Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

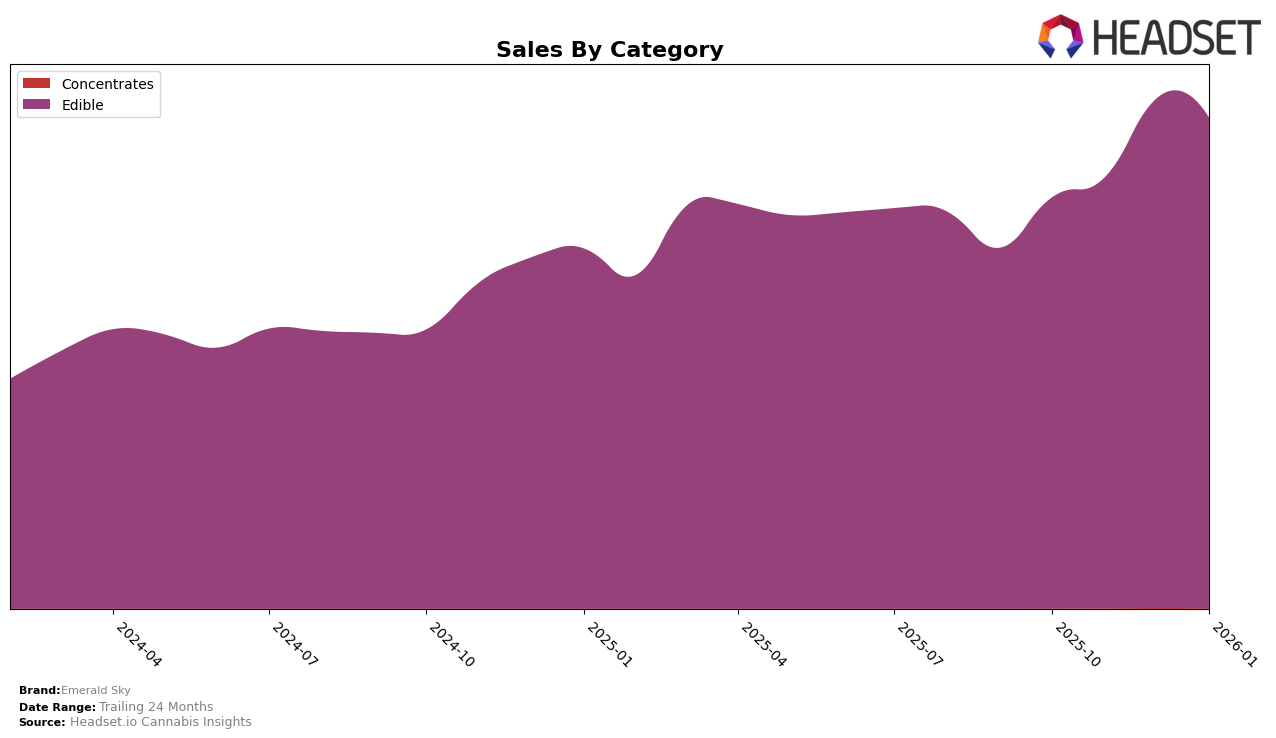

Emerald Sky has demonstrated consistent performance within the Edible category in California. Over the course of four months from October 2025 to January 2026, the brand maintained a stable rank, consistently holding the 8th position from November 2025 onwards. This stability indicates a solid market presence and consumer preference within the state. Notably, there was a significant increase in sales from November to December 2025, suggesting a successful holiday season or a possible product launch that resonated well with consumers. However, Emerald Sky's absence from the top 30 rankings in other states could imply challenges in expanding their geographic footprint or competing effectively in different markets.

While Emerald Sky's consistent ranking in California is commendable, their performance in other states remains a mystery. The data does not reveal their presence in the top 30 brands in any other state or province, which could be a point of concern for the brand's growth strategy. This absence might suggest that Emerald Sky is either focusing heavily on the California market or facing stiff competition elsewhere. The brand's ability to maintain its position in California, despite the competitive nature of the Edible category, highlights its strong brand loyalty and effective marketing strategies within the state. For a deeper understanding of their strategy and performance, one might consider exploring their product offerings or market initiatives in California.

Competitive Landscape

In the competitive California edibles market, Emerald Sky has shown a consistent performance, maintaining its rank at 8th place from November 2025 to January 2026. This stability in ranking is a positive indicator, especially when compared to competitors like Plus, which fluctuated between 9th and 10th place during the same period. Notably, Emerald Sky's sales have seen a significant upward trend, peaking in December 2025 and maintaining strong figures into January 2026. This growth trajectory positions Emerald Sky favorably against Highatus, which experienced a drop in rank in December 2025, and Froot, which consistently held the 7th position but did not exhibit the same sales growth momentum. Meanwhile, Heavy Hitters remains a strong competitor, consistently holding the 6th rank, yet Emerald Sky's ability to close the sales gap suggests potential for further advancement in the rankings.

Notable Products

In January 2026, Berry Blaze Gummy (100mg) reclaimed its position as the top-performing product for Emerald Sky, achieving sales of 9210 units. Grape Quake High Dose Gummy (100mg) moved from the first position in December 2025 to second place, demonstrating strong but slightly reduced sales. Hybrid Melon Thunder Gummy (100mg) maintained a steady presence in the top three, though its sales have decreased slightly from previous months. Strawberry Slam Gummy (100mg) consistently held the fourth position, showing a slight decline in sales compared to December. Indica Peanut Butter Dark Chocolate Cups 10-Pack (100mg) re-entered the rankings in January, securing the fifth spot after a temporary absence in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.