Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

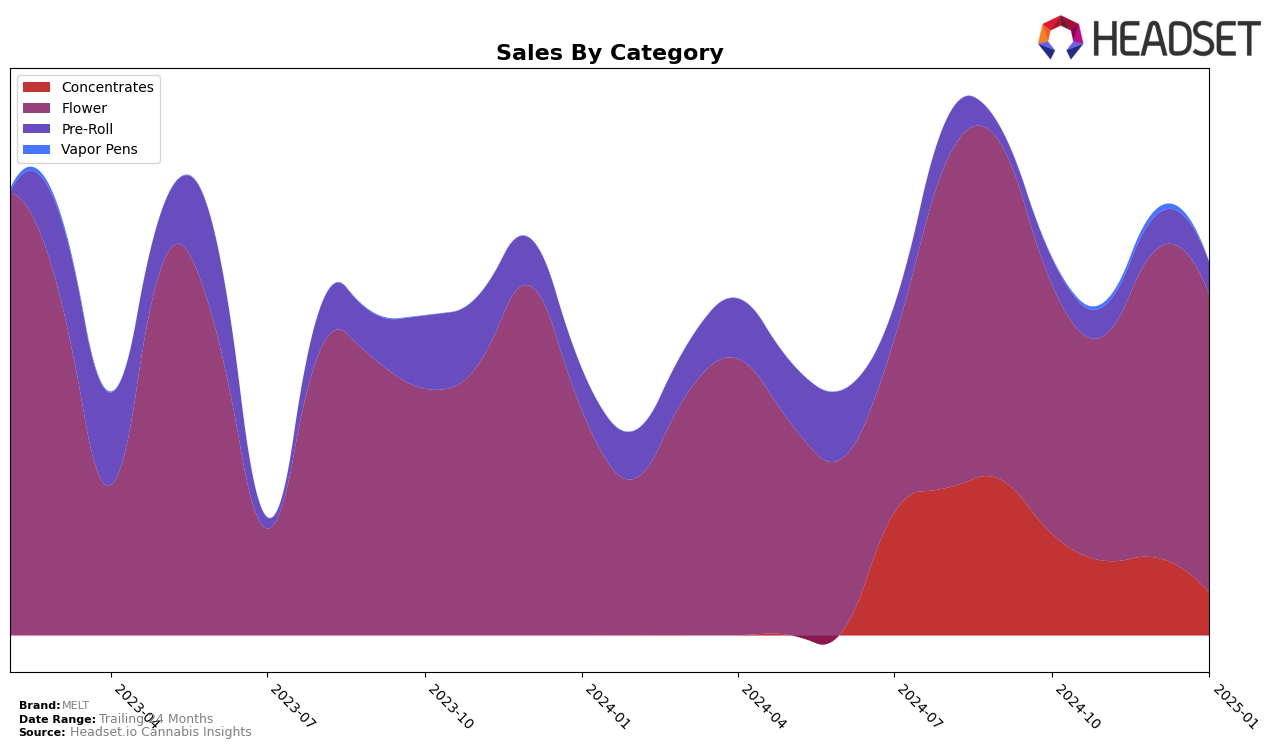

In the Alberta market, MELT's performance in the Flower category has been relatively stable, although not within the top 30 rankings. From October to November 2024, MELT's sales experienced a decline, dropping from 87th to 89th place, which indicates a challenging market environment. In Ontario, however, MELT showed a more positive trajectory in the same category. Starting at 88th place in October 2024, the brand improved its ranking to 71st by January 2025, suggesting a strengthening presence and possibly effective strategies in this province.

In Arizona, MELT's performance in the Concentrates category has been more consistent, maintaining a presence within the top 30 brands. Despite a slight decline in rankings from 24th in October 2024 to 29th by January 2025, the brand managed to sustain its position, which is notable given the competitive nature of the market. This suggests that while there may be fluctuations, MELT's products in this category continue to resonate with consumers in Arizona. The absence of MELT in the top 30 for other states and categories highlights areas for potential growth and market penetration.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, MELT has shown a notable upward trajectory in rankings from October 2024 to January 2025. Starting at a rank of 88 in October, MELT improved significantly to 71 by January, indicating a positive reception and increased market penetration. This improvement is particularly remarkable when compared to competitors such as QWEST, which experienced a decline in rank from 47 to 70 over the same period, and Freedom Cannabis, which also saw a drop from 56 to 76. Meanwhile, Verse maintained a relatively stable position, hovering around the low 70s, and BC OZ experienced a significant decline from 32 to 69. MELT's sales figures also reflect this upward trend, with a notable increase from November to December, aligning with its improved rank. This suggests that MELT's strategic initiatives or product offerings during this period resonated well with consumers, setting it apart from its competitors and positioning it for continued growth in the Ontario market.

Notable Products

In January 2025, the top-performing product from MELT was Sunset Angel (3.5g) in the Flower category, which achieved the number one rank with notable sales of 2314 units. Sugar Crush (3.5g), also in the Flower category, secured the second spot after previously holding the top rank in December 2024. Cookie Dawg (3.5g) maintained its presence in the top three, though it dropped from a first-place ranking in October 2024 to third in January 2025. Dragon Cookies Pre-Roll 10-Pack (5g) consistently held the fourth rank across the months from October 2024 through January 2025. A new entrant, Craft Crop Tour Pre-Roll 7-Pack (3.5g), debuted at fifth place in January 2025, indicating a fresh interest in pre-roll products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.