Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

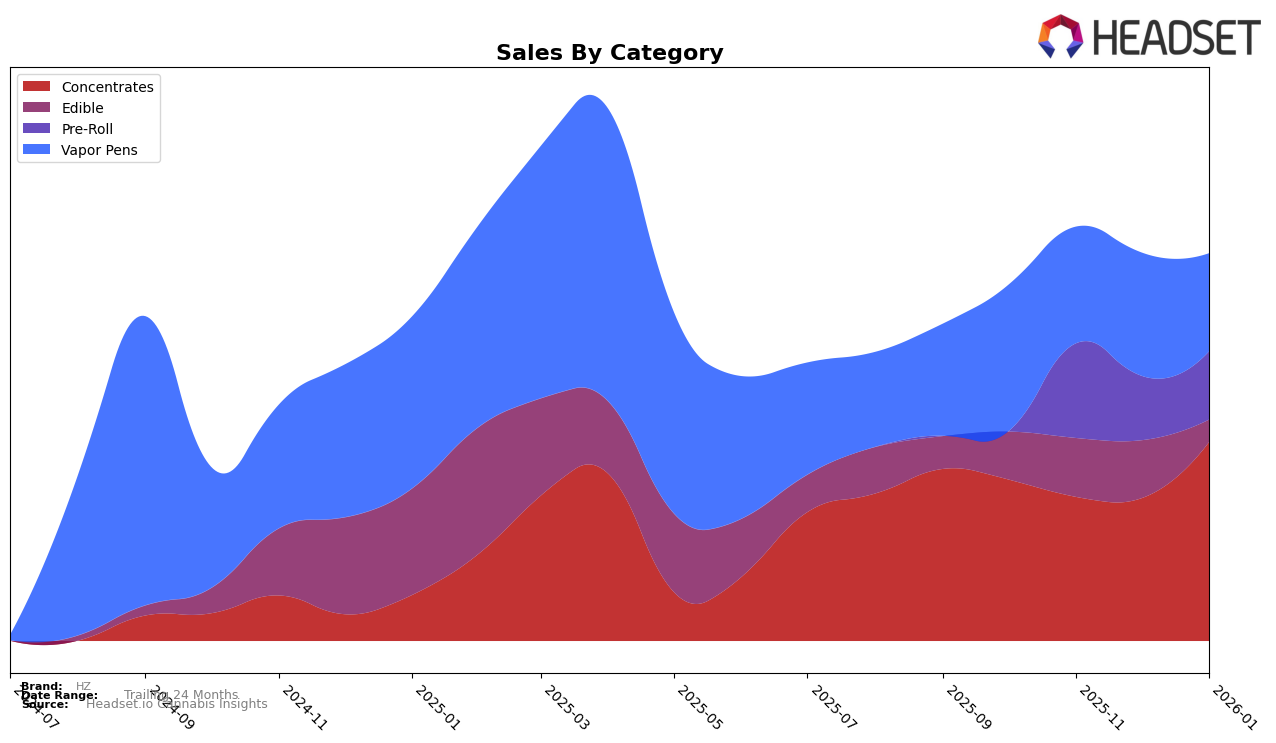

In Ohio, HZ has shown varied performance across different product categories. Notably, in the Concentrates category, HZ demonstrated a positive upward trend, improving its rank from 24th in December 2025 to 19th by January 2026. This is a significant movement given the competitive nature of the market, accompanied by a substantial increase in sales during this period. Conversely, the Edible category presents a challenge for HZ, as it struggled to break into the top 30 by January 2026, indicating potential areas for growth or reevaluation of strategy in this segment. The Pre-Roll category also saw a decline in performance, with HZ dropping out of the top 30 by January, which could suggest shifting consumer preferences or increased competition.

Vapor Pens in Ohio tell a slightly different story, with HZ maintaining a relatively stable ranking around the high 60s. Despite this consistency, sales figures indicate a downward trend, signaling a need for strategic adjustments to regain momentum in this category. The varied performance across these categories highlights the dynamic nature of the cannabis market in Ohio and underscores the importance of targeted strategies to capitalize on growth opportunities while addressing areas of decline. This snapshot provides a glimpse into HZ's market positioning, offering insights into its strengths and potential areas for improvement, but leaves room for deeper exploration into the factors driving these trends.

Competitive Landscape

In the Ohio concentrates market, HZ has shown a notable improvement in its competitive positioning over the past few months. Starting from a rank of 22 in October 2025, HZ climbed to 19 by January 2026, indicating a positive trend in market presence. This upward movement is significant when compared to competitors like Josh D, which fluctuated outside the top 20, and CannAscend | HASH, which saw a decline in sales from November to January. Meanwhile, Ancient Roots and Pure Ohio Wellness maintained relatively stable ranks, with Pure Ohio Wellness consistently outperforming HZ in sales. Despite this, HZ's sales growth in January 2026 suggests a strengthening market position, potentially driven by strategic marketing efforts or product innovations that appeal to Ohio consumers.

Notable Products

In January 2026, the top-performing product for HZ was Square Dance Live Rosin Infused Pre-Roll (1g) in the Pre-Roll category, which ascended to the number one rank. Jealous Mind Live Rosin Infused Pre-Roll (1g) dropped from its previous top position to second place, with notable sales of 179 units. In the Concentrates category, both New York Cheesecake Live Rosin Badder (0.5g) and White Strawberry Live Rosin Badder (1g) shared the second rank, marking their debut on the list. Belly Laugh Infused Pre-Roll (1g) entered the rankings at third place, showcasing a strong performance. These shifts indicate a dynamic change in consumer preferences within the brand's offerings from previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.