Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

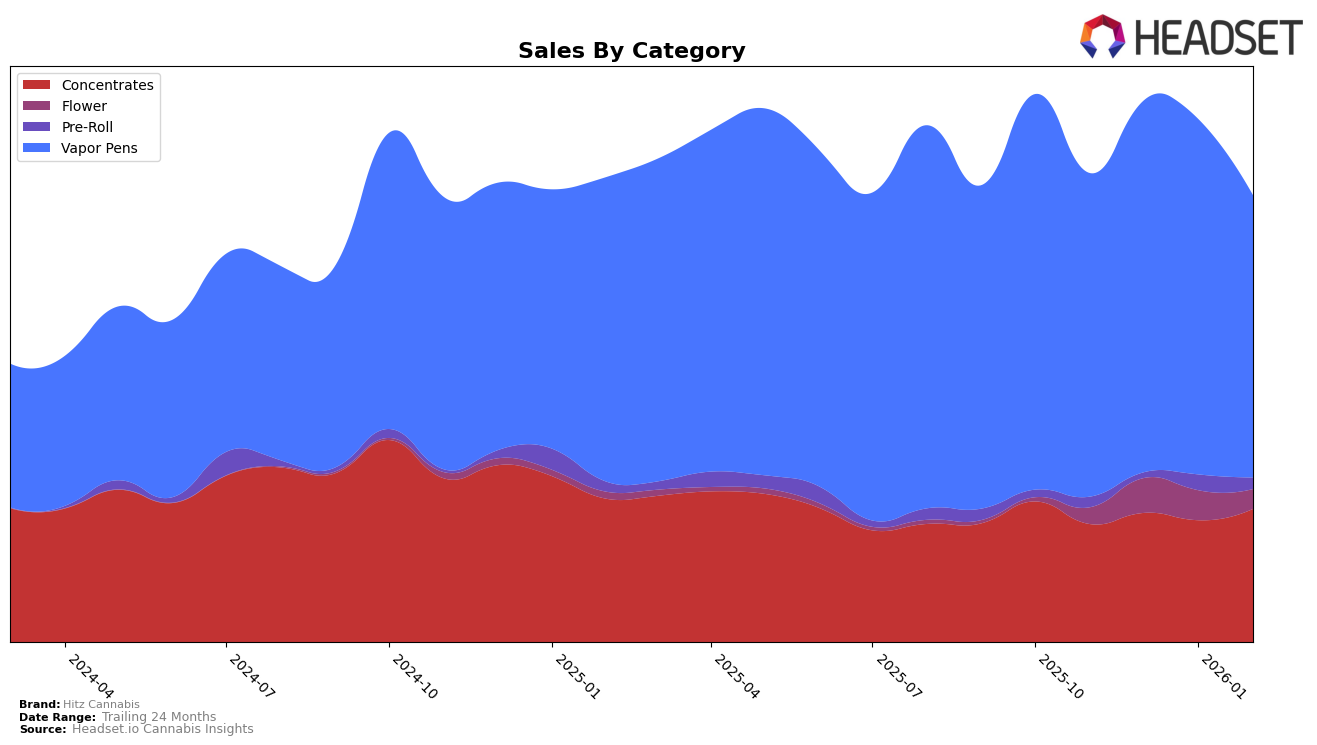

In the state of Washington, Hitz Cannabis has shown a notable performance in the Concentrates category. Over the months from November 2025 to February 2026, the brand's ranking fluctuated slightly, starting at 19th position, dipping to 22nd in January, and then rising to 17th by February. This upward movement suggests a strengthening position in the market, possibly due to strategic initiatives or product improvements. Despite the fluctuations, Hitz Cannabis consistently remained within the top 30, indicating a stable presence in this competitive category.

When it comes to Vapor Pens in Washington, Hitz Cannabis maintained a steady ranking, starting and ending at 24th position from December 2025 through February 2026. However, it is noteworthy that the brand did not break into the top 20, which could signal challenges in gaining a stronger foothold or increasing market share in this segment. Interestingly, despite the consistent rankings, there was a noticeable dip in sales from January to February, which might suggest seasonality or increased competition. These insights could be crucial for stakeholders looking to understand market dynamics and the brand's strategic positioning.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, Hitz Cannabis has maintained a consistent rank, hovering around the 24th and 25th positions from November 2025 to February 2026. Despite this stability, Hitz Cannabis faces stiff competition from brands like Mama J's, which made a significant leap from 70th in November 2025 to 25th by January 2026, indicating a rapid increase in market presence. Meanwhile, Freddy's Fuego (WA) has shown a slight decline in sales, yet it remains ahead of Hitz Cannabis, consistently ranking around the 23rd position. Honey Tree Extracts has also been a close competitor, maintaining ranks in the mid to high 20s. Notably, Regulator experienced a drop from the 16th to the 22nd position by February 2026, suggesting potential opportunities for Hitz Cannabis to capitalize on shifting consumer preferences and improve its standing in the market.

Notable Products

In February 2026, Hitz Cannabis saw the Blackberry Kush Distillate Cartridge (1g) maintain its position as the top-performing product in the Vapor Pens category, with impressive sales of 2068 units. The Narnia RSO Syringe (1g) debuted strongly in the Concentrates category, securing the second rank. Blackberry Kush RSO (1g) improved its rank from fifth in January to third in February, indicating a resurgence in popularity. Gorilla Glue #4 Distillate Cartridge (1g) experienced a slight decline, moving from second place in January to fourth in February. Meanwhile, Bubba Kush RSO Syringe (1g) re-entered the rankings in fifth place after being absent in January, suggesting a renewed interest in this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.