Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

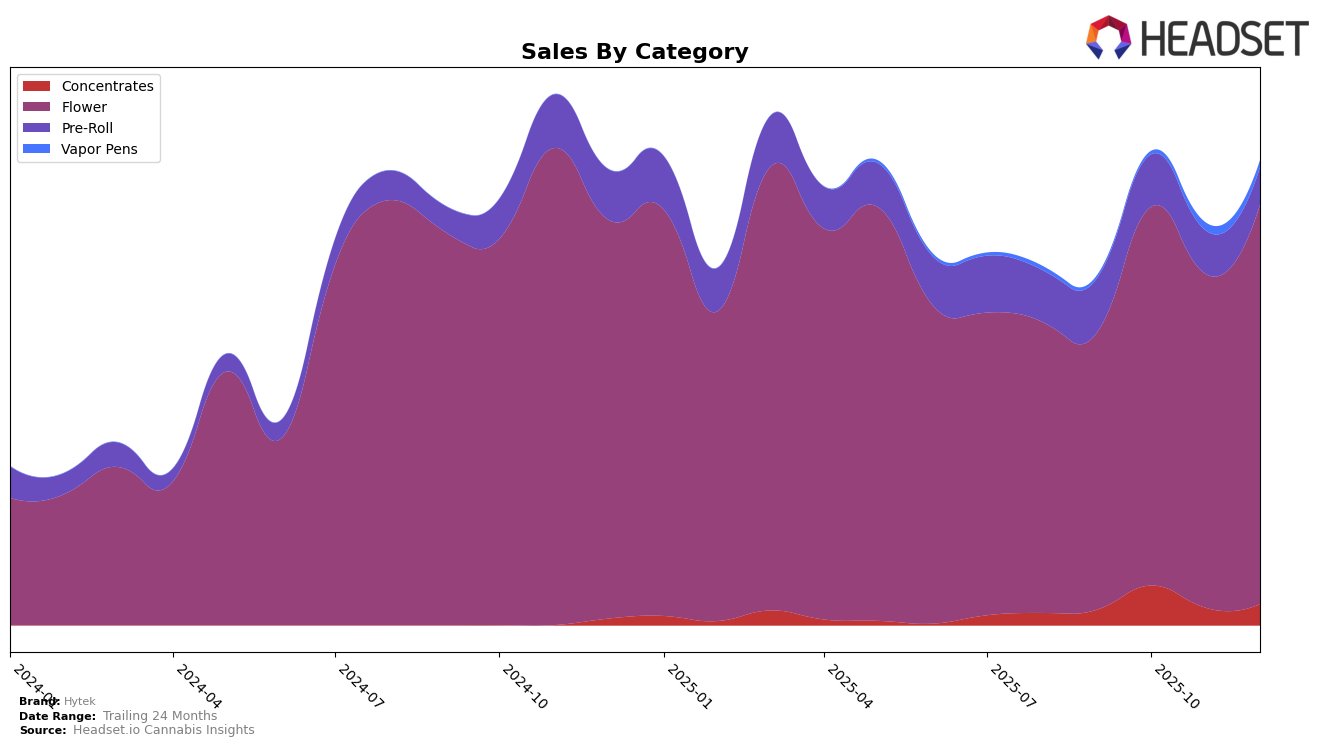

In the state of Michigan, Hytek has shown notable movements across various product categories. Within the Concentrates category, Hytek made a significant leap from being ranked 61st in September 2025 to 29th in October 2025, indicating a strong upward trajectory. However, the brand struggled to maintain this momentum, falling back to 67th in November before recovering slightly to 49th by December. This fluctuation highlights both the potential and volatility within this category for Hytek. In contrast, the Flower category has demonstrated more consistent performance, with Hytek ranking within the top 30 throughout the last quarter of 2025, peaking at 17th in December. This consistency suggests a strong foothold in the Flower market, though there remains room for improvement to climb higher in the rankings.

Conversely, the Pre-Roll category has been a challenging area for Hytek in Michigan. The brand did not manage to break into the top 30, with rankings slipping from 60th in September to 76th by December. This downward trend indicates a decline in market presence and possibly consumer preference in this category. Despite the struggles in Pre-Rolls, Hytek's overall sales figures in the Flower category are impressive, with a notable increase in December 2025. This suggests that while Pre-Rolls may not be a strong suit, the brand's robust performance in Flower could offer a strategic focus for future growth. Understanding these dynamics can provide insights into where Hytek might focus its efforts to strengthen its market position across different categories.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Hytek has shown a notable upward trajectory in its rankings over the last few months of 2025, moving from 24th in September to 17th by December. This improvement in rank is indicative of a positive trend in sales performance, with Hytek's sales increasing from September to December. In contrast, Heavyweight Heads experienced fluctuations, dropping out of the top 20 in October before recovering to 19th in December. Meanwhile, Glorious Cannabis Co. maintained a relatively stable position, though it saw a dip from 10th in November to 15th in December. Goodlyfe Farms, which was consistently in the top 5, experienced a significant drop to 16th in December, highlighting potential volatility in the market. Additionally, Carbon showed slight rank fluctuations, ending the year close to Hytek in 18th place. These dynamics suggest that Hytek's strategic efforts are paying off, positioning it as a rising contender in the Michigan flower market.

Notable Products

In December 2025, Lantz (3.5g) reclaimed its top position as the leading product for Hytek, achieving a significant sales figure of 6431 units, marking a comeback from its fifth position in November. Pink Runtz (3.5g) maintained its strong performance, securing the second rank with consistent sales momentum. Candy Cartel (3.5g) made an impressive debut in the rankings, clinching the third spot in its first recorded month. Pink Runtz (Bulk) entered the rankings at fourth place, indicating a growing preference for bulk purchases. Potato Runtz (3.5g) rounded out the top five, showcasing a steady entry into the competitive landscape.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.