Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

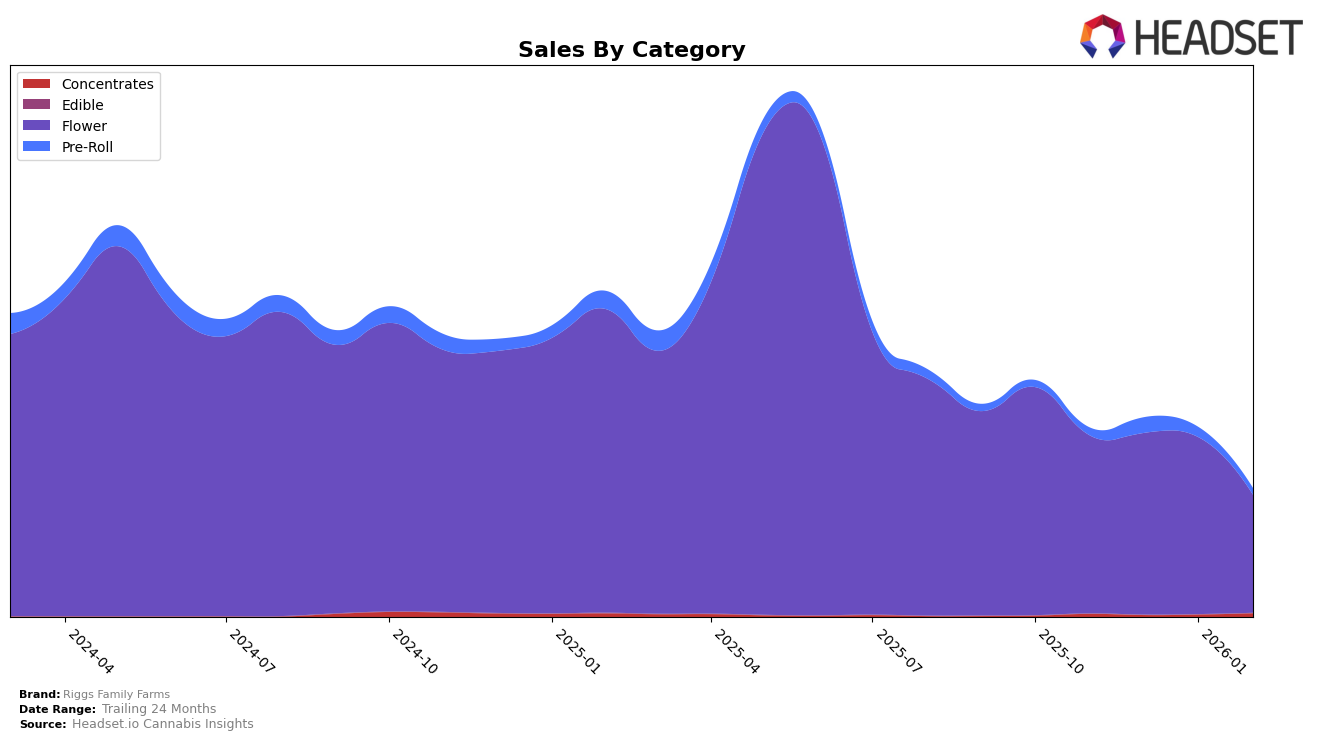

Riggs Family Farms has shown varied performance across different product categories and states over recent months. In the Arizona market, their Flower category experienced some fluctuations in rankings, starting at 18th in November 2025 and slipping to 23rd by February 2026. This movement indicates a potential challenge in maintaining a steady position within the top 20, despite a robust sales figure of $495,512 in November 2025. The brand's ability to regain its footing in this competitive category will be crucial for sustaining its market presence in Arizona.

In contrast, the Pre-Roll category in Arizona presents a different narrative. Riggs Family Farms did not make it into the top 30 rankings for any of the months, highlighting a significant area for improvement. Despite a sales peak in December 2025, the brand's ranking remained outside the competitive threshold, indicating a potential mismatch between sales efforts and market penetration in this category. The brand's strategy in Arizona's Pre-Roll market may require reevaluation to enhance visibility and capture a more significant share of consumer interest.

Competitive Landscape

In the Arizona flower category, Riggs Family Farms experienced notable fluctuations in its competitive positioning from November 2025 to February 2026. Initially ranked 18th in November 2025, Riggs Family Farms saw a slight dip to 20th in December, a recovery to 17th in January 2026, and then a drop to 23rd in February. This decline in February coincides with a decrease in sales, suggesting potential challenges in maintaining market share. In contrast, The Pharm maintained a relatively stable position, ranking between 18th and 21st throughout the period, while FENO demonstrated volatility, peaking at 16th in January before falling to 25th in February. Meanwhile, TRIP consistently outperformed Riggs Family Farms, maintaining a rank between 24th and 28th, with a steady increase in sales. Swell Farmacy, although not a direct competitor in the top 20, showed a significant improvement in February, climbing to 22nd, potentially posing a future threat. These dynamics highlight the competitive pressures Riggs Family Farms faces and the importance of strategic adjustments to regain and sustain higher rankings.

Notable Products

In February 2026, Famous Cookies Pre-Roll (1g) emerged as the top-performing product for Riggs Family Farms, climbing from a fourth-place rank in January 2026 to first place with notable sales of 1320 units. Animal Tsunami (14g) secured the second position, making a strong debut in the rankings this month. SFV OG Pre-Roll (1g) maintained a consistent performance, holding steady at third place for two consecutive months. Krypto Chronic Pre-Roll (1g) entered the rankings at fourth place, demonstrating significant sales momentum. Burberry Gary (7g) saw a decline, dropping from first to fifth place, indicating a shift in consumer preference or market dynamics.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.