Jul-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

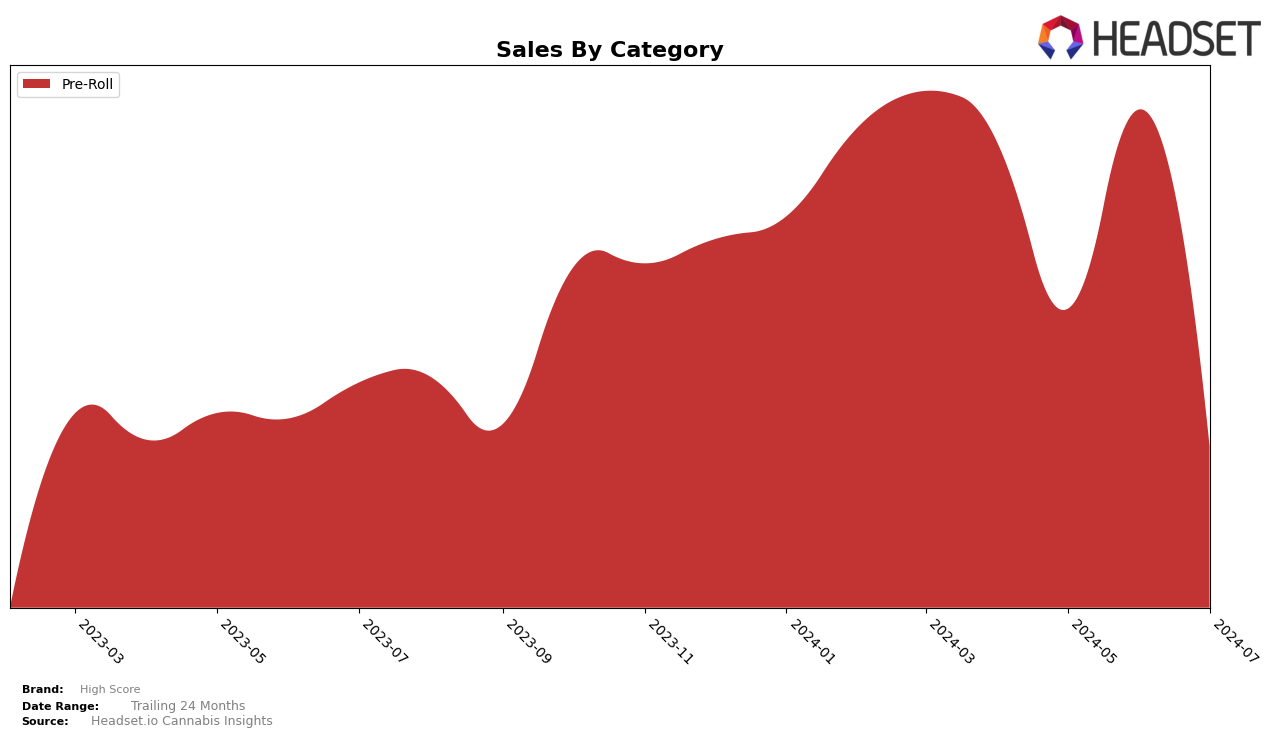

High Score has demonstrated notable fluctuations in its performance across various states and categories. In Arizona, the brand's performance in the Pre-Roll category has seen some significant movements. From April to July 2024, High Score's ranking oscillated between 16th and 24th place, peaking at 13th in June. This indicates that while the brand has managed to secure a spot within the top 30 consistently, its position is volatile, suggesting a competitive market landscape. A closer look at the sales figures reveals a sharp decline in July, which could be a point of concern for stakeholders.

In contrast, High Score's performance in other states and categories might present a different narrative. For instance, if the brand did not appear in the top 30 rankings for a particular month, it could be indicative of either a highly competitive category or a need for strategic adjustments. The absence from the top 30 can be seen as a setback, highlighting the challenges the brand faces in certain regions. Such data points underscore the importance of market-specific strategies and the need to adapt to varying consumer preferences across different states.

Competitive Landscape

In the competitive landscape of the Arizona Pre-Roll category, High Score has experienced notable fluctuations in its rank and sales over the past few months. High Score's rank dropped from 16th in April 2024 to 23rd in May 2024, before climbing back to 13th in June 2024 and then falling again to 24th in July 2024. This volatility indicates a highly competitive market. For instance, Shango consistently outperformed High Score, maintaining a top 10 position until July 2024 when it fell out of the top 20. Similarly, High Variety showed more stability, staying within the top 25 throughout the period. Meanwhile, Riggs Family Farms and Bangers have been climbing the ranks, with Riggs Family Farms reaching 25th in July 2024. These trends suggest that while High Score has potential for growth, it faces stiff competition from both established and emerging brands, necessitating strategic marketing efforts to improve its market position.

Notable Products

In July 2024, the top-performing product for High Score was Strawberry Mo'nana Sauce Infused Pre-Roll (1.2g), which climbed from the 4th position in June to the 1st position, with notable sales of 1,046 units. Strawberry Mo'nana x Cali-O-Socks Sauce Infused Pre-Roll (1.2g) took the 2nd spot, having been ranked 1st in June. Strawberry Mo'nana x Pineapple Express Infused Pre-Roll (1.2g) maintained a consistent performance, holding the 3rd position for the second consecutive month. Gello x Emergency Infused Pre-Roll 4-Pack (2.4g) entered the top five for the first time, securing the 4th position. Lastly, Cherry Treat x Forest Fire Sauce Infused Pre-Roll (1.2g) was ranked 5th, marking its debut in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.