Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

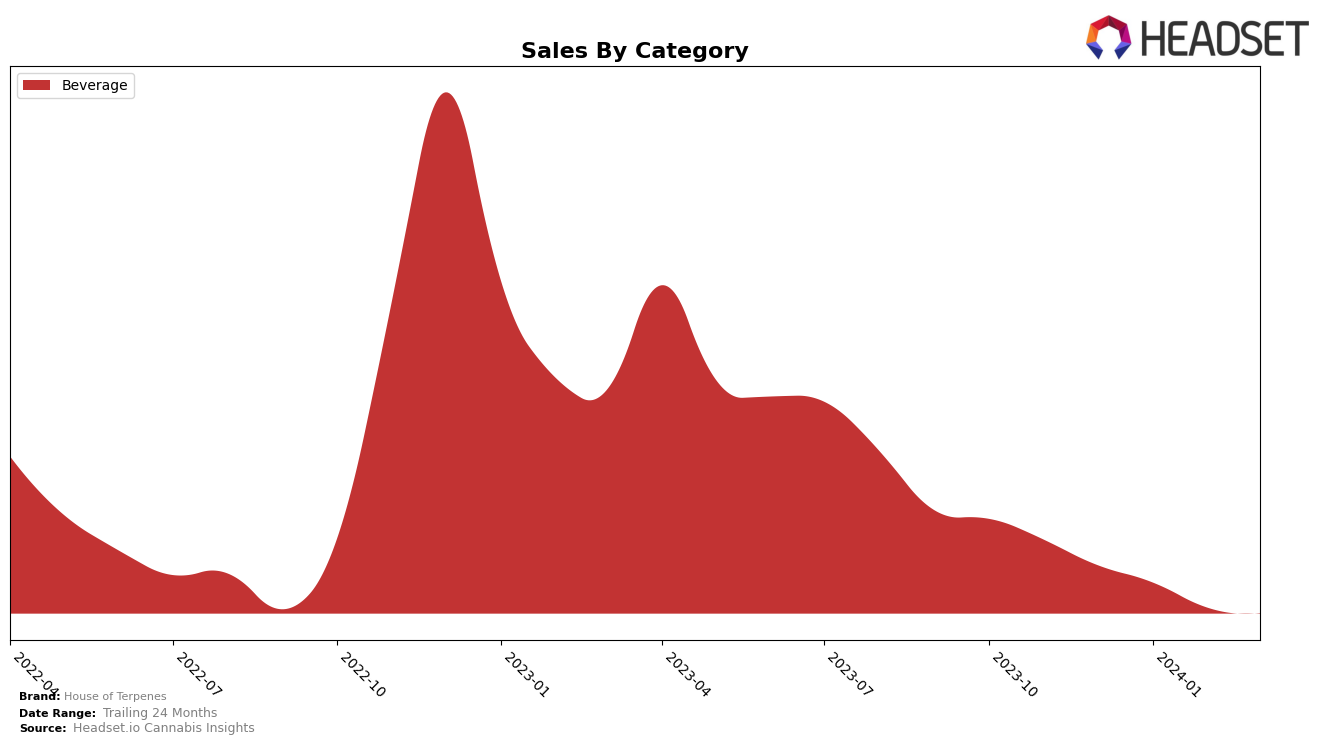

In the competitive cannabis beverage sector, House of Terpenes has shown varied performance across different provinces in Canada, with notable movements in rankings and sales. In Alberta, the brand experienced a slight improvement in rankings from December 2023 to January 2024, moving from 26th to 24th, before dropping to 30th in February and March 2024. This fluctuation is mirrored in their sales, which peaked in January at 3,654, before significantly declining in the following months. Conversely, in Saskatchewan, House of Terpenes maintained a more stable performance, with rankings hovering around the 18th to 19th positions from December 2023 through March 2024, though it also saw a decline in sales over the same period. This stability in rankings, despite a drop in sales, suggests a consistent market presence in Saskatchewan.

On the other hand, in Ontario, the brand struggled to make a significant impact, with rankings outside the top 30 brands for the entire period observed, indicating a challenge in penetrating this market. This is highlighted by a gradual decline in sales from December 2023 through March 2024. Meanwhile, in British Columbia, the brand's performance was somewhat stagnant, maintaining a mid-20s ranking in December 2023 and January 2024, before slightly declining to 27th in February, with no ranking available for March. This lack of data for March could imply either a sharp decline in performance or an absence from the competitive set, both of which are critical insights for stakeholders. These regional variances underscore the importance of tailored strategies for House of Terpenes to leverage strengths and address weaknesses in specific markets.

Competitive Landscape

In the competitive landscape of the beverage category in Ontario, House of Terpenes has experienced a gradual decline in rank from December 2023 to March 2024, moving from 35th to 43rd position. This shift indicates a challenging environment for the brand, as it has not only dropped in rank but also seen a decrease in sales over the same period. Notably, its competitors have shown varied performances; for instance, CANN Social Tonics initially held a strong position at 22nd in December but fell to 40th by March, experiencing a significant drop in sales. Conversely, Little Victory, despite a slight rank fluctuation, ended up closely ahead of House of Terpenes in March, ranking 42nd. This suggests that while House of Terpenes is facing downward pressure, the market dynamics are shifting, with some brands like Everie and The Green Organic Dutchman also experiencing challenges in maintaining or improving their market positions. The overall trend for House of Terpenes and its competitors points towards a highly competitive market with fluctuating consumer preferences, underscoring the importance of strategic marketing and product innovation to stay relevant.

Notable Products

In March 2024, House of Terpenes saw its top product as the Canntinis - THC-SAR Sparkling Beverage (10mg THC, 236ml), maintaining its number one spot from February with sales figures reaching 351 units. Following closely, the Canntinis - Ginger Lime Mule Sparkling Water (10mg THC, 236ml) secured the second rank, despite being the top seller in January. The third position was held by Canntinis - Cranberry Cosmos Citrus Sparkling Water (10mg THC, 236ml), consistently staying in the top three over the past months. Notably, the CBD/THC 1:1 Myrcene Sparkling Tonic (5mg CBD, 5mg THC 355ml) rose to the fourth rank, showing a steady increase in its ranking since December. Meanwhile, the CBD/THC 1:1 Limonene Sparkling Tonic (5mg CBD, 5mg THC, 355ml) also demonstrated a gradual improvement in its standing, moving up to the fifth position in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.