Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

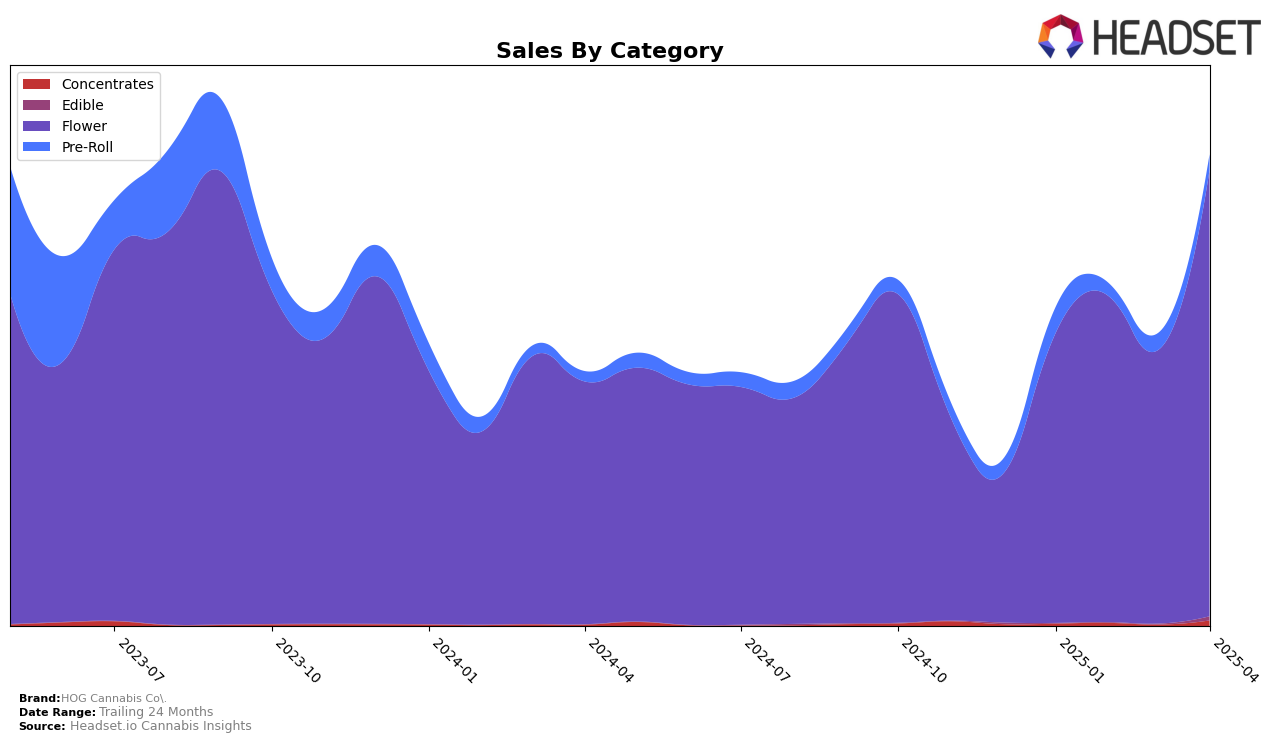

HOG Cannabis Co. has demonstrated notable performance fluctuations across the state of Michigan, particularly within the Flower category. In January 2025, the brand was not in the top 30, ranking 39th, but by April, it had impressively climbed to 28th place. This upward trajectory suggests a growing consumer preference or successful marketing strategies that have bolstered its position in the market. Despite a dip in March, where it fell to 47th, the significant sales increase in April, reaching over a million dollars, indicates a strong recovery and potential for sustained growth. This positive movement in rankings and sales volume highlights HOG Cannabis Co.'s resilience and adaptability in a competitive landscape.

Conversely, in the Pre-Roll category in Michigan, HOG Cannabis Co. has not managed to secure a position within the top 30 brands since January 2025, where it was ranked 96th. This absence from the top rankings in subsequent months could be a cause for concern, suggesting challenges in capturing market share or consumer interest within this category. The lack of presence in the top tier may indicate a need for strategic reevaluation or innovation to enhance their competitive edge in the Pre-Roll segment. Understanding these dynamics can provide valuable insights into the brand's overall market strategy and areas requiring attention for future growth.

Competitive Landscape

In the competitive landscape of the Michigan flower category, HOG Cannabis Co. has experienced notable fluctuations in its ranking, reflecting a dynamic market environment. In January 2025, HOG Cannabis Co. was ranked 39th, but by February, it improved to 35th, only to drop to 47th in March before climbing back to 28th in April. This volatility suggests a competitive pressure from brands like Fluresh, which consistently maintained a higher rank, ranging from 25th to 29th, and Uplyfted Cannabis Co., which showed a steady improvement from 49th to 29th over the same period. Meanwhile, High Life Farms made significant strides, jumping from 64th in January to 26th in April, indicating a potential threat to HOG Cannabis Co.'s market share. The sales trajectory of HOG Cannabis Co. reflects a positive trend, particularly in April, where it surpassed the million-dollar mark, indicating resilience and potential for growth despite the competitive challenges.

Notable Products

In April 2025, the top-performing product for HOG Cannabis Co. was Pineapple Burst (3.5g) in the Flower category, reclaiming its number one rank from January and February after slipping to second place in March. It achieved impressive sales of 5540 units. Hypno Stank (Bulk) maintained strong performance, securing the second position, slightly down from its peak in March where it was ranked first. Hypnostank Pre-Roll (1.2g) showed notable improvement, climbing from fifth place in March to third place in April, indicating a growing preference for pre-roll options. Meanwhile, Hypno Stank (3.5g) saw a resurgence, rising to fourth place after not ranking in March, suggesting a renewed interest in smaller package options. Peels (Bulk) consistently held the fifth position, showing steady demand in the Flower category throughout the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.