Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

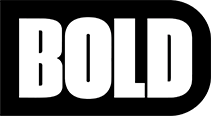

In examining Bold's performance across various categories, it's evident that the brand has experienced mixed results in different regions. In Saskatchewan, Bold has maintained a stronghold in the Vapor Pens category, consistently ranking first from October 2025 to January 2026. This demonstrates a robust consumer preference for Bold's vapor products in the province. Conversely, in Alberta, Bold's Flower category has seen a decline, slipping from 38th to 50th place over the same period, indicating challenges in maintaining market share in this particular segment.

Looking at Bold's performance in other regions, the brand has shown potential in British Columbia within the Pre-Roll category, where it improved its ranking significantly from 48th in October to 21st by January. This upward trend suggests increasing consumer acceptance and market penetration. In contrast, Bold's presence in Ontario in the Vapor Pens category remains limited, as they only appeared in the rankings in December 2025 at 61st place, highlighting an area for potential growth. Meanwhile, the absence of rankings in Illinois and Ohio for Vapor Pens suggests that Bold has yet to establish a significant footprint in these states.

Competitive Landscape

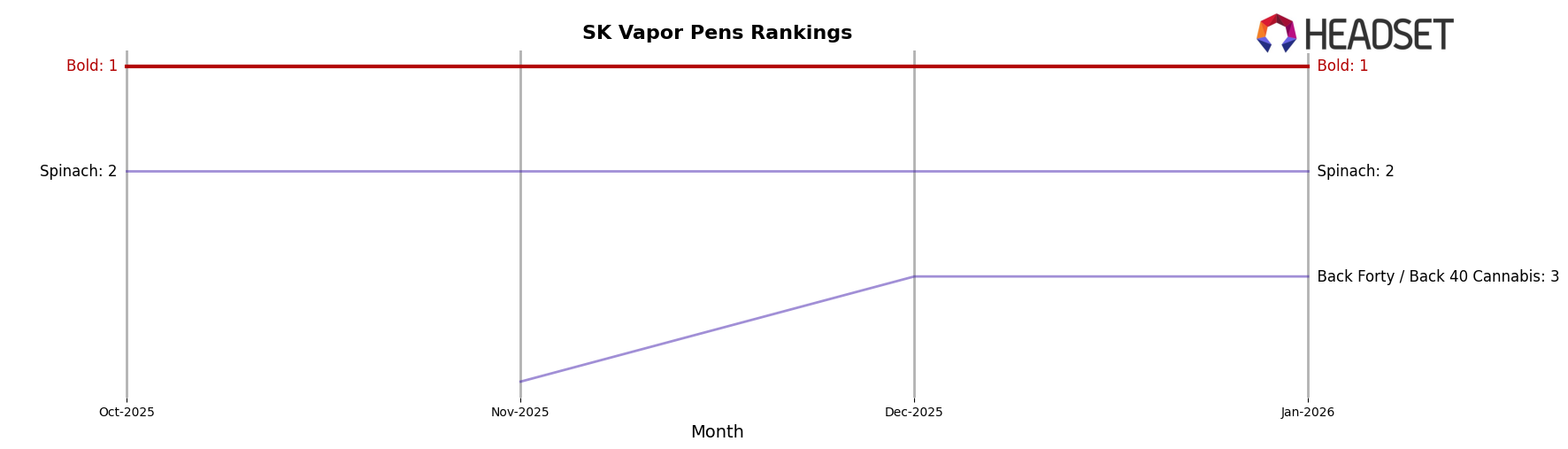

In the competitive landscape of vapor pens in Saskatchewan, Bold has consistently maintained its top position from October 2025 to January 2026, showcasing its dominance in this category. Despite the presence of strong competitors like Spinach, which held a steady second place, and Back Forty / Back 40 Cannabis, which improved its rank from fourth to third place, Bold's leadership remains unchallenged. This consistent top ranking indicates a robust brand loyalty and effective market strategy. While Spinach experienced a decline in sales from November to January, Bold's sales remained strong, suggesting a potential shift in consumer preference towards Bold's offerings. The absence of Back Forty / Back 40 Cannabis from the top ranks in October further highlights Bold's resilience and market strength during this period.

Notable Products

In January 2026, Bold's top-performing product was the Root Beer Float Blunt 3-Pack in the Pre-Roll category, maintaining its consistent number one rank from October 2025 with sales of 15,469 units. The Orange Crush Pre-Roll 3-Pack held steady at the second position for the third consecutive month, reflecting strong consumer preference. The Glazed Pre-Roll 2-Pack remained in third place, showing minor fluctuations in sales across the months. Notably, the Glazed - Melted Strawberries Liquid Diamonds Cartridge maintained its fourth rank, demonstrating a steady rise in sales figures. Meanwhile, Cool Aid Kush Pre-Roll 3-Pack, although ranked fifth, showed a decline in sales compared to its previous rank in October 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.