Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

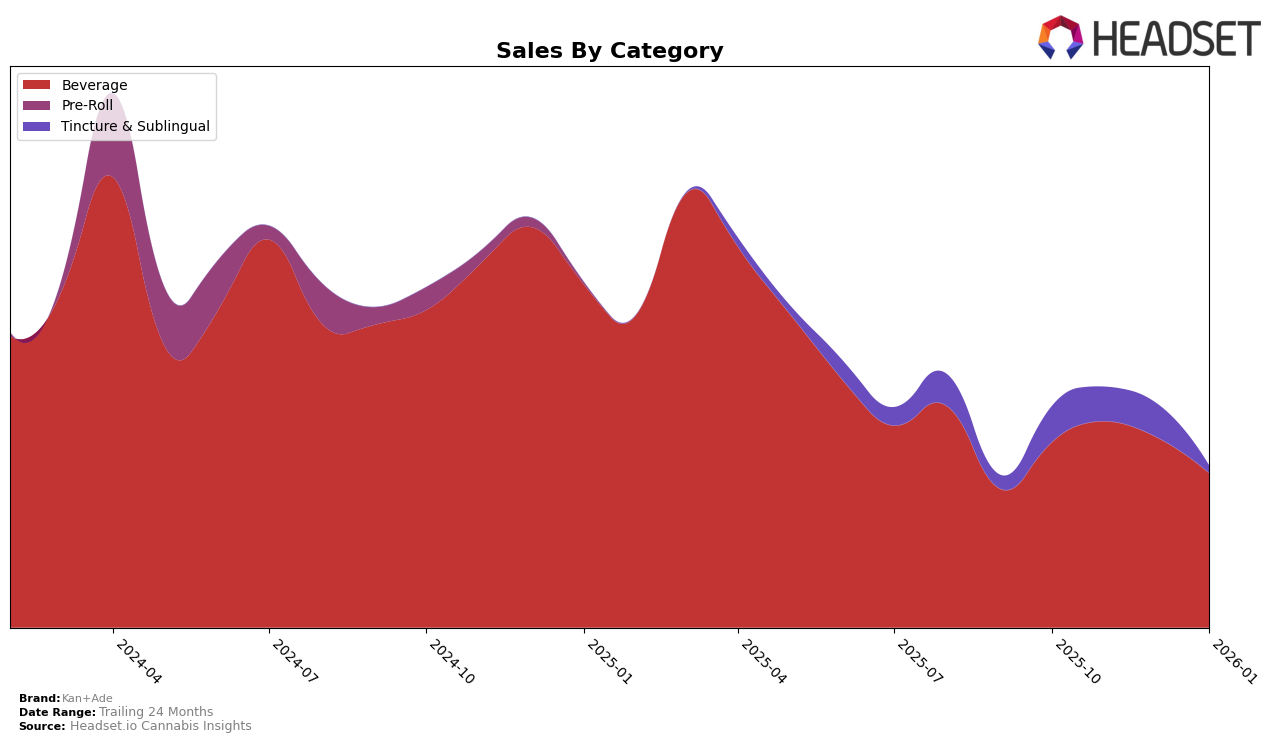

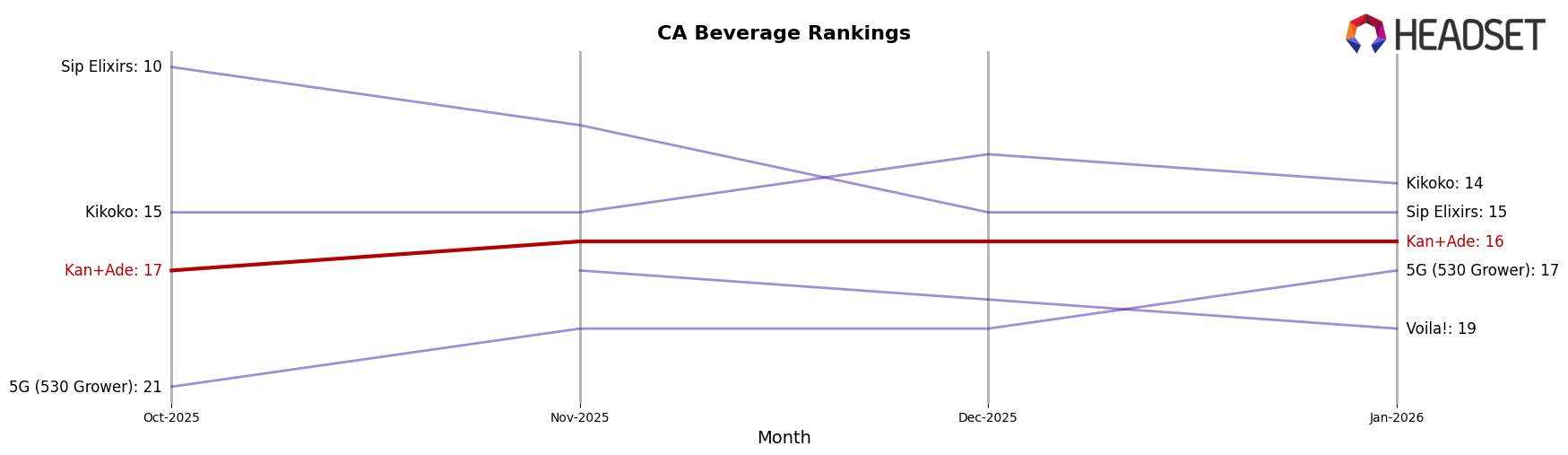

Kan+Ade has shown consistent performance in the Beverage category within California. Over the last few months, the brand maintained its position at 16th place from November 2025 to January 2026, indicating a stable presence in a competitive market. This consistency is noteworthy, especially considering the slight dip in sales from December 2025 to January 2026. However, Kan+Ade's ability to remain within the top 20 suggests a strong brand loyalty and effective market strategies in California's bustling cannabis beverage scene.

Despite the stability in California, Kan+Ade's absence from the top 30 rankings in other states or provinces could signal missed opportunities or areas where the brand's market penetration is limited. This absence highlights the potential for growth and expansion strategies that could be explored to enhance their footprint beyond California. The brand's consistent ranking in California could serve as a model for entering new markets, leveraging insights gained from their performance and consumer preferences in one of the largest cannabis markets in the United States.

Competitive Landscape

In the competitive landscape of the California cannabis beverage market, Kan+Ade has maintained a consistent presence, ranking 16th from November 2025 through January 2026, despite a slight dip in sales from December 2025 to January 2026. This