Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

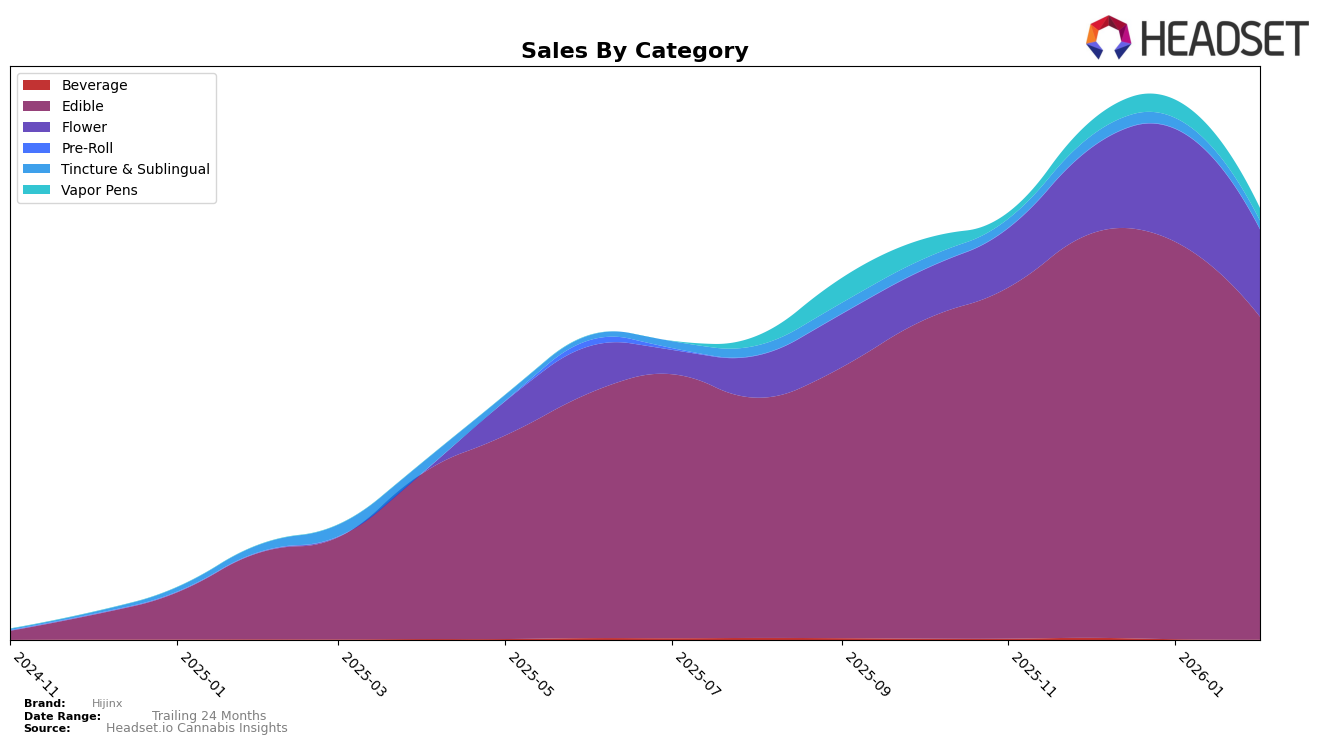

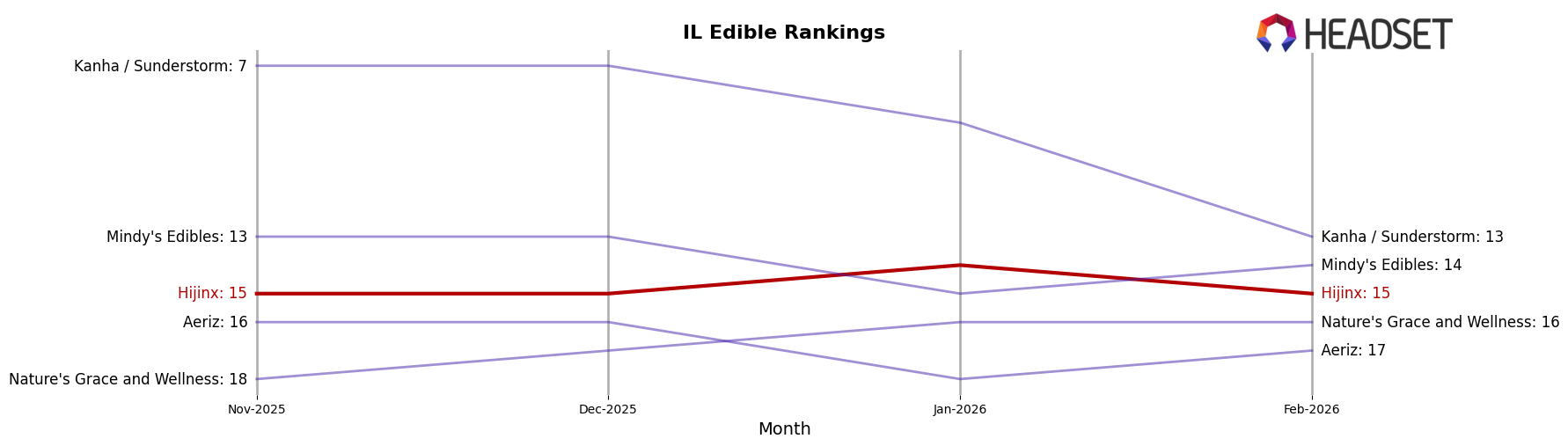

In the state of Illinois, Hijinx has shown consistent performance in the Edible category, maintaining a steady rank around the mid-teens, specifically holding the 15th position in both November 2025 and February 2026, with a slight improvement to 14th in January 2026. This indicates a stable presence in the market, although the slight dip in sales from December to February suggests a need for strategic adjustments. In the Tincture & Sublingual category, Hijinx made a notable entry into the top 30 in December 2025, securing the 5th position and maintaining a respectable 6th place in January 2026. This performance highlights their strong competitive edge in this niche category. However, their absence from the top 30 in November 2025 before this jump indicates a rapid rise, which could be either a strategic breakthrough or a temporary surge.

In Nevada, Hijinx has demonstrated an upward trend in the Flower category, moving from the 60th position in November 2025 to the 42nd position by February 2026. This upward trajectory suggests growing consumer interest or successful marketing strategies. However, it's worth noting that despite this progress, Hijinx has not yet broken into the top 30, indicating room for further growth and market penetration. In Illinois, the Vapor Pens category showed a gradual improvement, with Hijinx climbing from 89th in December 2025 to 83rd by February 2026, although this is still outside the top 30 brands. The brand's absence from the top 30 in November 2025 across multiple categories highlights areas where Hijinx could focus on enhancing its market presence to achieve a more competitive standing.

Competitive Landscape

