sales for both categories in Arizona. For Concentrates, sales dropped from $57,939 in October to $42,064 in January, showing a downward trend that aligns with their fluctuating rankings. In the Vapor Pens category, sales also decreased steadily, which may be contributing to their inability to secure a top 30 ranking. These trends suggest that Earth Extracts needs to address underlying issues in their product offerings or marketing strategies to regain and improve their market standing. The data highlights the importance of maintaining a strong presence in both categories to ensure overall brand success.

Competitive Landscape

In the Arizona concentrates market, Earth Extracts has experienced fluctuations in its rankings over the past few months, reflecting a competitive landscape. In October 2025, Earth Extracts was ranked 18th, but by January 2026, it had dropped to 22nd. This decline in rank is notable when compared to competitors like Abundant Organics, which maintained a presence in the top 20, and MADE, which improved its rank from 24th in October to 15th in November before settling at 23rd in January. Despite Earth Extracts' decrease in rank, its sales figures show a consistent trend, indicating a stable customer base, though not as robust as MADE, which saw a significant increase in sales during November and December. The competitive pressures from brands like House Exotics, which climbed from 26th in October to 21st in January, highlight the dynamic nature of this market segment and suggest that Earth Extracts may need to innovate or adjust strategies to regain a higher position.

Notable Products

In January 2026, the top-performing product from Earth Extracts was the EV Premium - Huckleberry Jam Oil Cartridge (1g) in the Vapor Pens category, securing the number one rank with sales reaching 344 units. The Amnesia Oil Cartridge (1g), also in the Vapor Pens category, improved its standing from fifth place in December 2025 to second place in January 2026, with sales of 280 units. Rainbow Guava Cold Cured Live Hash Rosin Badder (1g) debuted strongly in the Concentrates category, achieving third place. Gush Mints Cured Resin Badder (1g) dropped from first place in December to fourth in January. Premium - Tropical Cookies Oil Cartridge (1g) entered the rankings in fifth place, marking its presence in the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.