Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

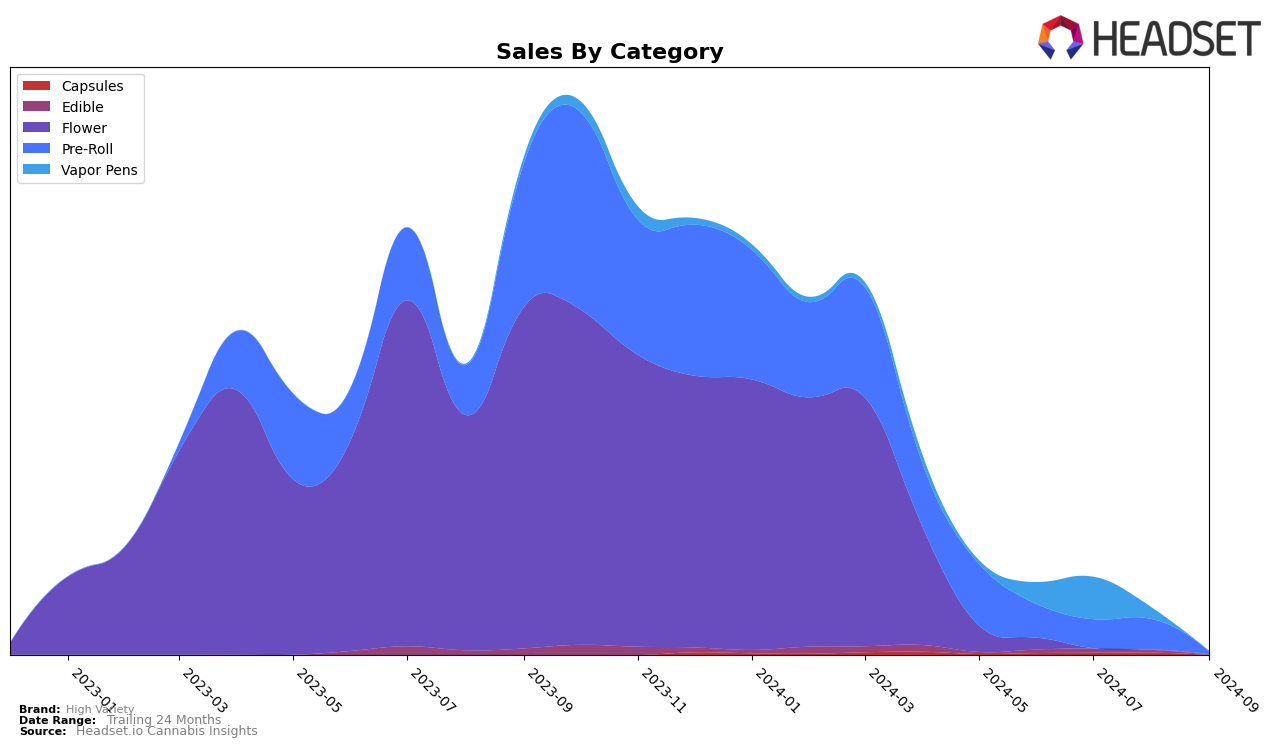

High Variety's performance across different categories in Arizona displays a mixed trajectory, with notable movements in the Pre-Roll and Vapor Pens categories. In the Pre-Roll category, High Variety maintained a consistent presence within the top 30 rankings, starting at 29th in June 2024, slightly dropping to 30th in July, and then climbing to 26th by August. This upward trend indicates a strengthening position in the market, potentially driven by consumer preference shifts or strategic brand initiatives. Conversely, the Vapor Pens category saw more volatility, with High Variety making a significant leap from 46th in June to 29th in July, only to fall to 56th in August. This fluctuation suggests potential challenges in maintaining a consistent market share, possibly due to competitive pressures or changes in consumer demand.

In the Flower category, High Variety did not rank within the top 30 in Arizona from July to September 2024, indicating a weaker performance relative to other categories. This absence from the top rankings could highlight challenges in product differentiation or market saturation. The brand's ability to remain competitive in the Pre-Roll category, despite not ranking in the Flower category, suggests a strategic focus on products that resonate more with the local consumer base. The data underscores the importance of category-specific strategies and market adaptation for High Variety to enhance its overall market presence and capitalize on emerging opportunities.

Competitive Landscape

In the competitive landscape of the Flower category in Arizona, High Variety has experienced notable shifts in its market presence. As of June 2024, High Variety held a rank of 69, but its absence from the rankings in subsequent months suggests a decline in its competitive standing, possibly falling out of the top 20. In contrast, Kaya Infusions (AZ) showed a positive trajectory, improving from a rank of 77 in July to 69 in August, indicating a strengthening market position. Meanwhile, Summus and Fourtwenty experienced fluctuations, with Summus re-entering the top 20 in August at rank 76, and Fourtwenty dropping out after July. These dynamics highlight the competitive volatility in the Arizona Flower market, where High Variety faces challenges in maintaining its rank against brands like Kaya Infusions (AZ) that are gaining traction.

Notable Products

In September 2024, the top-performing product from High Variety was Gello Pre-Roll (1g), which secured the first position in the rankings with sales of 252 units. Chem 91 Pre-Roll (1g) followed closely in second place, although it experienced a significant drop from its previous top position in August 2024, where it had sales of 2677 units. Super Lemon Haze Pre-Roll (1g) ranked third, showing a consistent presence in the top three over the past months. Grape Pie Pre-Roll (1g) took the fourth spot, slipping one rank from its third position in August. Meanwhile, Chimera #3 Pre-Roll (1g) made its debut in the rankings at fifth place, indicating a positive reception among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.