Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

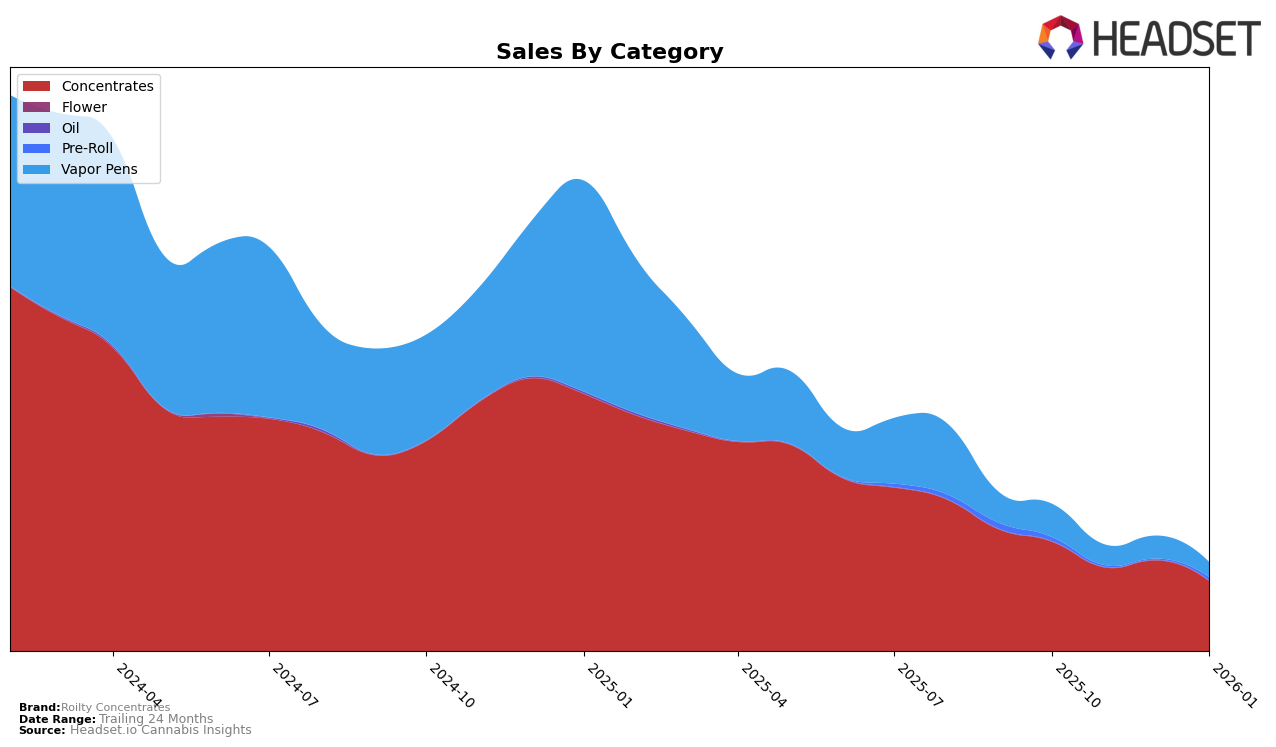

In the province of Alberta, Roilty Concentrates has shown some fluctuations in their rankings within the Concentrates category. Notably, the brand was ranked 11th in October 2025, but experienced a drop to 16th by November, before climbing back to 12th in December, and then falling again to 16th in January 2026. This indicates a somewhat volatile performance in this category, although they have consistently remained within the top 20. In the Vapor Pens category, however, Roilty Concentrates struggled to break into the top 30, with rankings of 74th, 83rd, and 82nd, and even failing to make the top 30 in December. This suggests that while they have a foothold in the Concentrates market, there is significant room for improvement in the Vapor Pens sector.

Meanwhile, in Ontario, the brand's performance in the Concentrates category has been on a downward trajectory, slipping from 20th in October 2025 to 35th by January 2026. This decline in ranking suggests challenges in maintaining market share amid increasing competition or changing consumer preferences. The Vapor Pens category presents a similar story, with Roilty Concentrates failing to make a significant impact, as evidenced by rankings of 75th, 96th, 77th, and 99th over the same period. The brand's inability to consistently rank within the top 30 in this category across both provinces highlights a potential area for strategic focus and growth.

Competitive Landscape

In the Alberta concentrates market, Roilty Concentrates experienced fluctuating rankings from October 2025 to January 2026, showing resilience amidst a competitive landscape. Starting at rank 11 in October 2025, Roilty Concentrates dropped to 16 in November, rebounded to 12 in December, but fell back to 16 in January 2026. This volatility contrasts with the steady rise of RAD (Really Awesome Dope), which improved from rank 19 in October to 14 by January, indicating a consistent upward trend. Meanwhile, Lord Jones experienced a decline from rank 6 to 19 over the same period, suggesting a potential shift in consumer preferences or competitive pressures. Western Cannabis and Headstone Cannabis also showed dynamic rank changes, with Headstone notably jumping from outside the top 20 to rank 8 in November before settling at 17 in January. These insights highlight the competitive challenges Roilty Concentrates faces, emphasizing the need for strategic adjustments to maintain and improve its market position.

Notable Products

In January 2026, White Knight Sugar Wax (1g) from Roilty Concentrates reclaimed its top spot, achieving the number one rank with sales of 618 units. Queen Bee Kush Shatter (1g) made a strong debut, securing the second position. Purple Dream Sugar Wax (1g), which had previously led in December 2025, dropped to third place. Roil - Lemon Haze Live Resin (1g) improved its standing from fifth to fourth, while Kings Kush Live Resin (1g) entered the rankings at fifth. The changes in rankings highlight a dynamic shift in consumer preferences, with White Knight Sugar Wax regaining its popularity after a dip in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.