Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

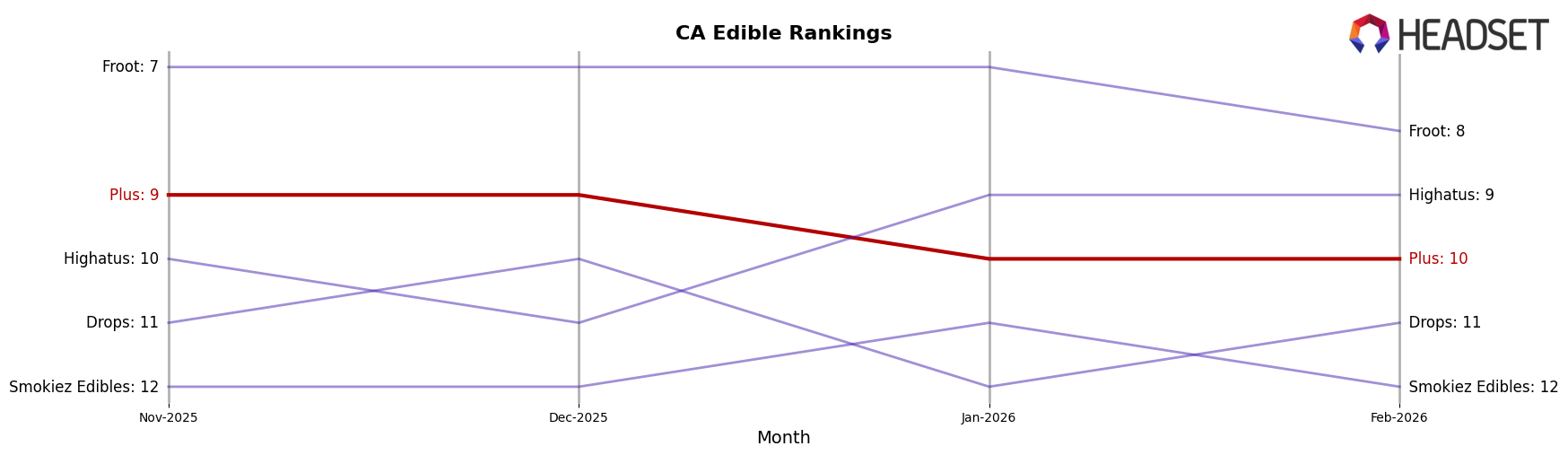

Plus has maintained a consistent presence in the California edible market, ranking 9th in both November and December of 2025. However, the brand experienced a slight dip in the rankings, dropping to 10th place in January and February of 2026. This movement indicates a minor shift in their market position, possibly influenced by the competitive landscape or seasonal purchasing patterns. Despite this, Plus has demonstrated resilience by staying within the top 10, a notable achievement given the dynamic nature of the cannabis industry.

