Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

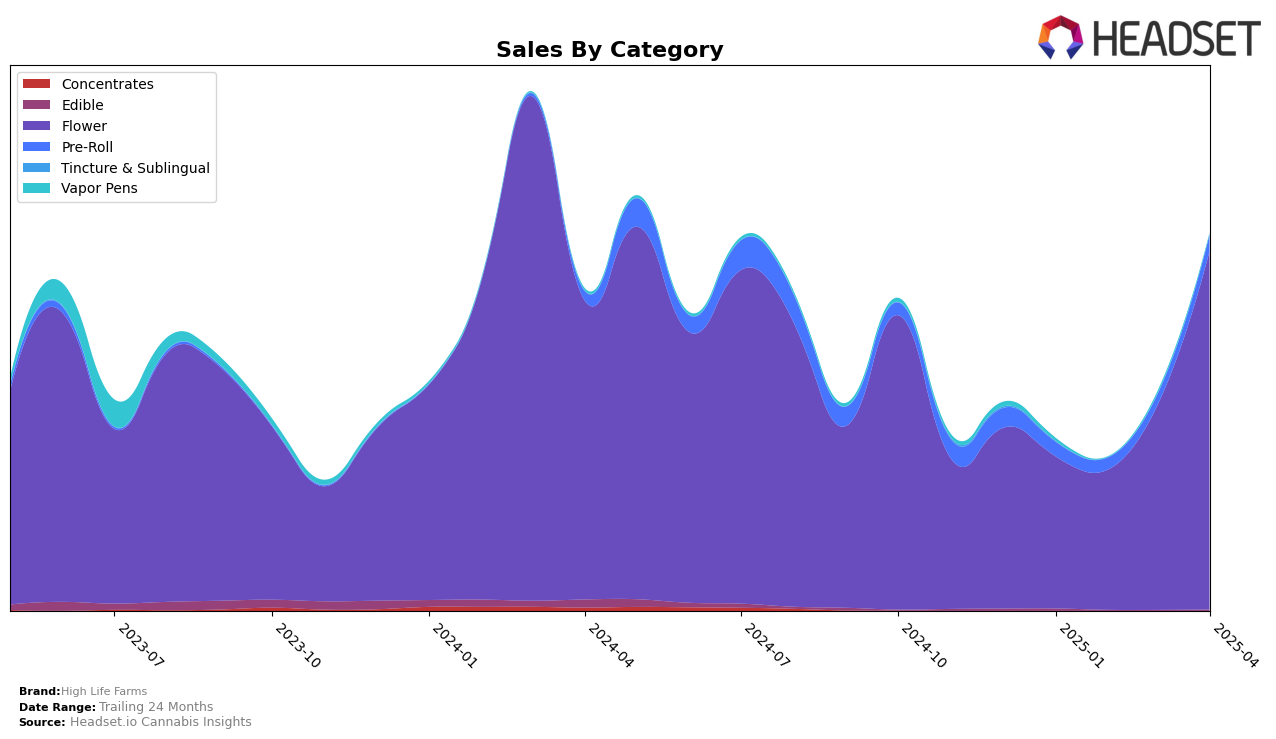

High Life Farms has shown significant performance improvements in the Flower category within Michigan over the first four months of 2025. Starting the year outside the top 30 brands, they made a considerable leap from a rank of 64 in January to breaking into the top 30 by April, securing the 26th position. This upward trajectory is underscored by a substantial increase in sales, with April sales more than doubling compared to January. Such a performance suggests that High Life Farms is gaining traction and market share in the Michigan Flower category, possibly due to strategic initiatives or shifts in consumer preferences.

While the Flower category in Michigan has shown promising growth for High Life Farms, the absence of rankings in other states or categories indicates areas where the brand is either not present or not yet competitive enough to break into the top 30. This could be seen as a potential opportunity for expansion or a focus area for improvement. The brand's ability to climb the ranks in Michigan may serve as a blueprint for entering or enhancing their presence in other markets. Observers and stakeholders should watch for any strategic moves by High Life Farms to replicate this success in additional states or categories.

Competitive Landscape

In the competitive landscape of the Michigan flower category, High Life Farms has demonstrated a remarkable upward trajectory in rank and sales over the first four months of 2025. Starting from a rank of 64 in January, High Life Farms surged to 26 by April, showcasing a significant improvement in its market position. This positive shift is accompanied by a substantial increase in sales, indicating a growing consumer preference for their products. In contrast, Fluresh maintained a relatively stable rank, hovering around the mid-20s, while Light Sky Farms experienced a similar upward trend, moving from 69 to 24. Meanwhile, Hytek and HOG Cannabis Co. showed fluctuations in their rankings, with Hytek dropping slightly and HOG Cannabis Co. improving its position. These dynamics suggest that High Life Farms is effectively capturing market share and enhancing its competitive stance in the Michigan flower market.

Notable Products

In April 2025, the top-performing product for High Life Farms was Crunch Berries (Bulk) from the Flower category, securing the number one rank with sales of 14,716 units. Frost Donkey (3.5g) followed closely behind in second place, while Blue Mosa (1g) claimed the third spot. Candy Fumes #4 Smalls (28g) was ranked fourth, showing a consistent performance despite not appearing in previous months' rankings. Ice Cream Cake (3.5g) maintained its position at fifth, showing steady sales growth from January 2025. This marks a significant rise in performance for Crunch Berries (Bulk) and Frost Donkey (3.5g), which were not ranked in prior months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.