Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

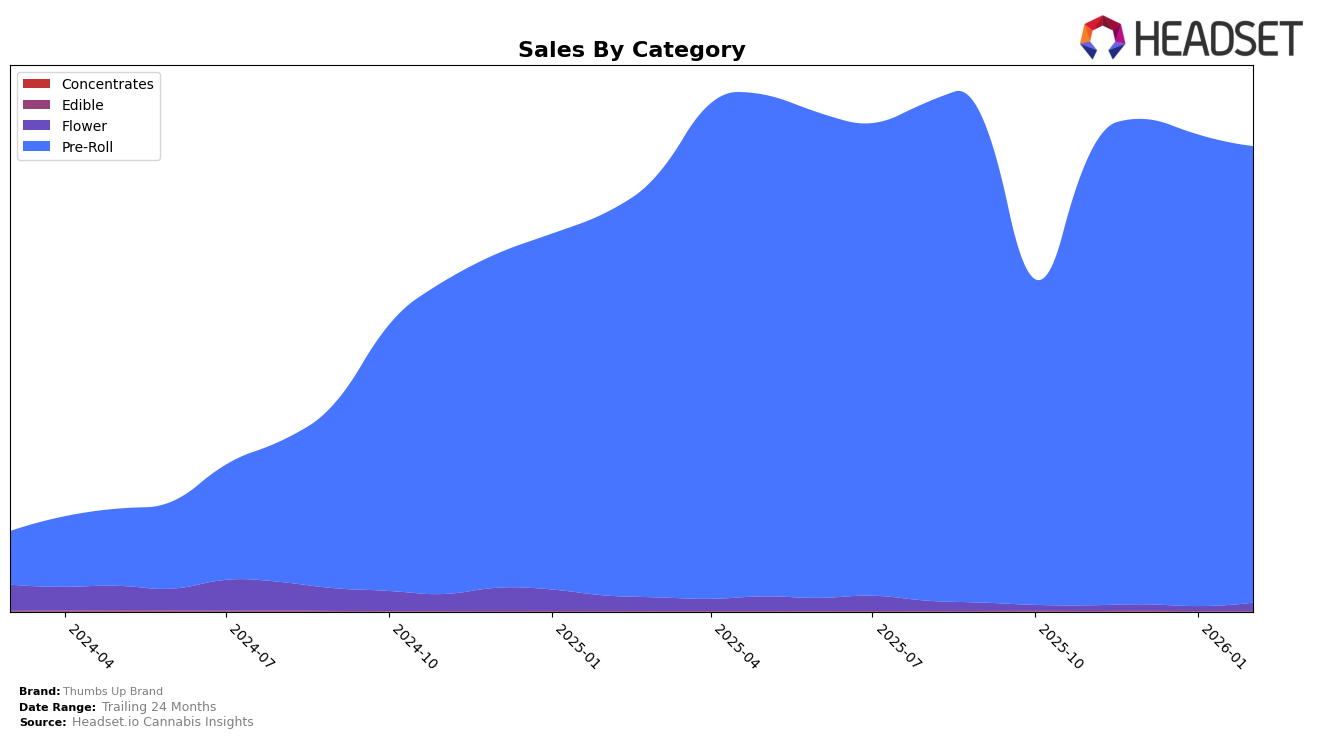

Thumbs Up Brand has demonstrated notable performance in the Pre-Roll category across several Canadian provinces. In British Columbia, the brand has consistently maintained a strong position, holding the 3rd rank from December 2025 through February 2026. This stability at the top of the rankings suggests a solid market presence and consumer preference in the province. Meanwhile, in Ontario, Thumbs Up Brand improved its standing from 8th in November 2025 to 5th by February 2026, indicating positive momentum and growing popularity among consumers. Conversely, in Saskatchewan, the brand was ranked 19th in November 2025 but did not make it into the top 30 in subsequent months, highlighting areas for potential improvement or increased market focus.

In Alberta, Thumbs Up Brand experienced a gradual improvement in its rankings within the Pre-Roll category, moving from 18th in November 2025 to 13th by February 2026. This upward trajectory indicates a strengthening position in the market, possibly driven by strategic marketing or product quality enhancements. The sales trend in Alberta also reflects this positive movement, with a notable increase from November to February. However, the absence of the brand in the top 30 rankings in Saskatchewan after November 2025 could be a point of concern, suggesting either a decline in market share or heightened competition in the region. Overall, while Thumbs Up Brand shows promising growth in certain provinces, there are opportunities for strategic adjustments to bolster its presence across all markets.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Ontario, Thumbs Up Brand has shown a notable upward trajectory in its rankings over recent months. Starting from the 8th position in November 2025, the brand has climbed to the 5th spot by February 2026. This improvement in rank is indicative of a positive trend in sales performance, contrasting with some competitors who have experienced declines. For instance, Redecan has seen a drop from 4th to 7th place, while Good Supply has fluctuated slightly but remains behind Thumbs Up Brand. Meanwhile, Claybourne Co. has maintained a steady 4th position, and Jeeter consistently holds the 3rd rank. The steady ascent of Thumbs Up Brand in the rankings suggests a strengthening market presence, potentially driven by strategic marketing or product differentiation, positioning it as a formidable competitor in the Ontario Pre-Roll market.

Notable Products

In February 2026, the top-performing product for Thumbs Up Brand was Indica Pre-Roll 2-Pack (2g) in the Pre-Roll category, maintaining its consistent first-place ranking with a sales figure of 127,021 units. Sativa Pre-Roll 2-Pack (2g) also held steady in second place, showing stable performance over the months. The Sativa Pre-Roll 4-Pack (2g) retained its third position, indicating a slight decline in sales but stable customer interest. Sativa Pre-Roll 10-Pack (3.5g) and Indica x Sativa Pre-Roll 2-Pack (2g) remained in the fourth and fifth positions, respectively, with both experiencing a gradual decline in sales since November 2025. Overall, the rankings have shown remarkable consistency, with no changes in positions from January 2026 to February 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.