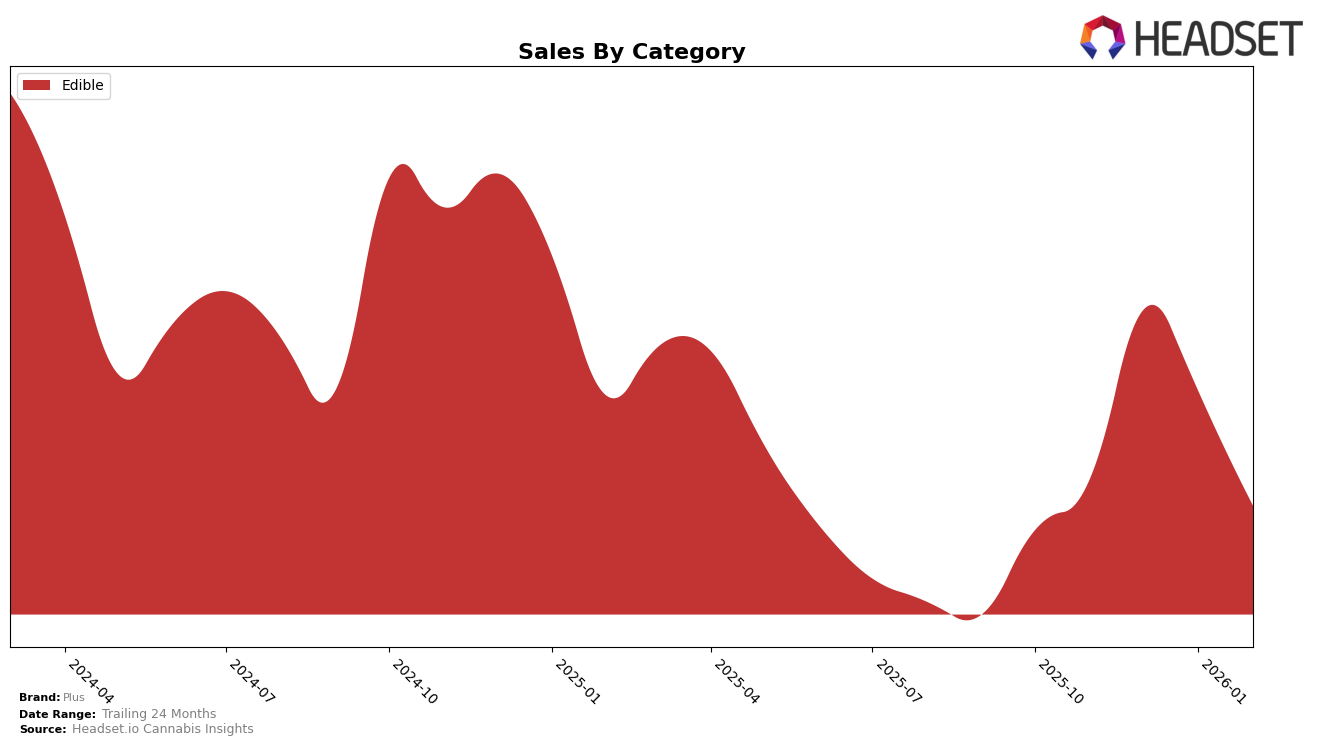

In terms of sales, Plus witnessed a peak in December 2025, surpassing the $1 million mark, which suggests a strong holiday season performance. However, there was a decline in sales in January and February 2026, which could be attributed to post-holiday seasonality or increased competition. It's important to note that Plus's absence from the top 30 in any other states or categories could be seen as a limitation in their market reach or category diversification. This highlights both the brand's strength in its core market and potential areas for growth in the future.

Competitive Landscape

In the competitive landscape of the California edibles market, Plus has maintained a consistent presence, ranking 9th in both November and December 2025, before slightly dropping to 10th in January and February 2026. Despite this minor dip in rank, Plus's sales figures have remained robust, indicating a strong brand loyalty and market presence. Notably, Froot consistently outperformed Plus, holding a steady 7th position until February 2026, when it dropped to 8th, yet still maintaining higher sales figures. Meanwhile, Highatus showed a fluctuating pattern, moving from 10th to 9th, and then back to 9th, with sales peaking in January 2026. Smokiez Edibles and Drops also hovered around the lower top 10 positions, with Smokiez Edibles consistently ranking 12th except for January 2026 when it improved to 11th, and Drops showing a similar pattern. These dynamics suggest that while Plus faces stiff competition, particularly from Froot, its stable sales performance indicates a resilient market position that could be leveraged for strategic growth.

Notable Products

In February 2026, the top-performing product for Plus was Deep Sleep - THC/CBD/CBN 1:1:1 Goodnight Cherry Gummies 10-Pack, maintaining its number one rank with sales of 16,465 units. CBD/CBG/THC 20:5:1 Relief Tart Cherry Gummies 20-Pack held steady in the second position, showcasing consistent performance over the past months. PLUS Sleep - THC/CBD/CBN 5:1:1 Cloudberry Sleep Gummies 20-Pack rose to third place, improving from fourth in January 2026. Sour Watermelon Gummies 20-Pack, previously third, dropped to fourth in February 2026. Sleep - CBD/THC/CBN 3:2:1 Lychee Gummies 20-Pack consistently ranked fifth, indicating a stable but lower demand compared to other top products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.