Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

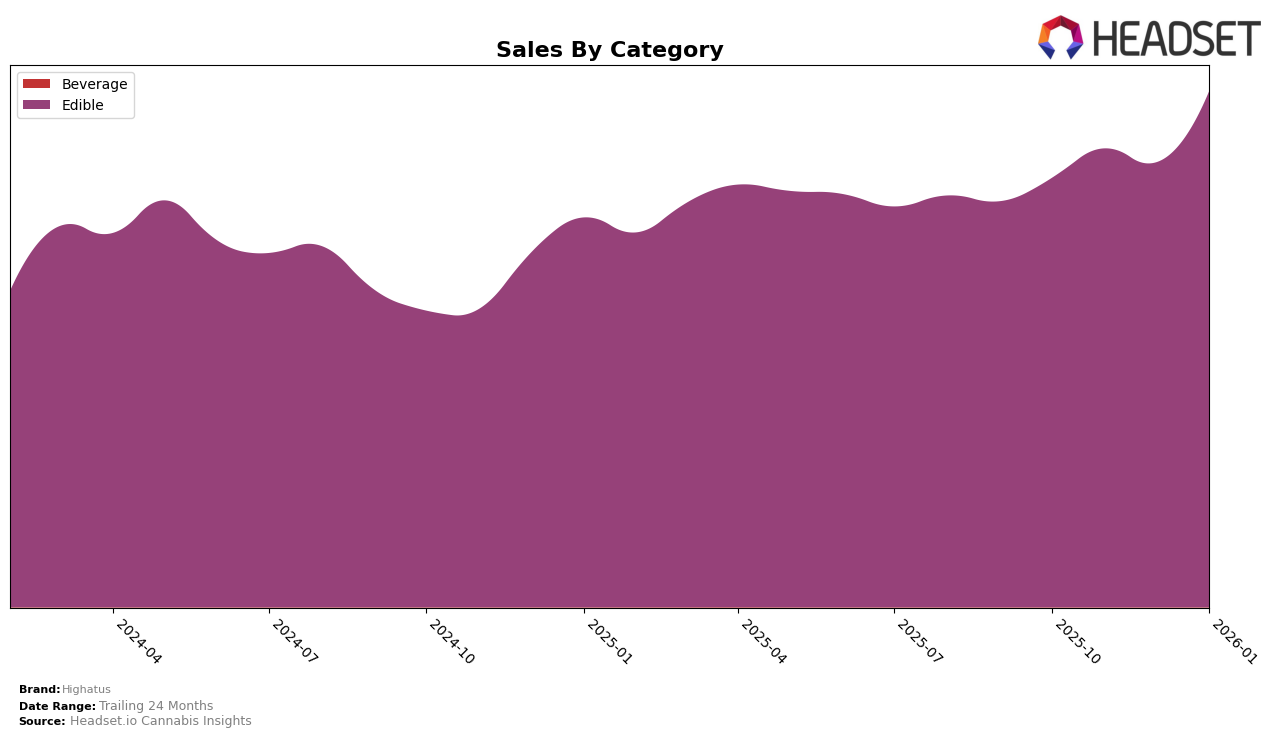

Highatus has shown a consistent performance in the California edible market over the last few months. The brand experienced a slight dip in December 2025, dropping to the 11th position, but quickly rebounded to the 9th position in January 2026. This recovery is indicative of the brand's resilience and ability to maintain a strong presence in a competitive market. Notably, their sales in January 2026 reached over one million, suggesting a positive trend and potential growth in consumer demand.

While Highatus has maintained a notable position within the California edible market, their absence from the top 30 rankings in other states and categories could be seen as an area for potential growth or concern. This lack of presence might highlight opportunities for expansion or indicate challenges in penetrating other markets. Understanding these dynamics requires a closer look at market conditions and consumer preferences in those regions, which could provide valuable insights for future strategic decisions.

Competitive Landscape

In the competitive landscape of the California edible market, Highatus has shown a dynamic performance with its ranking fluctuating between 9th and 11th place from October 2025 to January 2026. This indicates a resilient position amidst strong competition. Notably, Emerald Sky consistently maintained its 8th rank, showcasing a stable market presence, while Plus improved its rank from 11th to 10th, reflecting a positive sales trajectory. Froot held a steady 7th rank, indicating a robust market position with sales consistently higher than Highatus. Meanwhile, Smokiez Edibles showed a slight improvement, moving from 12th to 11th place. Highatus's ability to regain its 9th position in January 2026, after a dip in December, suggests a potential for upward momentum, especially as its sales in January surpassed those of November, indicating a positive trend in consumer preference.

Notable Products

In January 2026, the top-performing product for Highatus was the CBN/CBD/THC 1:1:1 Sour Blueberry Gummies 10-Pack, maintaining its first-place ranking from previous months with a notable sales figure of 20,992 units. The Sour Pineapple Gummies 10-Pack rose to the second position, improving from third and fourth in October and November respectively, with a consistent upward trend in sales. Sour Watermelon Gummies 10-Pack held steady in third place, showing a slight increase in sales compared to December. Sour Strawberry Lemonade Gummies 10-Pack ranked fourth, down from second in October and November, but sales figures remained strong. Sour L'Orange Gummies 10-Pack consistently ranked fifth, showing steady growth in sales across the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.