Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

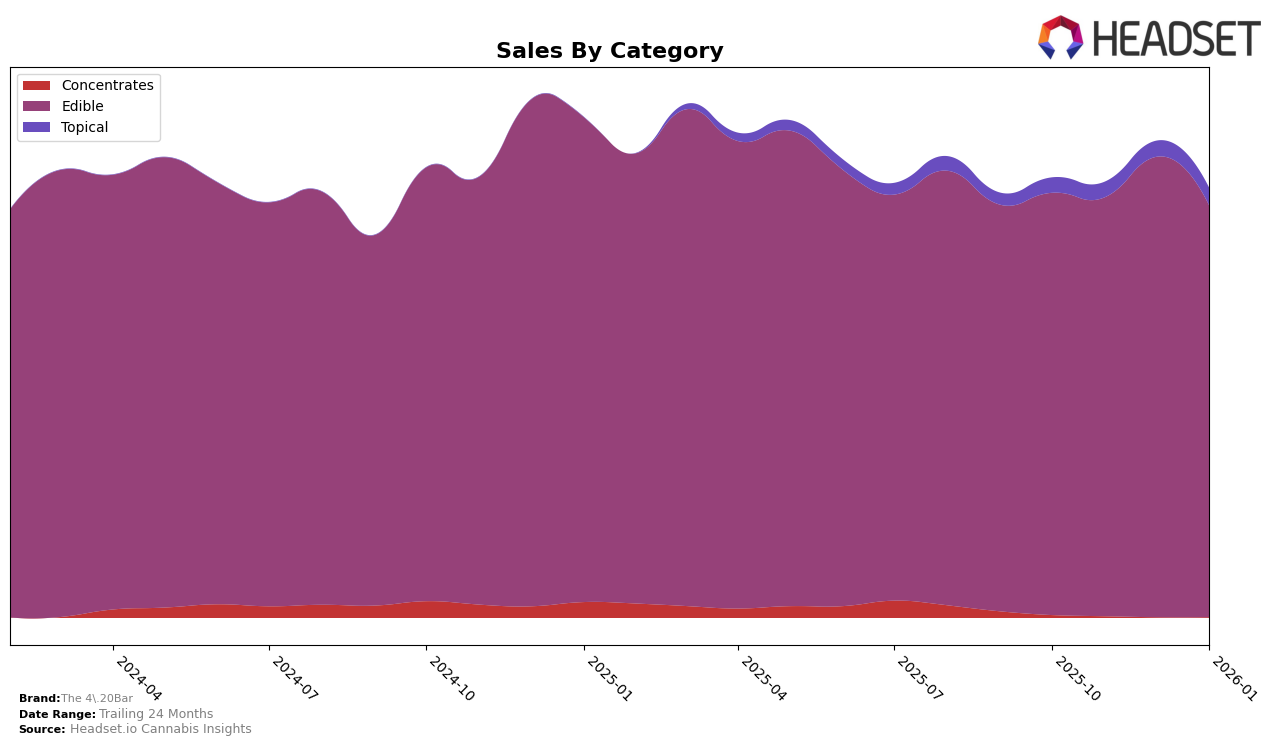

The 4.20Bar has shown a consistent performance within the Edible category in Washington, maintaining a steady rank of 13 from October 2025 through January 2026. Despite the consistency in ranking, there was a noticeable fluctuation in sales figures, with a peak in December 2025. This peak suggests a possible seasonal trend or successful promotional activity during that period. However, the subsequent dip in January 2026 indicates a return to more typical sales levels, which could be an area for strategic improvement to sustain higher sales post-holiday season.

It's important to note that The 4.20Bar did not appear in the top 30 brands in any other states or provinces during this timeframe, which could be seen as a limitation in their market penetration outside of Washington. This lack of presence suggests potential opportunities for expansion and growth in new markets. The brand's stable performance in Washington might serve as a strong foundation to leverage when considering entry strategies into other markets to diversify their geographic footprint and reduce dependence on a single state.

Competitive Landscape

In the competitive landscape of the Washington edible cannabis market, The 4.20Bar has consistently maintained its position at rank 13 from October 2025 through January 2026. Despite a stable rank, The 4.20Bar faces stiff competition from brands like Mr. Moxey's and Cormorant, which have consistently ranked higher. Notably, Mr. Moxey's improved its rank from 12 to 11 by December 2025, while Cormorant experienced a slight decline from 11 to 12 in the same period. Meanwhile, Marmas and Constellation Cannabis remained consistently below The 4.20Bar, indicating a stable competitive edge over these brands. The 4.20Bar's sales saw a peak in December 2025, but a decline in January 2026 suggests a need for strategic adjustments to maintain its market position and potentially climb the ranks amidst fluctuating competitor dynamics.

Notable Products

In January 2026, the top-performing product from The 4.20Bar was the Minis - CBG/CBC/CBD/THC 1:1:1:1 Dark Chocolate Sea Salt Bites 10-Pack, maintaining its first-place rank since October 2025 with sales of 1873 units. Following closely, the Minis - CBD/THC 1:1 Dark Chocolate Sea Salt Bites 10-Pack held steady in second place throughout the same period. The Minis - CBG/CBC/CBD/THC 1:1:1:1 Milk Chocolate Bites 10-Pack consistently ranked third since October 2025. Notably, the CBD/CBN/THC 2:2:1 Minis Dark Chocolate Sea Salt Bites moved up to fourth place from its previous fifth position in December 2025. Lastly, the Minis - CBG/CBC/CBD/THC 1:1:1:1 Milk Chocolate Hemp Crunch Bites entered the top five for the first time in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.