Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

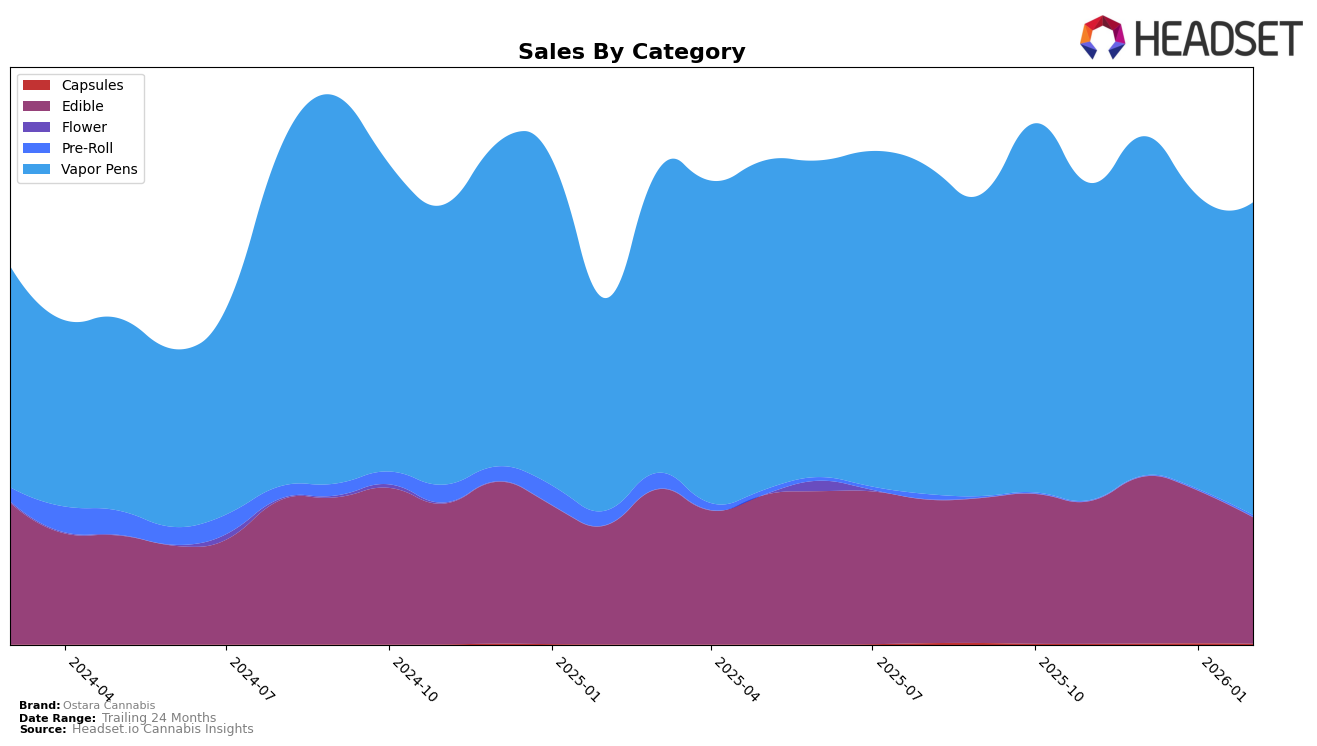

Ostara Cannabis has shown a consistent presence in the Missouri market, particularly within the Edible and Vapor Pen categories. In the Edible category, the brand maintained a steady ranking, holding the 13th position from November 2025 through February 2026, with a slight improvement to 12th in January 2026. This indicates a relatively stable performance, though the drop in sales from December 2025 to February 2026 suggests some volatility. Meanwhile, in the Vapor Pens category, Ostara Cannabis exhibited more dynamic movement, fluctuating between the 11th and 13th positions over the same period. This suggests a competitive landscape in the Vapor Pens market, where Ostara Cannabis is managing to hold its ground despite the challenges.

It's noteworthy that Ostara Cannabis did not fall out of the top 30 rankings in either category, which speaks to its consistent market presence in Missouri. The brand's highest sales were recorded in December 2025 for Vapor Pens, indicating a peak in consumer demand during that period. However, the subsequent decrease in sales suggests that maintaining momentum post-holiday season could be an area for strategic focus. The absence of rankings outside the top 30 in any category indicates that Ostara Cannabis is performing well relative to its competitors, though there is room for improvement to climb higher in the rankings.

Competitive Landscape

In the competitive landscape of vapor pens in Missouri, Ostara Cannabis has shown a consistent presence, maintaining a rank between 11th and 13th from November 2025 to February 2026. Despite not breaking into the top 10, Ostara Cannabis has demonstrated resilience, especially when compared to brands like Vibe Cannabis (MO), which fluctuated between 11th and 13th place, and Kushy Punch, which saw a drop from 8th to 12th place. However, Ostara Cannabis faces stiff competition from Rove, which consistently ranks higher, maintaining a position between 6th and 9th, and Indi Vapes, which has also outperformed Ostara Cannabis with rankings between 8th and 10th. The sales trends indicate that while Ostara Cannabis is holding steady, there is room for growth, particularly in increasing market share to compete more effectively with these higher-ranked brands.

Notable Products

In February 2026, Ostara Cannabis's top-performing product was Sour Variety Gummies 10-Pack (100mg) in the Edible category, maintaining its first-place rank for four consecutive months with sales of 5317 units. The THC/CBG 1:1 Rise Variety Sour Gummies 10-Pack (100mg THC, 100mg CBG) held steady in second place, mirroring its consistent performance since November 2025. Gold Variety High Dose Gummies 10-Pack (200mg) also retained its third-place ranking, continuing its streak without any shifts in position. Gold Super High Dose Variety Sour Gummies 25-Pack (750mg) and THC/CBN 5:2 Rest Variety Sour Gummies 10-Pack (100mg THC, 40mg CBN) occupied the fourth and fifth spots respectively, with no changes in their rankings from January 2026. Overall, the top five products have shown remarkable stability in their rankings, reflecting sustained consumer preference for these offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.