Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

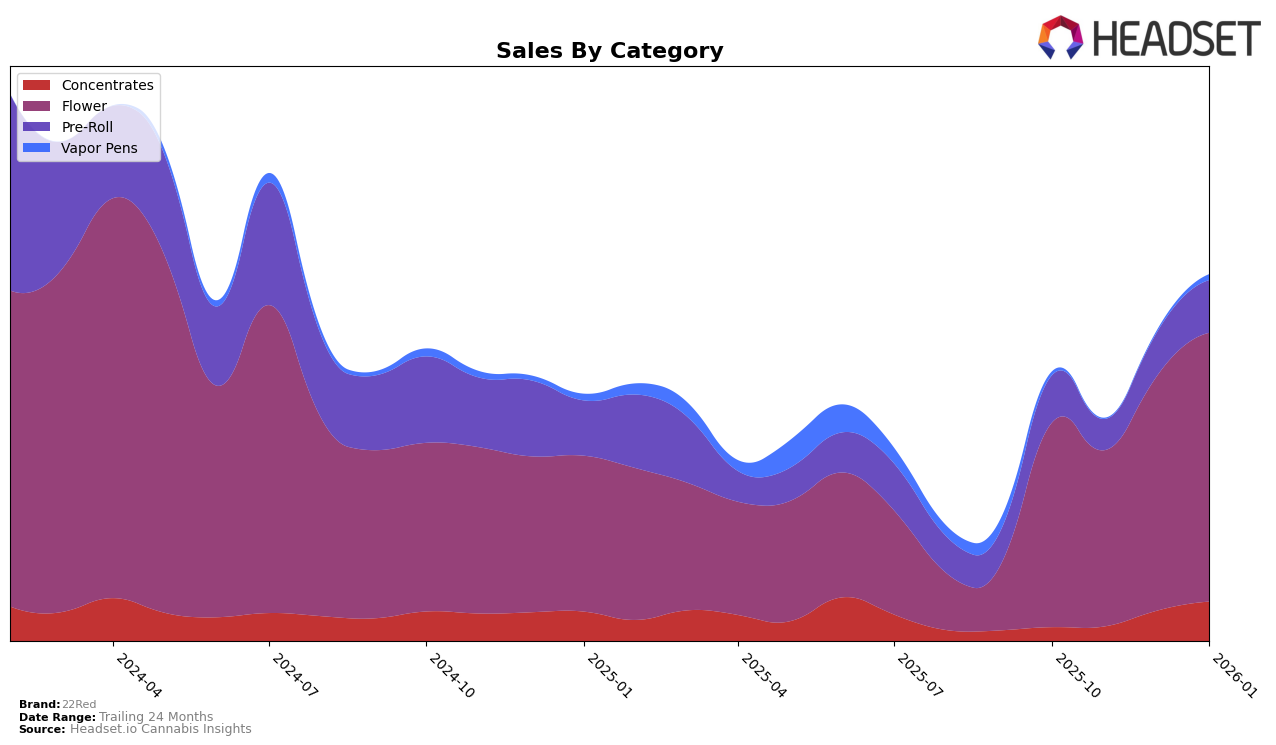

In the state of Arizona, 22Red has shown notable progress in the Concentrates category, climbing from the 29th position in October 2025 to 13th by January 2026. This upward movement indicates a strong market presence and increasing consumer preference for their concentrates. In contrast, their performance in the Pre-Roll category has been less consistent, with rankings fluctuating and even dropping out of the top 30 in November 2025. This inconsistency may point to challenges in maintaining a steady market share in this segment, despite an eventual recovery to the 23rd position by January 2026.

The Flower category tells a more stable story for 22Red in Arizona. Despite a slight dip in November 2025, where they ranked 22nd, the brand quickly regained strength, climbing back to 14th by January 2026. This suggests that while there might have been temporary setbacks, the brand's Flower products are generally well-received in the market. The overall sales trajectory in this category also reflects a positive trend, with a noticeable increase from October 2025 to January 2026. However, more detailed insights into specific product performance and consumer feedback could provide a clearer picture of the factors driving these changes.