In the competitive landscape of the Illinois edible market, Hijinx has maintained a consistent presence, although it has faced challenges in climbing the ranks. From November 2025 to February 2026, Hijinx's rank fluctuated slightly, peaking at 14th in January 2026 before settling back to 15th in February. Despite this, Hijinx's sales trajectory shows a noteworthy pattern, with a peak in December 2025, followed by a decline in the subsequent months. This trend is indicative of the competitive pressure from brands like Mindy's Edibles, which consistently outperformed Hijinx, even reclaiming the 14th position in February 2026. Additionally, Kanha / Sunderstorm experienced a significant drop from 7th to 13th place, which could have provided an opportunity for Hijinx to advance, yet the brand remained stable. Meanwhile, Nature's Grace and Wellness and Aeriz hovered around similar ranks, indicating a tightly contested market where small shifts in sales can impact rankings. This analysis highlights the importance for Hijinx to strategize effectively to leverage market dynamics and potentially improve its standing in the coming months.

Notable Products

In February 2026, Hijinx's top-performing product was Space Chunk OG RSO Gummies 2-Pack (100mg) in the Edible category, maintaining its number one ranking for four consecutive months with notable sales of 14,224 units. The CBD/THC 1:1 Chill Space Chunk RSO Gummies 2-Pack (100mg CBD, 100mg THC) held steady in second place, although its sales figures declined from the previous month. Space Chunk OG Minis Gummies 10-Pack (100mg) remained in third place, showing consistency in its ranking since January 2026. The CBN/THC 1:1 Sleep Space Chunk OG RSO Gummy (50mg CBN, 50mg THC) continued in fourth place despite a drop in sales. The CBN/THC 1:1 Sleep Space Chunk OG RSO Gummies 2-Pack (100mg CBN, 100mg THC) maintained its fifth position, having re-entered the rankings in January 2026 after being unranked in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.