Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

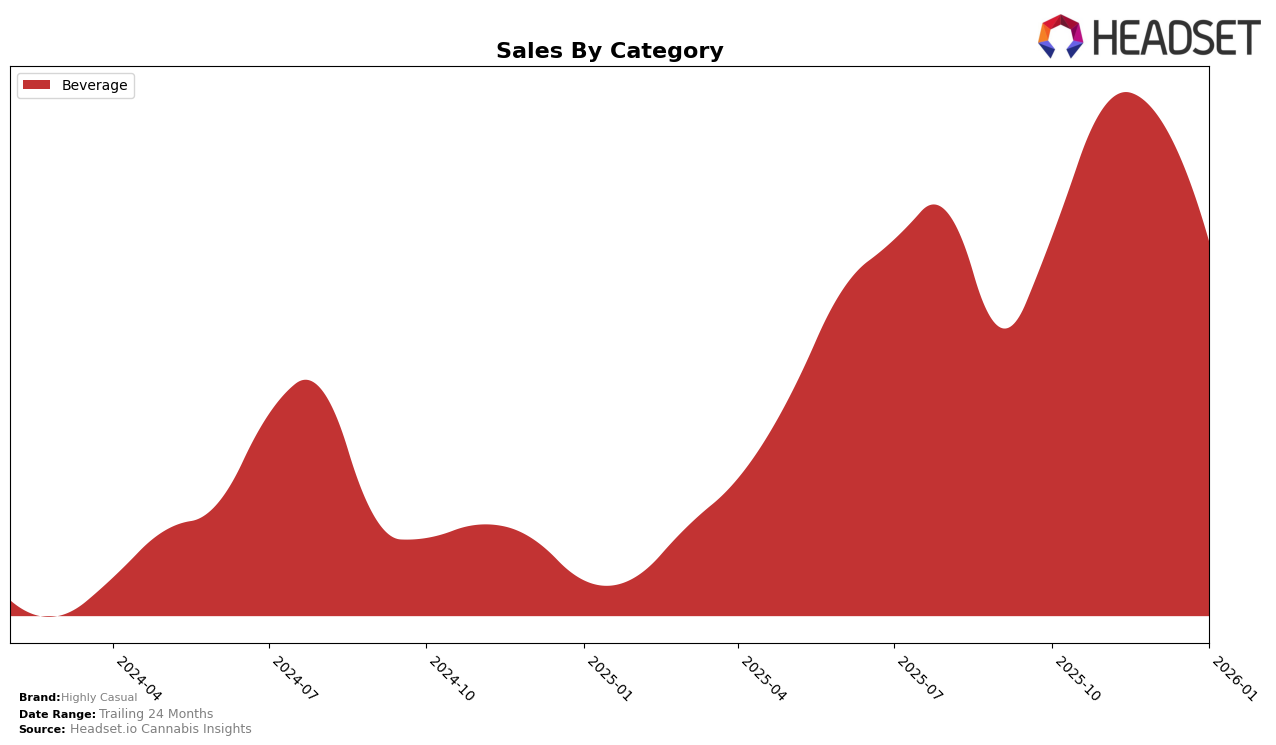

Highly Casual has shown a strong performance in the Beverage category within the state of Michigan. The brand maintained a consistent presence in the top five rankings over the last four months. In October 2025, Highly Casual was ranked 5th, and it climbed to the 3rd position in November and December. However, there was a slight dip in January 2026, as the brand moved to the 4th position. Despite this small decline in rank, the brand's sales figures reflect a noteworthy peak in November, indicating a successful promotional or seasonal strategy that month. This consistent ranking within the top five suggests that Highly Casual has established a strong foothold in Michigan's beverage market, although the slight drop in January could indicate increased competition or a post-holiday sales slump.

While Highly Casual's performance in Michigan's beverage category is commendable, the absence of rankings in other states or categories could be seen as a potential area for growth or concern. The lack of presence in the top 30 brands in other regions or categories might indicate that the brand is either focusing its efforts specifically on Michigan or that it has yet to penetrate other markets effectively. This could be an opportunity for Highly Casual to explore expansion strategies or to diversify its product offerings to capture a larger market share across different states and categories. The brand's ability to maintain a high ranking in Michigan suggests a strong product-market fit there, which could be leveraged in other regions with a similar consumer base.

Competitive Landscape

In the competitive Michigan beverage category, Highly Casual has demonstrated notable fluctuations in its market position over the past few months. Starting from a rank of 5th in October 2025, Highly Casual improved to 3rd place in November and December, before slightly dropping to 4th in January 2026. This movement suggests a dynamic competitive landscape, with Highly Casual consistently outperforming CQ (Cannabis Quencher) and Pleasantea, which have maintained lower ranks throughout this period. However, Highly Casual faces stiff competition from Pot Shot, which has shown resilience by reclaiming the 3rd position in January 2026. Meanwhile, Keef Cola remains a strong leader, consistently holding the 2nd rank. These insights highlight the importance for Highly Casual to strategize effectively to maintain and improve its standing in this competitive market.

Notable Products

In January 2026, Honeycrisp Apple Hang Ten Seltzer (10mg) maintained its top position as the best-selling product from Highly Casual, with sales reaching 6,498 units. The CBD/THC 1:1 Blueberry & Pineapple Seltzer (5mg CBD, 5mg THC, 12oz, 355ml) rose to second place, showing consistent performance improvement over the past months. High 5 - CBD/THC 1:1 Strawberry & Watermelon Seltzer (5mg CBD, 5mg THC) dropped to third place, despite previously holding the second position. The CBD/THC 1:1 Lemon + Lime Seltzer (5mg CBD, 5mg THC) remained stable in fourth place, while Cold Brew Coffee (10mg) retained its fifth position. Overall, the rankings indicate a strong preference for seltzers, with minor fluctuations in product positioning from the previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.