Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

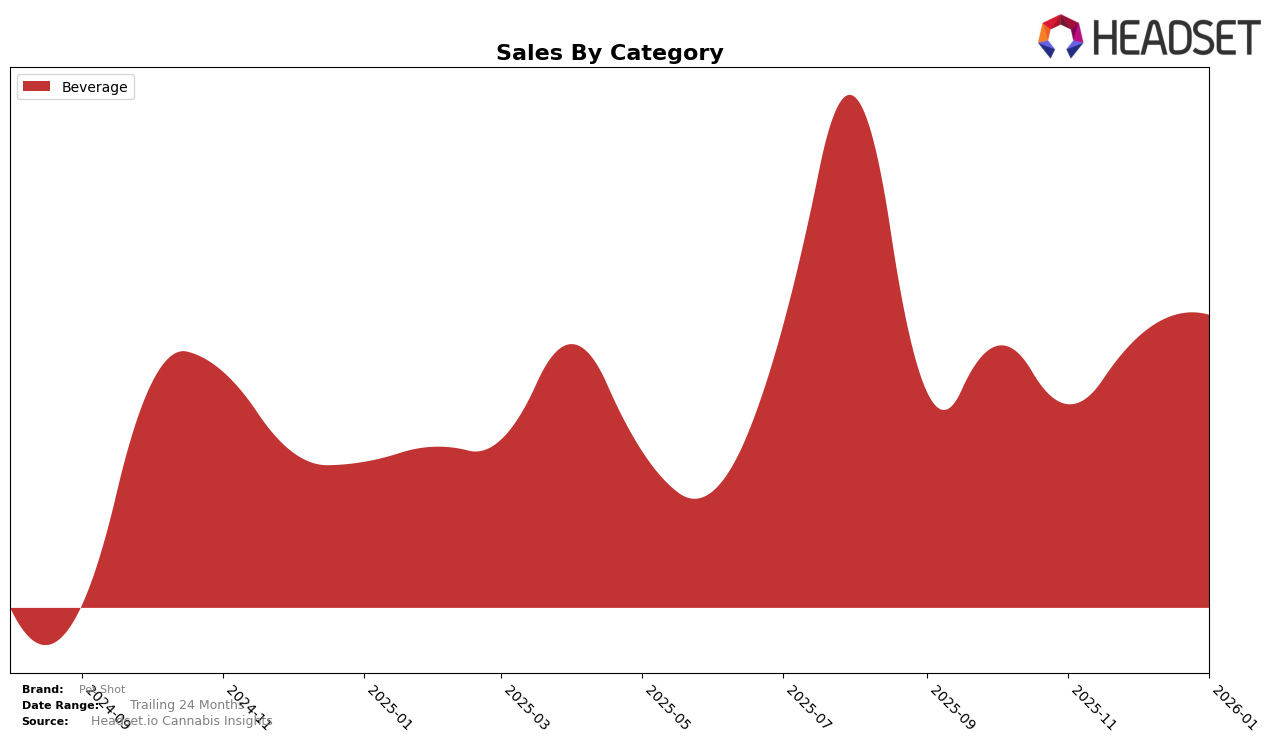

In the state of Arizona, Pot Shot has shown a notable presence in the Beverage category. Starting with a rank of 9 in October 2025, the brand was not ranked in November, which could be seen as a setback. However, Pot Shot made a strong comeback in December, securing the 6th position and maintaining this rank into January 2026. This resilience in the rankings suggests that Pot Shot has a competitive edge in Arizona's beverage market, even though the absence from the November rankings indicates potential volatility or market challenges during that period.

Meanwhile, in Michigan, Pot Shot has consistently maintained a top-tier position in the Beverage category. The brand started strong with a rank of 3 in October 2025, briefly dropping to 4th place in November and December, before reclaiming the 3rd spot in January 2026. This consistent performance, with only slight fluctuations, highlights Pot Shot's solid foothold in Michigan's market. Notably, the brand's sales in Michigan remained robust, with an increase from November to January, indicating a positive growth trajectory and a strong consumer base in this state.

Competitive Landscape

In the competitive landscape of the Michigan cannabis beverage market, Pot Shot has experienced notable fluctuations in its rank over recent months. While consistently maintaining a position within the top 5, Pot Shot's rank shifted from 3rd in October 2025 to 4th in November and December, before reclaiming the 3rd spot in January 2026. This dynamic positioning highlights Pot Shot's resilience amidst strong competition from leading brands such as Mary Jones, which has consistently held the top rank, and Keef Cola, which remains firmly in 2nd place. Meanwhile, Highly Casual has shown a competitive edge, briefly surpassing Pot Shot in November and December. Despite these challenges, Pot Shot's sales trajectory indicates a positive trend, with a significant rebound in January 2026, suggesting effective strategies in regaining market share and consumer interest.

Notable Products

In January 2026, the top-performing product for Pot Shot was Lunar Lime Shot, maintaining its leading position from December with sales of 7,288 units. Following closely, Martian Mango Shot climbed to the second spot, up from third in December. Warped Watermelon Shot secured the third rank, showing consistency by holding a similar position in previous months. Blasted Berry Shot, which was second in December, fell to fourth place. Overall, the rankings indicate a stable performance for Lunar Lime Shot, while the other products experienced slight shifts in their positions.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.