Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

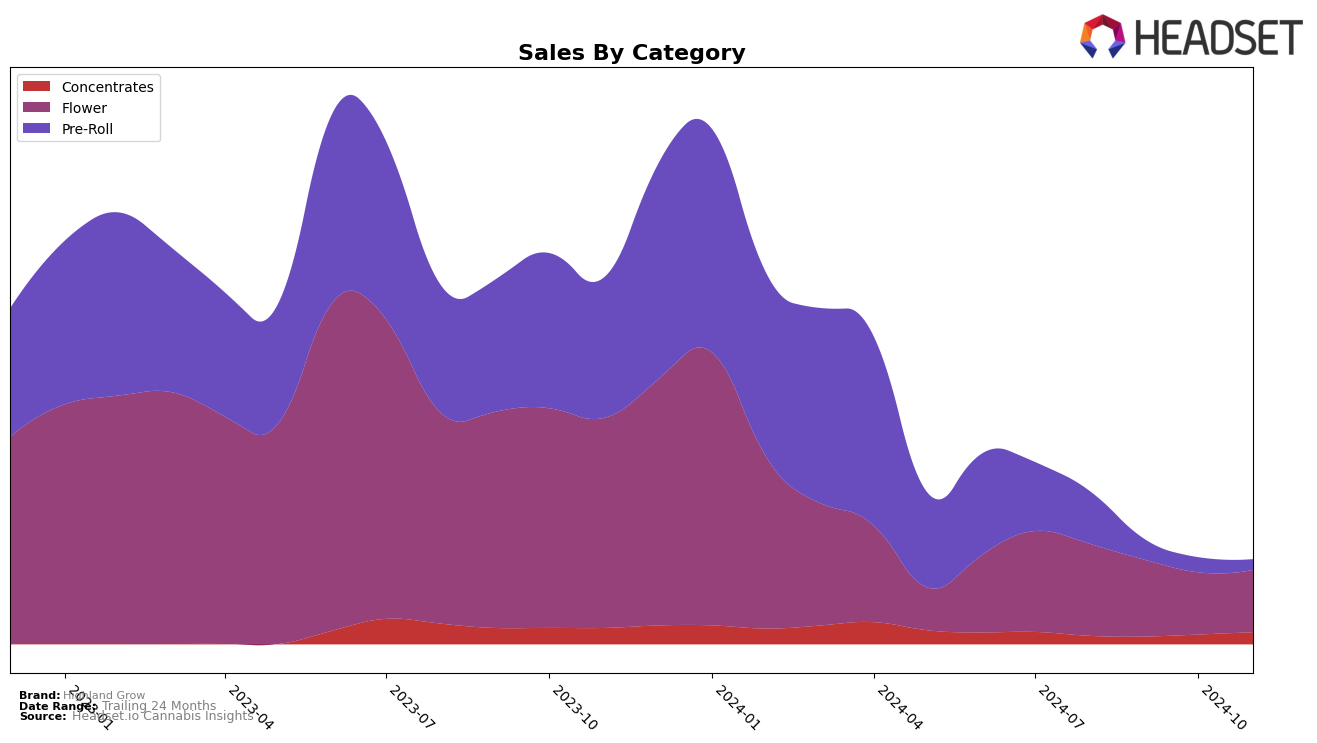

Highland Grow's performance in the Ontario market has shown some notable trends, particularly in the Flower category. Despite not making it into the top 30 rankings from August to November 2024, the brand has maintained a consistent presence in the market. In August 2024, Highland Grow achieved a sales figure of $99,329, which slightly decreased in September. This indicates a potential challenge in maintaining competitive positioning within the Flower category, as the brand did not break into the top ranks during this period. This absence from the top 30 could suggest a need for strategic adjustments to improve market penetration and visibility.

It's worth noting that Highland Grow's consistent ranking at 95th place in both August and September suggests a stable, albeit modest, foothold in Ontario. However, the lack of data for October and November might imply either a plateau in sales or a strategic withdrawal from reporting. The absence from the top 30 rankings highlights a competitive environment where Highland Grow might need to innovate or reevaluate its market strategies to regain or enhance its standing. Observing how the brand adapts in the coming months could provide further insights into its long-term sustainability and growth potential in Ontario's Flower category.

Competitive Landscape

In the competitive landscape of the Ontario flower category, Highland Grow has experienced notable fluctuations in its market positioning over recent months. While it maintained a stable rank of 95 in both August and September 2024, it did not appear in the top 20 rankings for October and November, indicating a potential decline in market visibility or sales performance. In contrast, Thumbs Up Brand showed a more dynamic presence, with ranks ranging from 88 to 99 over the same period, suggesting a more resilient market position despite fluctuations. Similarly, MELT demonstrated a strong presence, consistently ranking within the top 100 and achieving a notable peak rank of 80 in August. Meanwhile, Bold and Community Cannabis c/o Purple Hills also showed varying degrees of market engagement, with Bold re-entering the rankings in October and November after a brief absence in September. These dynamics highlight the competitive pressures Highland Grow faces and underscore the importance of strategic marketing and product differentiation to regain and sustain its market position.

Notable Products

In November 2024, Highland Grow's top-performing products were Frostbite Iced Infused Blunt (1g) and Paulander Purple (7g), both securing the first rank in their respective categories. Notably, Frostbite Iced Infused Blunt (1g) maintained its top position from October, despite a sales figure of 428.0. Paulander Purple (14g) showed significant improvement, climbing to the second rank from its debut at fifth in October. Rainbow Shades Live Rosin Jam (1g) entered the rankings at third place, indicating a strong market entry. Meanwhile, Dankarooz (3.5g) experienced a decline, dropping to fourth place from its previous third rank in October.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.