Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

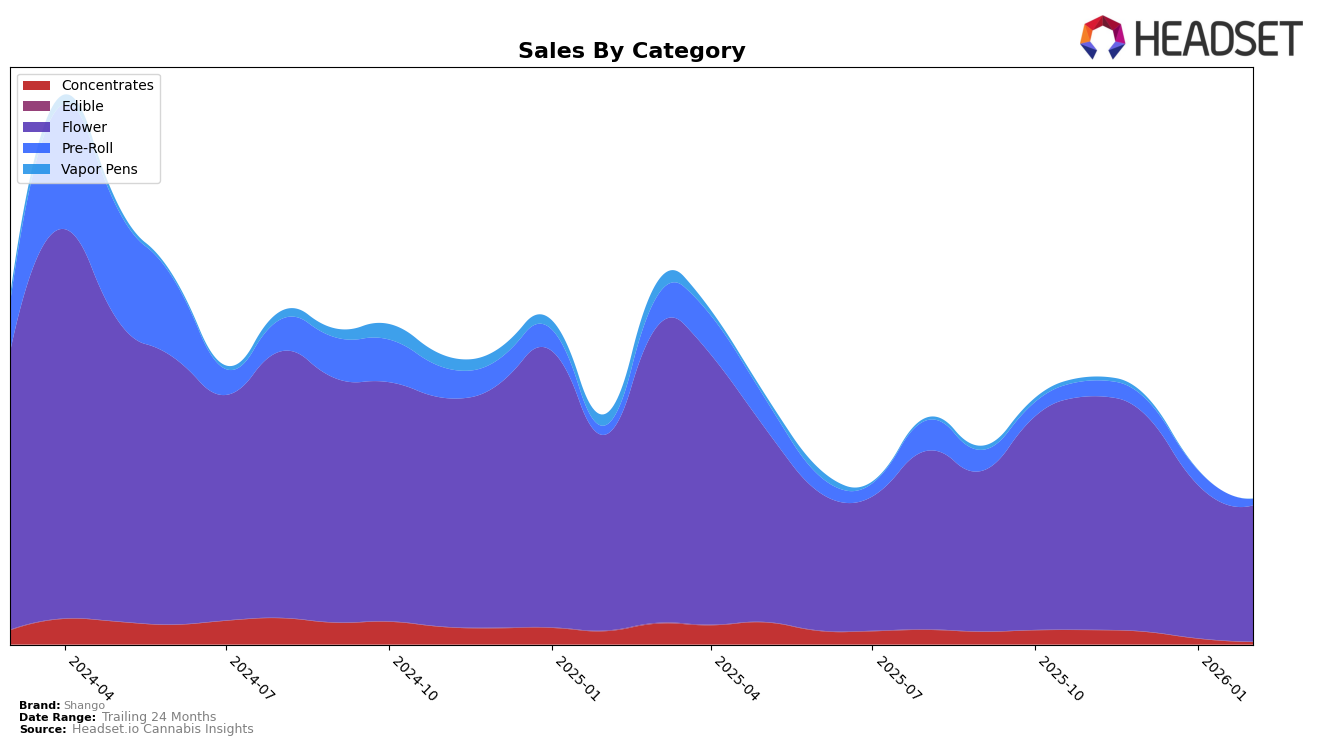

In the competitive landscape of cannabis brands, Shango has demonstrated varied performance across different categories and states. In Arizona, Shango's presence in the Flower category has been relatively strong, consistently ranking within the top 15 over the past few months, although it experienced a slight decline from 5th place in November and December 2025 to 13th by February 2026. This downward trend in ranking is mirrored by a decrease in sales figures over the same period. In contrast, Shango's performance in the Concentrates category in Arizona has seen a more significant drop, with the brand falling out of the top 30 by February 2026 after starting at 13th place in November 2025. Such a decline suggests potential challenges in maintaining competitiveness within this category.

Meanwhile, Shango's footprint in Nevada is notably less prominent. In the Flower category, Shango did not appear in the top 30 rankings until January 2026, where it entered at 82nd place. This indicates a relatively weak market presence in Nevada compared to Arizona. Furthermore, Shango's performance in the Pre-Roll category in Arizona has been on a downward trajectory, dropping from 32nd in November 2025 to 47th by February 2026, highlighting potential areas for growth or strategic reevaluation. These movements across states and categories underscore the importance of regional strategies and the need for adaptability in the ever-evolving cannabis market.

Competitive Landscape

In the competitive Arizona flower market, Shango has experienced a notable decline in its ranking over the past few months, dropping from 5th place in November 2025 to 13th place by February 2026. This downward trend in rank is paralleled by a decrease in sales, indicating potential challenges in maintaining market share. In contrast, Fade Co. has shown resilience, climbing from 8th place in December 2025 to 11th place in February 2026, with sales figures that have remained relatively stable, even surpassing Shango's in January 2026. Meanwhile, 22Red has demonstrated significant growth, moving up to 12th place in February 2026, with a consistent increase in sales, suggesting a strengthening position in the market. Additionally, Savvy has made a notable leap from being outside the top 20 in November 2025 to 14th place in February 2026, indicating a positive trajectory. These shifts highlight the dynamic nature of the Arizona flower market and suggest that Shango may need to reassess its strategies to regain its competitive edge.

Notable Products

In February 2026, Shango's top-performing product was Lemon Cherry Gelato Shake (14g) in the Flower category, securing the first rank with notable sales of 1502 units. Platinum Anslinger Demise (3.5g) followed closely in second place, showing a strong market presence. Glitter Bomb (3.5g), which maintained its third position from previous months, demonstrated consistent popularity with sales of 1216 units. Glitter Bomb Smalls (14g) and Melonade (3.5g) ranked fourth and fifth, respectively, making significant entries into the top five. Notably, Glitter Bomb (3.5g) was the only product consistently ranked in the top three since November 2025, highlighting its steady demand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.