Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

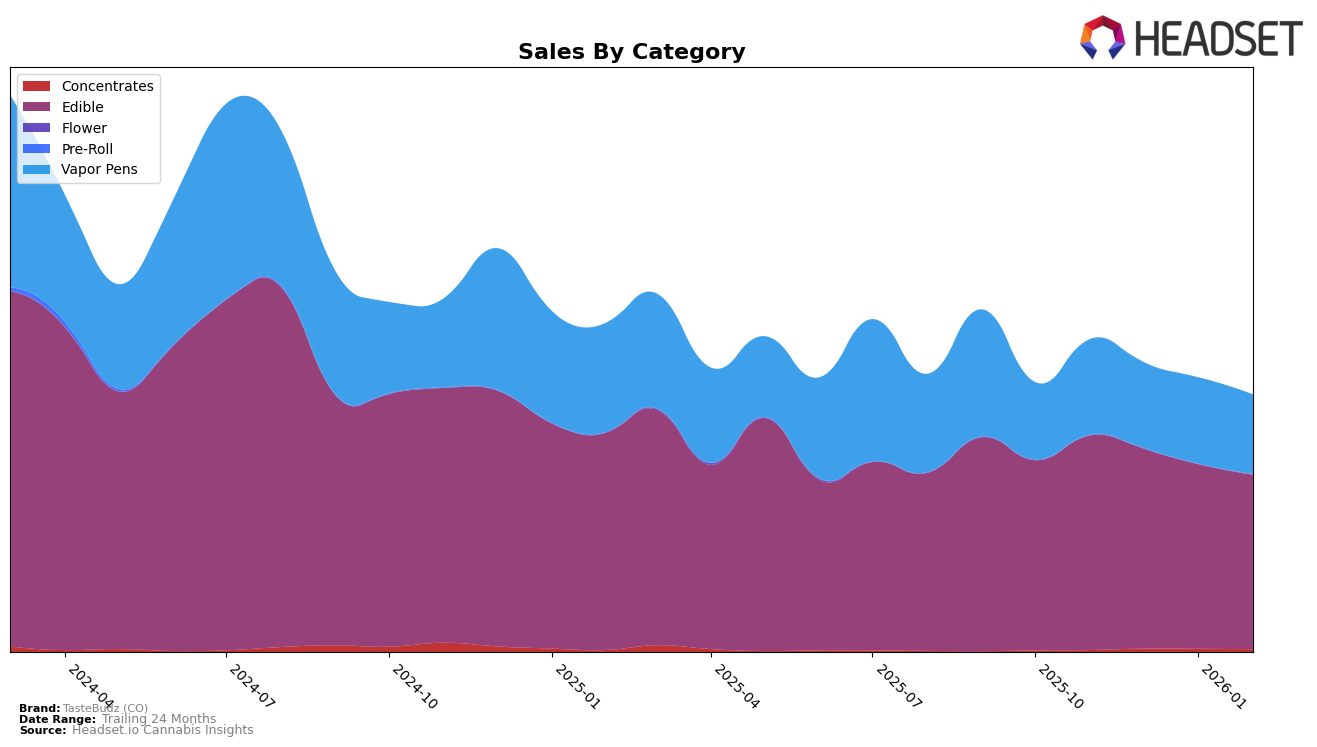

TasteBudz (CO) has demonstrated a consistent performance in the Colorado Edible category, maintaining a solid presence with a slight decline from 6th to 7th rank from November 2025 to February 2026. This indicates a stable yet slightly declining market position in a highly competitive segment. The sales figures, starting at $611,407 in November 2025 and gradually decreasing to $486,113 by February 2026, suggest a need for strategic adjustments to regain momentum. In the Vapor Pens category within Colorado, TasteBudz (CO) has shown a slight improvement, moving from 29th in December 2025 to 27th in February 2026, indicating a positive trend despite being outside the top 20 brands.

In Illinois, TasteBudz (CO) has struggled to break into the top 30 in the Edible category, lingering at the 32nd position in both January and February 2026. This consistent ranking outside the top 30 highlights the challenges the brand faces in gaining a stronger foothold in the Illinois market. Despite this, there was a slight uptick in sales from December 2025 to February 2026, moving from $106,867 to $93,850, which may indicate potential for growth if the brand can capitalize on emerging opportunities. Overall, TasteBudz (CO) appears to be well-established in its home state of Colorado but faces significant competition in expanding its presence in other states like Illinois.

Competitive Landscape

In the competitive landscape of the Colorado edible market, TasteBudz (CO) has experienced a slight decline in its ranking, moving from 6th place to 7th place by February 2026. This shift is notable as it marks the first time in four months that TasteBudz (CO) has dropped in rank, indicating potential challenges in maintaining its market position. Despite consistent sales figures in the preceding months, the brand's sales have shown a downward trend, which may have contributed to its rank change. In contrast, Joyibles has improved its position, climbing from 7th to 6th place, likely due to a steady increase in sales. Meanwhile, Good Tide maintains a strong hold on the 5th position, although its sales have fluctuated. Brands like Incredibles and Revel (CO) remain stable in their rankings, suggesting a consistent performance. For TasteBudz (CO), the current market dynamics highlight the need for strategic adjustments to regain its previous standing and counteract the sales decline.

Notable Products

In February 2026, the top-performing product for TasteBudz (CO) was Nightly Rituals - CBD/CBN/THC 1:1:1 Blueberry Lavender Rosin Gummies 20-Pack, maintaining its first-place ranking for the fourth consecutive month with sales of $5,460. Sour Green Slapple Gummies 10-Pack moved up one spot to second place, showing a positive trend in sales figures compared to previous months. The CBD:THC 50:1 Hybrid Raspberry Lemonade Gummies 20-Pack dropped to third place, despite consistently strong performance in earlier months. A new entry, CBD/THC 2:1 Sour Water mellow Gummies 10-Pack, debuted in fourth place, indicating a promising start. Indica Blue Raspberry Live Rosin Gummies 10-Pack remained steady in fifth place, although its sales have seen a gradual decline over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.