Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

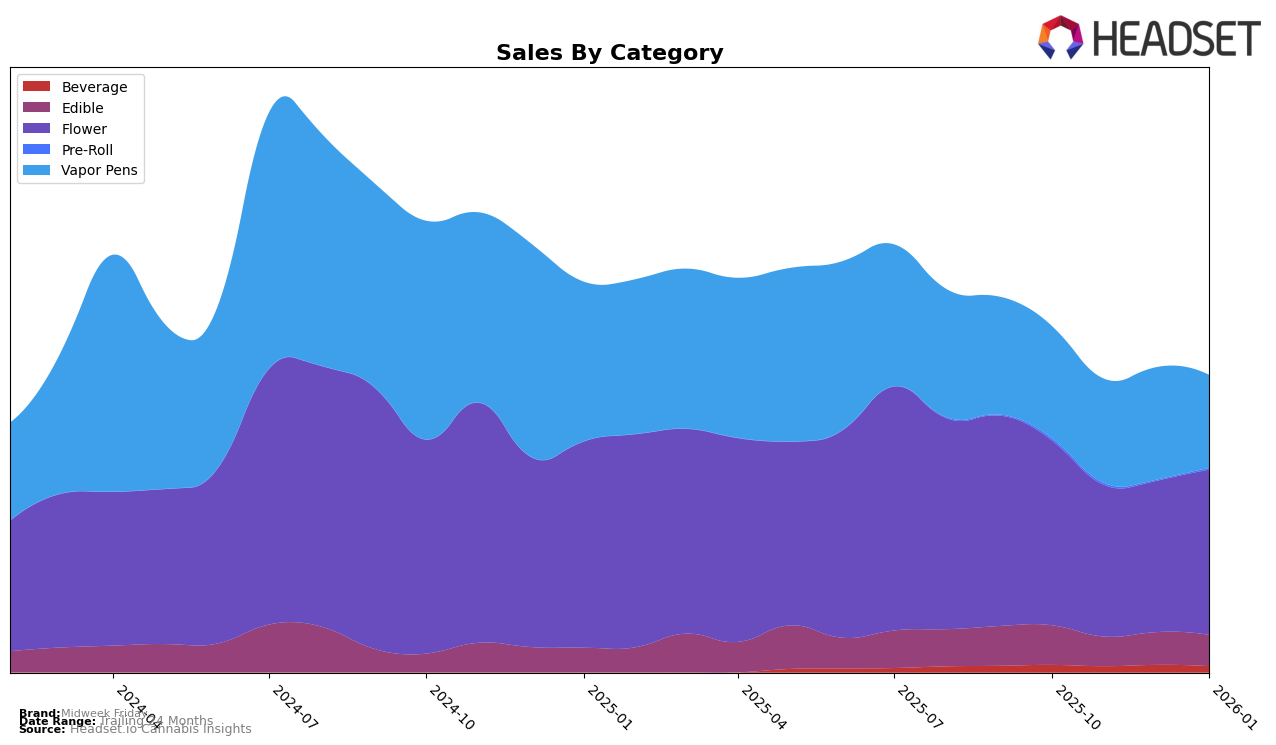

Midweek Friday has shown a varied performance across different product categories in Illinois. In the Beverage category, the brand consistently maintained a strong presence, holding the 7th position in October, December, and January, with only a slight dip to 9th place in November. This consistency suggests a stable demand for their beverage offerings. However, in the Edible category, Midweek Friday experienced a gradual decline, slipping from 21st to 23rd place by January. This downward trend indicates potential challenges in maintaining market share within this segment.

In the Flower category, Midweek Friday showed resilience, regaining its 11th place ranking in January after a dip to 14th in December. This recovery could signal a renewed interest or strategic adjustments that resonated with consumers. Conversely, in the Vapor Pens category, the brand's ranking fluctuated, ending at 14th in January after reaching 13th in December. Notably, Midweek Friday did not break into the top 30 in other states or provinces, highlighting an area for potential growth or concern depending on market strategy and expansion plans.

Competitive Landscape

In the competitive landscape of the Illinois flower category, Midweek Friday has experienced notable fluctuations in its ranking and sales performance from October 2025 to January 2026. Initially ranked 11th in October 2025, Midweek Friday saw a dip to 13th in November and 14th in December, before rebounding to 11th in January 2026. This volatility contrasts with the consistent performance of Grassroots, which maintained a steady 9th position throughout the same period, indicating a strong and stable market presence. Meanwhile, UpNorth Humboldt demonstrated significant upward momentum, climbing from 15th in October and November to 10th in December and January, potentially posing a competitive threat to Midweek Friday. Despite these challenges, Midweek Friday's sales showed resilience, particularly in January 2026, where it outperformed its November and December figures, suggesting a positive trend that could be leveraged for future growth.

Notable Products

In January 2026, the top-performing product for Midweek Friday was the Tangerine Energize Gummies 10-Pack (100mg) in the Edible category, maintaining its first-place rank from December 2025 with sales of 5003 units. The Lemon Vibe Pectin Gummies 10-Pack (100mg) secured the second position, consistent with its performance in December, highlighting its steady demand. Strawberry Doze Gummies 10-Pack (100mg) slipped to third place from its previous second-place rank, indicating a slight decline in sales momentum. A notable entry in the rankings is the Don Shula Popcorn (7g) in the Flower category, debuting at fourth place, suggesting a growing interest in this product type. The Happy Hour - Tropical Blast Fruit Drink (100mg THC, 4oz) maintained its fifth position from December, indicating stable consumer interest in the Beverage category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.