Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

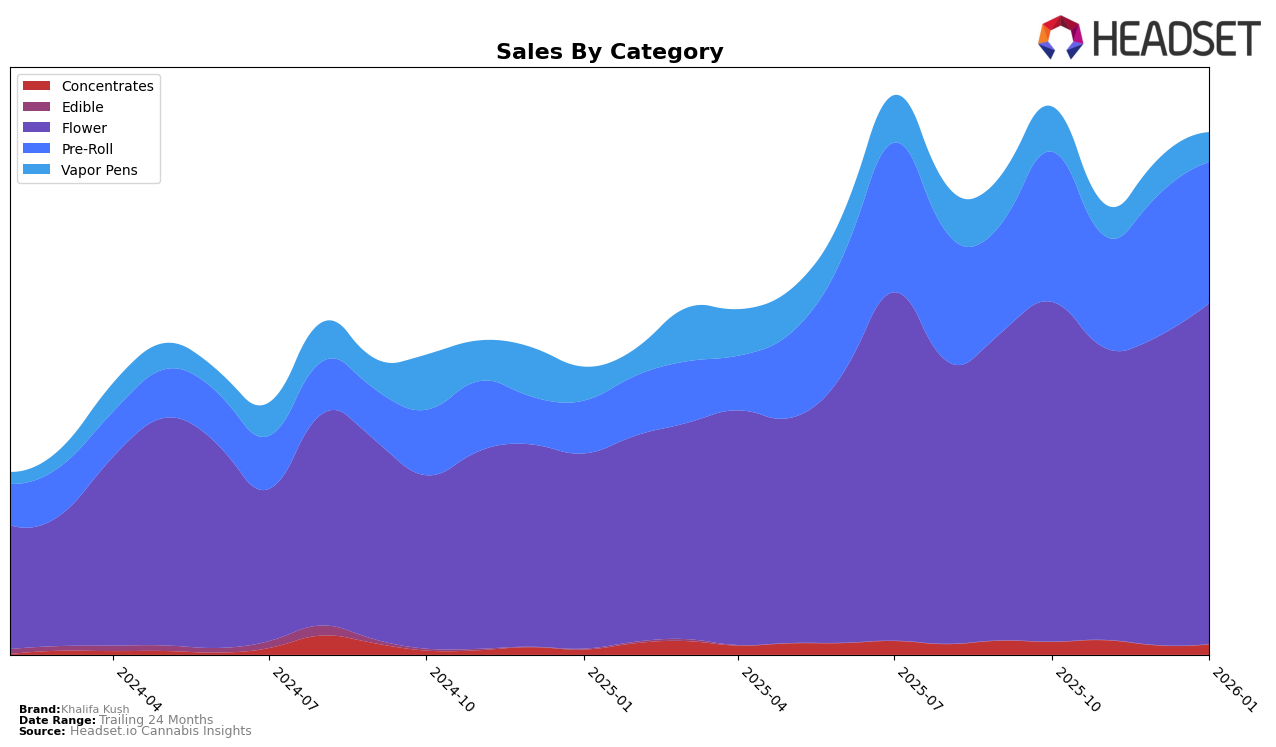

Khalifa Kush has demonstrated varying performance across its product categories and different states. In Illinois, the brand's Flower category saw a gradual improvement, moving from 34th to 31st position by January 2026, indicating a positive trend in consumer preference. Meanwhile, their Pre-Roll category in Illinois showed a more significant rise, climbing from 30th to 22nd. In contrast, in Massachusetts, the brand's Flower category did not make it into the top 30, remaining in the 50s range, which suggests challenges in gaining a foothold in this segment. However, their Pre-Roll category improved significantly, moving from 68th to 39th, which is a positive sign for their presence in Massachusetts.

In Nevada, Khalifa Kush's Pre-Roll category consistently performed well, maintaining a top 10 position, which highlights strong consumer demand. However, their Vapor Pens in Nevada experienced a decline, dropping from 28th to 35th, reflecting possible competitive pressures or changing consumer preferences. In Maryland, while the Flower category showed improvement, moving from 42nd to 37th, the Pre-Roll category experienced a slight decline, ending at 30th. Interestingly, in Ohio, the Flower category saw fluctuating rankings but ended on a positive note, moving up to 43rd. Overall, the brand's performance varies by state and category, reflecting the dynamic nature of the cannabis market and the need for targeted strategies to enhance market presence.

Competitive Landscape

In the competitive landscape of the Flower category in Illinois, Khalifa Kush has shown a steady improvement in its rank from October 2025 to January 2026, moving from 34th to 31st position. This upward trend in rank is accompanied by a consistent increase in sales, indicating a positive reception in the market. In comparison, Galaxy (CA) has experienced fluctuations, peaking at 27th rank in November and December 2025 before dropping to 30th in January 2026, although their sales remain higher than Khalifa Kush. Meanwhile, Mini Budz has struggled to maintain a stable position, with ranks varying significantly and sales showing a recovery in January 2026. Blaze Craft Cannabis Flower (IL) has maintained a relatively stable rank, slightly ahead of Khalifa Kush but with less pronounced sales growth. Notably, Elevate has surged in rank, moving from 46th to 29th, surpassing Khalifa Kush in January 2026, driven by a significant increase in sales. These dynamics suggest that while Khalifa Kush is on an upward trajectory, it faces stiff competition from brands like Elevate and Galaxy (CA), which are also vying for market share in Illinois.

Notable Products

In January 2026, Khalifa Kush (3.5g) retained its top position in the Flower category with sales reaching 12,774. Premium Khalifa Kush Pre-Roll (1g) maintained its second place in the Pre-Roll category, showing consistent performance since December 2025. Khalifa Mints Pre-Roll (1g) held steady at third in the Pre-Roll category over the past three months. Point Breeze Pre-Roll (1g) improved its rank from fifth in December 2025 to fourth in January 2026. Baby Turtle (3.5g) re-entered the rankings at fifth place, marking a notable presence in the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.