Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

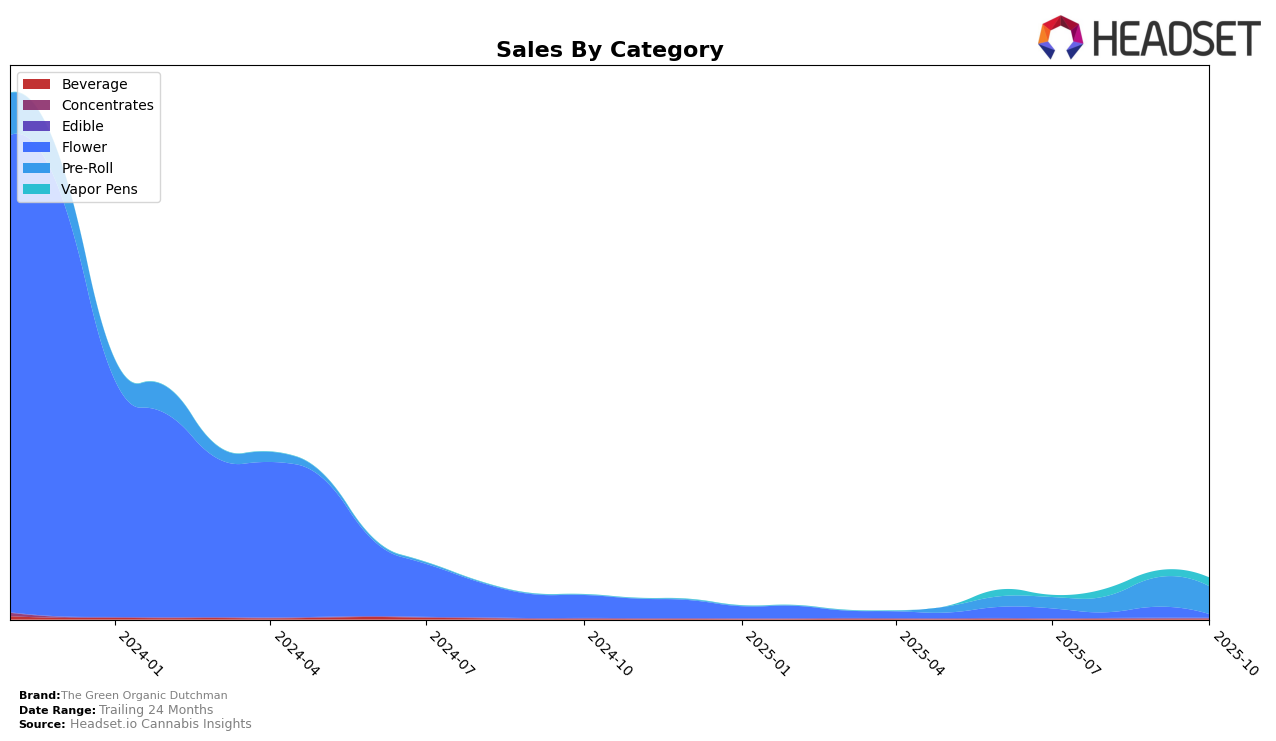

The Green Organic Dutchman has shown varying performance across different categories and regions, indicating a dynamic presence in the cannabis market. In Alberta, the brand's performance in the Pre-Roll category is noteworthy. Although the brand did not secure a position in the top 30 rankings from July to October 2025, this could suggest a struggle to maintain competitive standing in a crowded market. This absence from the top 30 may indicate challenges in market penetration or consumer preference shifts within the province, highlighting potential areas for improvement or strategic adjustment.

Despite the lack of top rankings in Alberta, The Green Organic Dutchman continues to be a recognizable name, suggesting that there is still consumer interest and potential for growth. While specific sales figures for each month are not fully disclosed, the available data shows that the brand's sales in Alberta for October 2025 were recorded at CAD 30,165. This figure, although not directly linked to top-ranking positions, provides a glimpse into the brand's market presence and potential revenue streams. The brand may benefit from exploring innovative strategies or product differentiation to regain or establish a stronger foothold in the competitive cannabis market.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Alberta, The Green Organic Dutchman has faced notable challenges in maintaining its market position. As of October 2025, The Green Organic Dutchman ranked 99th, indicating a struggle to break into the top 20 brands in this category. In contrast, competitors like Palmetto and GORILLA GARDEN CRAFT CANNABIS & EXTRACTS have shown stronger performance, with Palmetto peaking at 84th in August 2025 and GORILLA GARDEN maintaining a consistent presence in the top 100, even reaching 81st in September. Meanwhile, Big Bag O' Buds has consistently outperformed, securing a 47th rank in September. These trends highlight the competitive pressures The Green Organic Dutchman faces, particularly from brands that have shown the ability to climb the ranks and sustain higher sales figures, suggesting a need for strategic adjustments to enhance its market presence.

Notable Products

In October 2025, The Green Organic Dutchman's top-performing product was the Granddaddy Purp Infused Pre-Roll 10-Pack (10g) in the Pre-Roll category, maintaining its first-place rank from September. The Sugar Plum Infused Pre-Roll 5-Pack (2.5g) climbed back to second place with notable sales of 241 units. The Unicorn Blood Distillate Cartridge (1g) improved its ranking to third place in the Vapor Pens category, showing a recovery from fourth in September. The Organic Maple Kush Pre-Roll 3-Pack (1.5g) dropped to fourth place, despite slightly increasing sales figures. Lastly, the Juicy Fuel Live Resin Disposable (1g) entered the top five, marking a return to the rankings after an absence in September.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.