Competitive Landscape

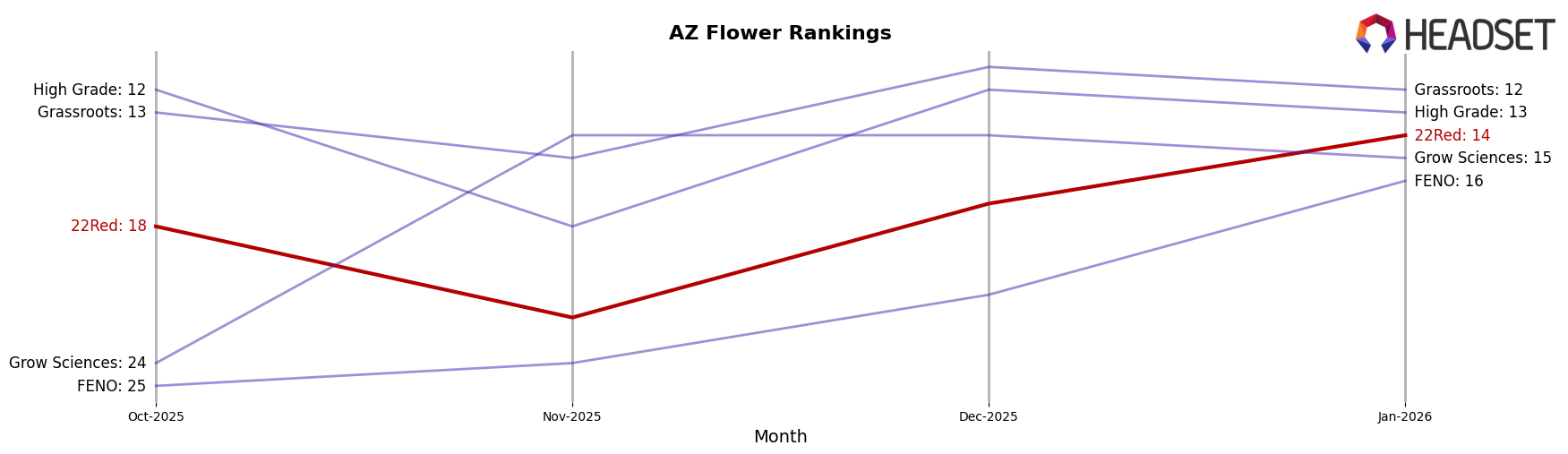

In the competitive landscape of the Flower category in Arizona, 22Red has shown a notable upward trend in its rankings, moving from 18th place in October 2025 to 14th by January 2026. This improvement in rank is accompanied by a significant increase in sales, indicating a strengthening market presence. Meanwhile, competitors like Grassroots and High Grade have maintained relatively stable positions, with Grassroots consistently ranking higher than 22Red, although its sales have shown a slight decline in January 2026. Grow Sciences and FENO have also seen improvements, with FENO making a significant leap from 25th to 16th in the same period. These dynamics suggest that while 22Red is gaining ground, the competitive environment remains robust, with several brands vying for higher market share. For consumers and investors, this indicates a vibrant market with potential opportunities for growth and differentiation.

Notable Products

In January 2026, the top-performing product from 22Red was Sherbanger (3.5g) in the Flower category, which climbed to the number one rank with sales of 3845 units. Banana OG (14g), also in the Flower category, held the second position, showing a notable recovery from being unranked in December 2025. Brainfizz Pre-Roll (1g) maintained a strong presence, ranking third, consistent with its fourth-place ranking in the previous two months. Sherbanger Pre-Roll (1g) slipped to fourth place after debuting at third in December. Cherry AK 47 Pre-Roll (1g) entered the rankings at fifth place, marking its first appearance in the top five.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.