Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

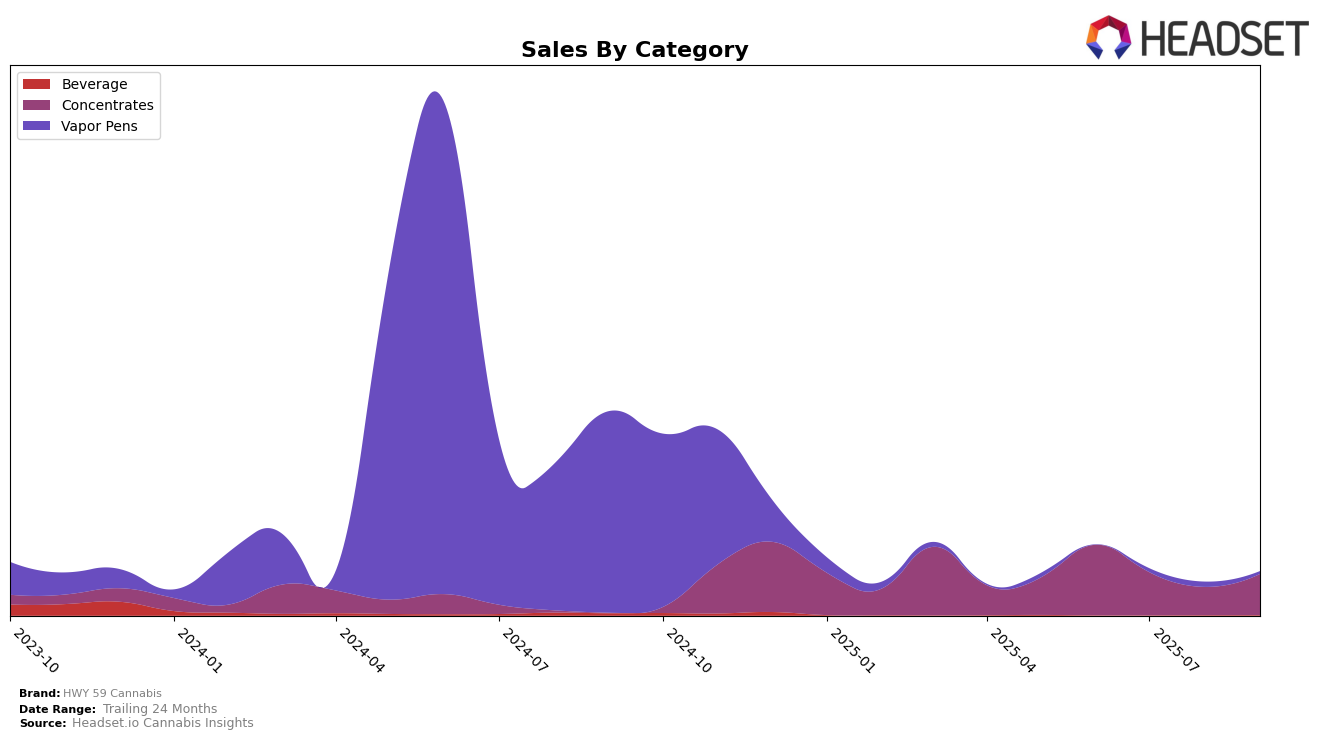

HWY 59 Cannabis has shown a strategic presence in the Saskatchewan market, particularly in the concentrates category. In June 2025, the brand achieved a noteworthy position, ranking 14th, with sales amounting to $11,377. However, the subsequent months of July, August, and September did not see HWY 59 Cannabis maintaining a top 30 presence in this category, potentially signaling a competitive landscape or shifts in consumer preferences. This drop-off in ranking suggests that while the brand had a promising start, sustaining momentum in the Saskatchewan market could be challenging.

Focusing on the broader market trends, the absence of HWY 59 Cannabis from the top 30 rankings in the following months highlights the volatility and competitiveness within the concentrates category. This pattern could indicate either a change in strategic focus for HWY 59 Cannabis or increased competition from other brands in the region. The initial success in June suggests potential, but the lack of continued presence in the rankings underscores the need for strategic adjustments to regain market share. Observing how HWY 59 Cannabis adapts in coming months will be crucial for understanding their long-term positioning in Saskatchewan's cannabis market.

Competitive Landscape

In the Saskatchewan concentrates market, HWY 59 Cannabis experienced a notable absence from the top 20 rankings from July to September 2025, after securing the 14th spot in June. This decline in visibility contrasts with competitors like North 40 Cannabis and Encore Supply Co, who maintained their presence in the rankings throughout the same period, albeit with fluctuating positions. Roilty Concentrates also saw a downward trend, dropping from 3rd in June to 18th by September, yet still remained in the top 20. The absence of HWY 59 Cannabis from the rankings during these months suggests a potential decline in market share and sales, highlighting the need for strategic adjustments to regain competitive positioning in this dynamic market.

Notable Products

In September 2025, Hybrid Diamond Dust (1g) from HWY 59 Cannabis emerged as the top-performing product, reclaiming its number one position in the Concentrates category with sales of 279 units. Sativa Shatter (1g) maintained its strong presence by ranking second, although its sales have slightly decreased compared to previous months. The Jealousy Kush Live Terp Diamond Cartridge (1g) stayed consistent at third place in the Vapor Pens category. Notably, the Caramel Hot Chocolate Drink Mix 2-Pack (10mg) rose to fourth place, showing a steady improvement in its rank since July. Strawberry Cough Distillate Dabber (1g) did not appear in the rankings for September, indicating a potential drop in demand or availability.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.