Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

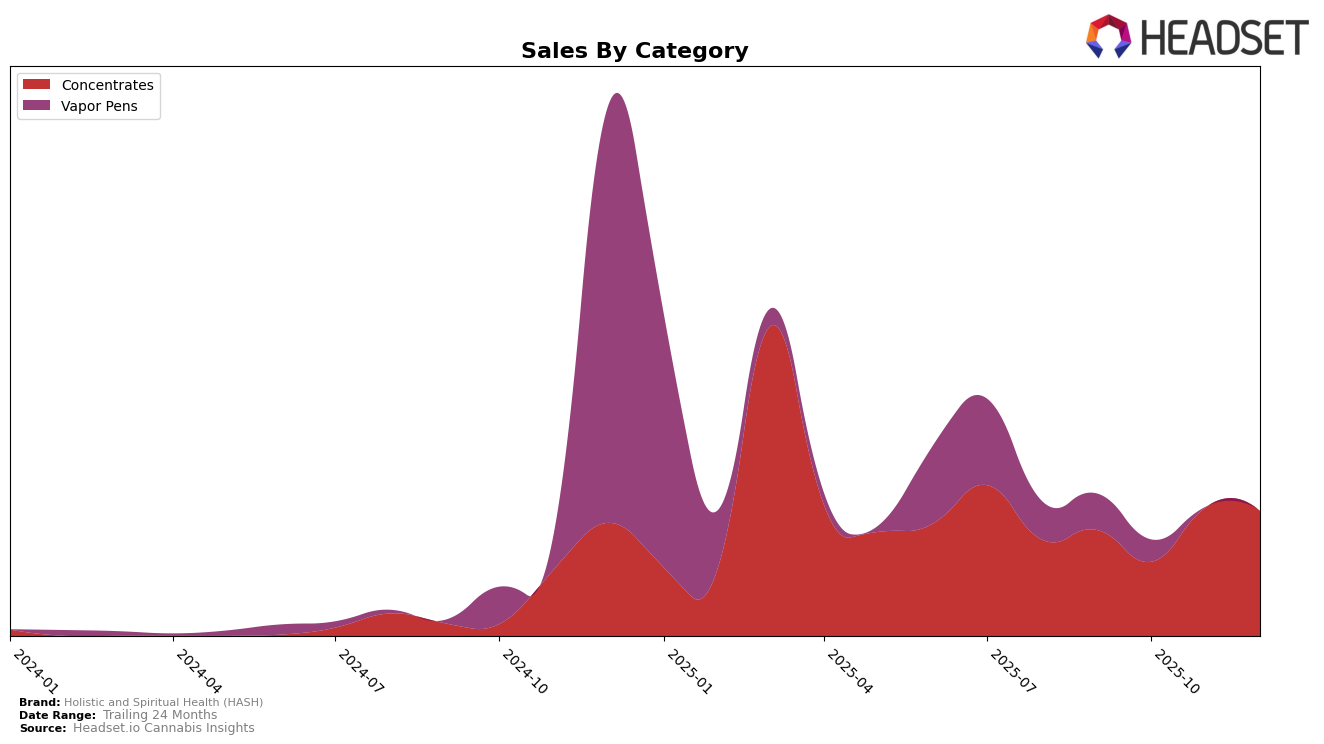

Holistic and Spiritual Health (HASH) has shown notable fluctuations in its performance across different states and categories. In Ohio, the brand has maintained a presence in the Concentrates category, albeit with varying rankings over the months. Starting at rank 27 in September 2025, HASH experienced a dip to rank 30 in October, but then improved to rank 24 in November, before settling at rank 28 in December. This indicates a degree of volatility in their market position, yet also suggests resilience and potential for recovery. The sales figures reflect this movement, with a significant increase from October to November, which could be attributed to strategic marketing efforts or seasonal demand shifts.

While HASH managed to stay within the top 30 in Ohio's Concentrates category, the absence of rankings in other states or categories suggests challenges in gaining traction beyond this specific market. Being out of the top 30 in other regions might highlight areas where the brand could focus on strengthening its presence or diversifying its product offerings. Such gaps in performance could be seen as opportunities for growth if HASH can leverage its existing strengths and adapt to the preferences of consumers in other states. The data points to a brand that is actively navigating the complexities of the cannabis market, with a particular foothold in Ohio's Concentrates sector.

Competitive Landscape

In the Ohio concentrates market, Holistic and Spiritual Health (HASH) has experienced fluctuating rankings over the last few months, indicating a dynamic competitive landscape. Notably, in December 2025, HASH ranked 28th, showing a slight decline from its November position of 24th, despite a consistent sales performance. This shift can be attributed to the competitive pressures from brands like Ancient Roots, which maintained a higher rank at 22nd in December, and HZ, which, despite a drop to 27th, still managed to stay ahead of HASH. Meanwhile, Josh D and Hijinks were not in the top 20, suggesting that HASH's competitive challenges are primarily from brands like Ancient Roots and HZ. This competitive environment highlights the need for HASH to strategize effectively to regain and maintain a stronger market position in Ohio.

Notable Products

In December 2025, Holistic and Spiritual Health (HASH) saw Cake Crasher Live Rosin Badder (1g) maintain its top position in the Concentrates category, with a notable sales figure of 215 units. Lollipopz Live Resin Sugar (1g) held steady at the second rank, showing consistent performance since its debut in November. Cake Crasher Live Resin Badder (1g) remained at the third spot, reflecting a stable demand over the months. Cherry Mintz Rosin Badder (1g) climbed back to fourth, having dropped out of the rankings in November, indicating a resurgence in popularity. Lollipopz Sugar Wax (1g) entered the rankings at fifth in November and maintained its position in December, suggesting a growing interest among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.