stability is noteworthy given the dynamic shifts among competitors. For instance, Kikoko improved its rank from 15th to 13th in December 2025, before settling back to 14th in January 2026, reflecting a fluctuating but generally upward trend in sales. Meanwhile, Sip Elixirs experienced a more volatile trajectory, dropping from 10th in October 2025 to 15th by January 2026, with a notable decline in sales. Voila!, on the other hand, saw a downward trend in both rank and sales, falling out of the top 20 by January 2026. These shifts suggest that while Kan+Ade's sales have decreased, its stable ranking indicates resilience amidst competitors' volatility, positioning it as a reliable choice in a fluctuating market.

Notable Products

In January 2026, the top product for Kan+Ade was Naked Flavorless Medible Mixer (1000mg), maintaining its lead from December with sales of 163 units. Blueberry Pomegranate Medible Mixer Syrup (1000mg) held steady at the second position, following its consistent performance from the previous month. Juicy Watermelon Medible Mixer (1000mg THC, 150ml) dropped one rank to third place, continuing its decline since October. Blueberry Pomegranate Medible Mixer Syrup (100mg) reappeared in the rankings at fourth place, marking a notable entry after missing from the previous months. Juicy Peach Syrup Medible Mixer (1000mg) remained in fifth place, showing consistent sales but a significant drop from its October performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.