Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

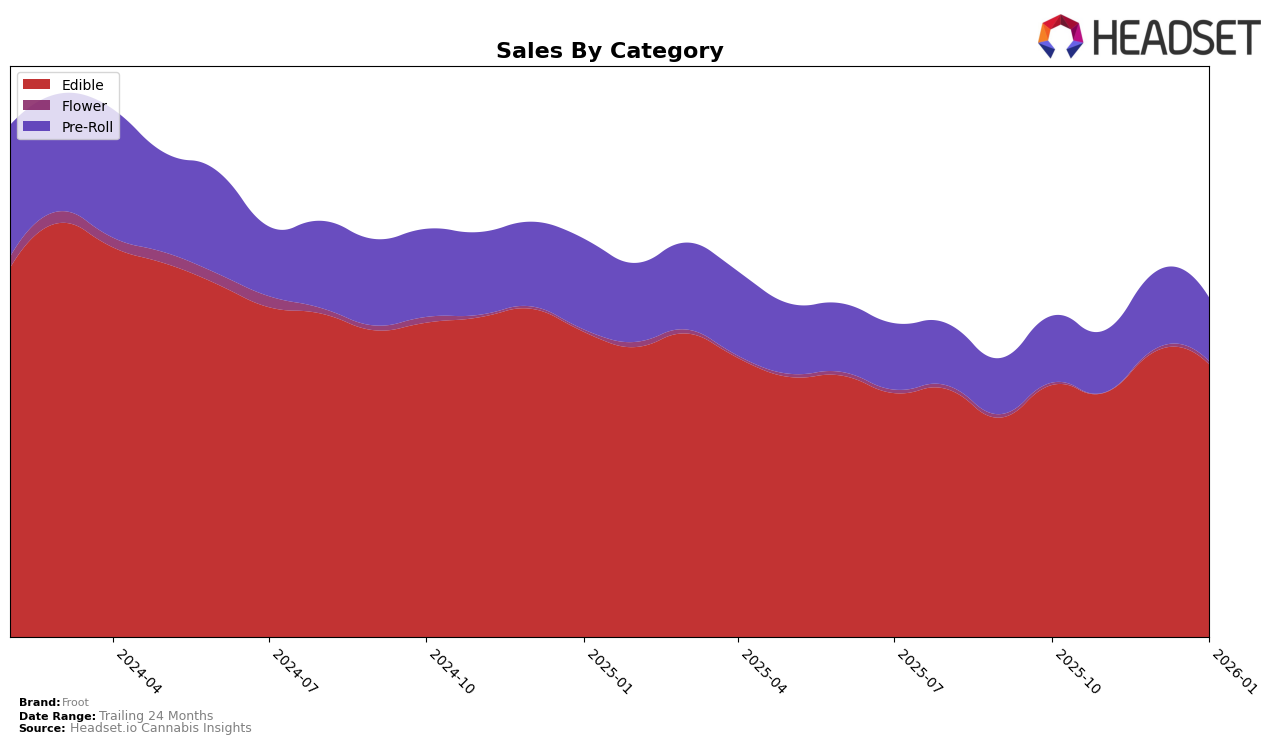

Froot has demonstrated consistent performance within the California market, particularly in the Edible category, where it has maintained a steady rank of 7th from October 2025 through January 2026. This stability in ranking is complemented by a noticeable increase in sales from November to December, suggesting a strong consumer demand during the holiday season. However, the brand's performance in the Pre-Roll category is less prominent, with rankings fluctuating between 38th and 41st, indicating challenges in breaking into the top tier of this competitive segment.

The absence of Froot from the top 30 rankings in the Pre-Roll category for several months could be seen as a potential area of concern, highlighting the need for strategic adjustments to enhance their market share. Conversely, maintaining a top 10 position in the Edible category across multiple months is a positive indicator of brand strength and consumer loyalty in this segment. This dual performance across categories illustrates the varied dynamics of the cannabis market in California, with Froot showing resilience and opportunity for growth in specific areas.

Competitive Landscape

In the California edibles market, Froot has maintained a consistent rank of 7th place from October 2025 through January 2026. This stability in ranking suggests a steady performance amidst a competitive landscape. Notably, Good Tide consistently holds the 5th position, indicating a stronger market presence with higher sales figures. Meanwhile, Heavy Hitters also remains stable at 6th place, just ahead of Froot, suggesting a close competition in terms of consumer preference. Emerald Sky has shown a slight upward trend, improving its rank from 9th to 8th, which may pose a future threat to Froot's position if this trend continues. Additionally, Highatus fluctuates between 9th and 11th, indicating a less stable performance compared to Froot. These insights highlight the importance for Froot to strategize effectively to either maintain or improve its standing in this competitive market.

Notable Products

In January 2026, the top-performing product from Froot was the Hybrid Blue Razz Dream Chews 10-Pack (100mg), maintaining its number one rank from December 2025 with sales of 13,430 units. The M.Y. Sleep - THC/CBN/Melatonin 5:2:2 Mellow Berry Gummies 20-Pack held steady in the second position, showing a notable increase in sales compared to previous months. Sour Grape Ape Gummies climbed to the third rank, up from fifth place in December 2025, indicating a resurgence in popularity. Indica Cherry Pie Gummies 10-Pack debuted at the fourth rank, suggesting strong initial demand. Lastly, the CBD/THC 1:1 Peach Fruit Chews 10-Pack dropped to fifth place, reflecting a slight decline in sales performance from prior months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.