Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

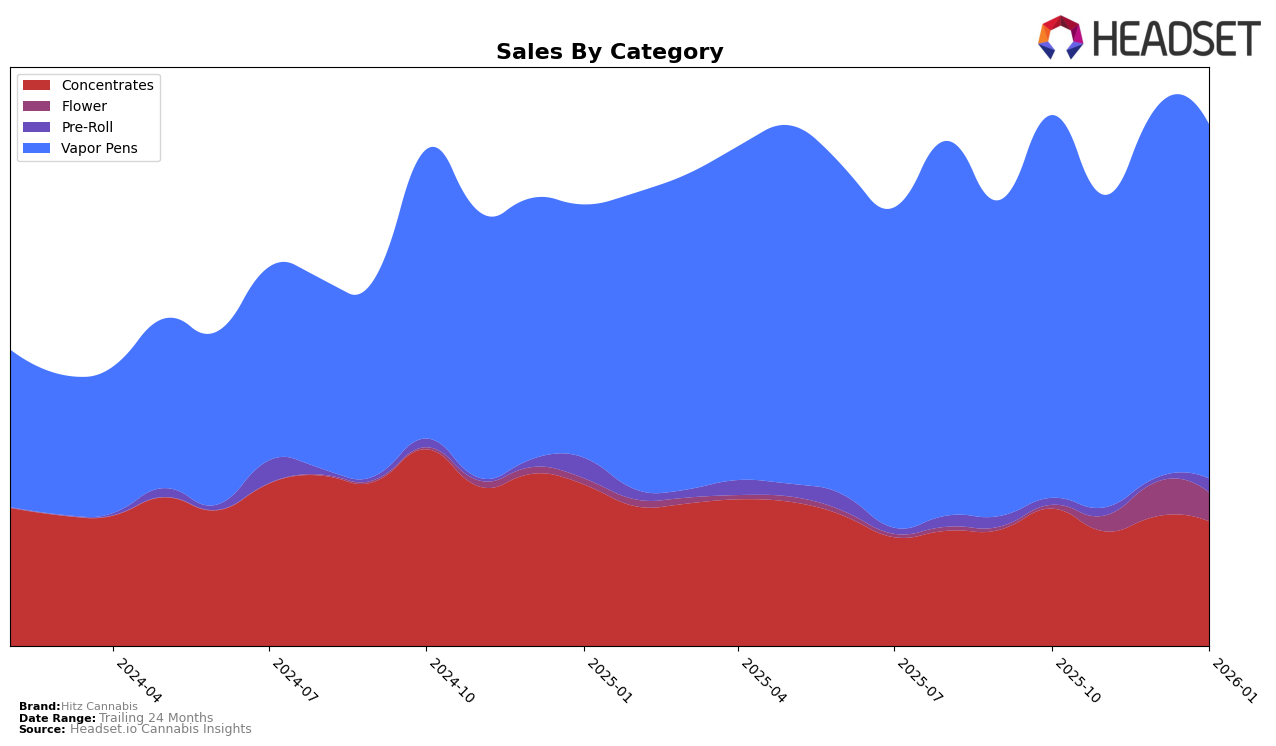

In the Washington market, Hitz Cannabis has shown varied performance across different product categories. In the Concentrates category, the brand saw a slight decline in its ranking from October 2025 to January 2026, moving from 17th to 22nd position. This downward trend suggests a potential challenge in maintaining its market share in Concentrates, although the sales figures indicate some resilience with a slight recovery in December 2025. The Vapor Pens category tells a slightly different story. Here, Hitz Cannabis managed to improve its position from 25th in November and December 2025 to 23rd by January 2026, indicating a positive trajectory despite not breaking into the top 20. This upward movement might reflect successful strategic adjustments in their product offerings or marketing efforts.

Interestingly, the absence of Hitz Cannabis from the top 30 in other states or categories could be seen as a missed opportunity or a strategic decision to focus on specific markets like Washington. The brand's performance in Washington's Vapor Pens category, with a notable increase in sales from November to December, suggests potential growth areas that could be capitalized upon. However, the lack of presence in other states or categories might indicate areas for expansion or improvement, as well as the need to evaluate competitive strategies. Such insights could be pivotal for stakeholders looking to understand the brand's market dynamics and potential future directions.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, Hitz Cannabis has experienced fluctuating rankings over the past few months, indicating a dynamic market presence. In October 2025, Hitz Cannabis was ranked 21st, but by November and December, it slipped to 25th, before slightly recovering to 23rd in January 2026. This volatility in rank suggests competitive pressure from brands like Oleum Extracts (Oleum Labs), which maintained a relatively stable position, and Freddy's Fuego (WA), which consistently ranked higher than Hitz Cannabis. Meanwhile, Bodhi High and Mama J's also present competitive challenges, with Mama J's notably climbing from 72nd in November to 25th by January. Despite these challenges, Hitz Cannabis's sales showed resilience, with a notable increase from November to December, although still trailing behind some competitors. This competitive environment underscores the need for Hitz Cannabis to innovate and differentiate to improve its market standing and capture more sales.

Notable Products

In January 2026, the top-performing product from Hitz Cannabis was the Blackberry Kush Distillate Cartridge (1g) in the Vapor Pens category, maintaining its first-place ranking from the previous months with a notable sales figure of 2130 units. The Gorilla Glue #4 Distillate Cartridge (1g) rose significantly in popularity, moving up to the second position from its fifth-place ranking in December 2025. The Blackberry Kush Distillate Disposable (1g) entered the rankings at third place, demonstrating strong performance. The LSD Distillate Cartridge (1g) appeared in the rankings for the first time, securing the fourth position. Meanwhile, the Blackberry Kush RSO (1g) in the Concentrates category dropped to fifth place from third, indicating a slight decline in sales momentum.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.