Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

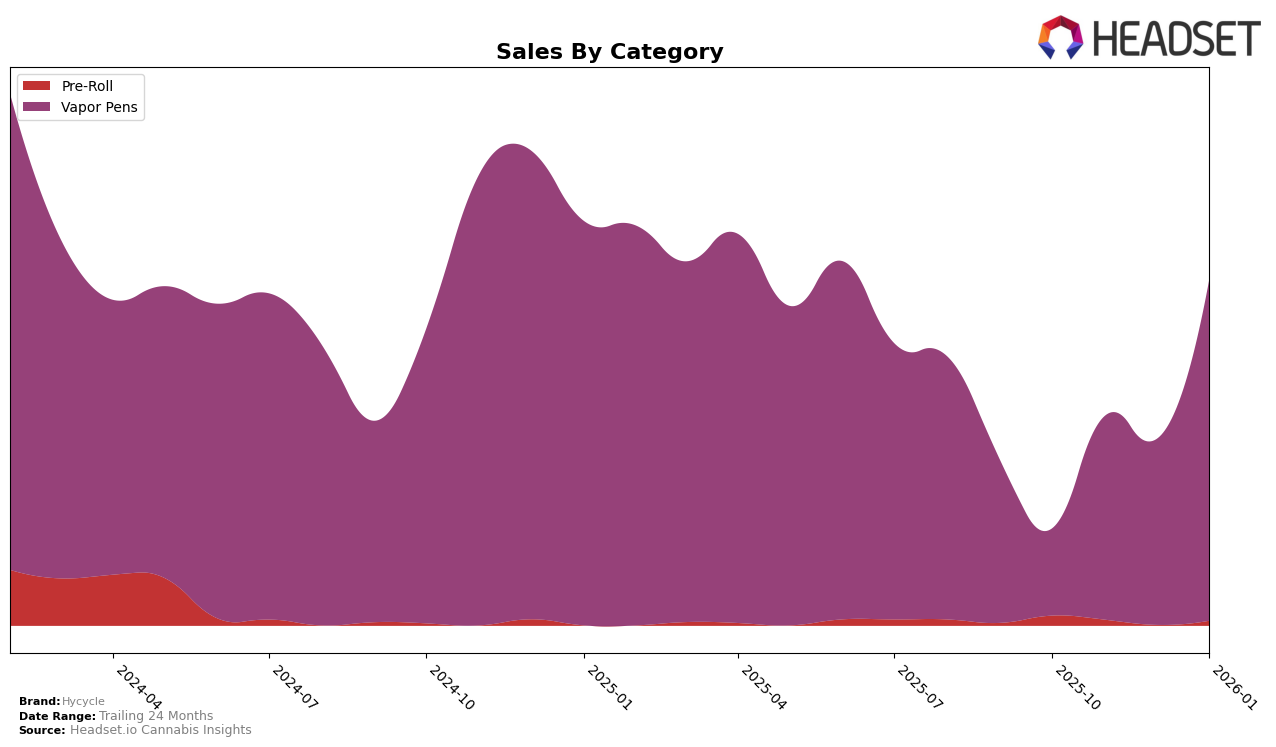

Hycycle has shown a promising upward trend in the Vapor Pens category within British Columbia. Starting from a rank of 42 in October 2025, they have climbed steadily to reach the 25th position by January 2026. This improvement is underscored by their sales growth, which saw a significant increase from $33,501 in October to $115,461 in January. Such a leap indicates a strong market presence and an effective strategy in this region. However, in Ontario and Saskatchewan, Hycycle did not make it to the top 30 in the same category for the last three months of 2025, only appearing in January 2026 with a rank of 74 and 33, respectively. This suggests potential areas for growth and market penetration strategies that could be explored further.

The absence of Hycycle in the top 30 rankings in Ontario and Saskatchewan for October, November, and December 2025 might be indicative of either a late entry into these markets or challenges in gaining traction against established competitors. The appearance in January 2026 with a rank of 74 in Ontario and 33 in Saskatchewan highlights a potential breakthrough that could be built upon. The sales figures in these regions, although not disclosed for the earlier months, suggest that there is room for improvement and that Hycycle may need to bolster their marketing efforts or adjust their product offerings to better meet consumer demands in these provinces. Exploring the reasons behind the delayed entry into the rankings could provide valuable insights for future strategic planning.

Competitive Landscape

In the competitive landscape of vapor pens in British Columbia, Hycycle has shown a notable upward trajectory in its market position, climbing from a rank of 42 in October 2025 to 25 by January 2026. This improvement in rank is indicative of a positive shift in sales performance, with Hycycle's sales peaking in January 2026. In contrast, Glacial Gold and Good Buds have also experienced upward trends, but their ranks remain slightly below Hycycle's recent performance, with Glacial Gold at 26 and Good Buds at 27 in January 2026. Meanwhile, Wildcard Extracts has seen a decline from a high rank of 5 in October 2025 to 24 by January 2026, suggesting a potential opportunity for Hycycle to capture more market share if this trend continues. Additionally, DEALR re-entered the top ranks in December 2025, achieving a rank of 23 by January 2026, which could pose a competitive challenge for Hycycle moving forward. These dynamics highlight the competitive pressures and opportunities within the vapor pen category in British Columbia, emphasizing the importance of strategic positioning for Hycycle to maintain and enhance its market presence.

Notable Products

In January 2026, the top-performing product from Hycycle was the Northern Lights Live Resin Cartridge (1.1g) in the Vapor Pens category, maintaining its first-place rank from December 2025 with sales of 2338 units. The Limonene No. 9 Live Resin Cartridge (1g) continued to hold the second position, following its rise from third place in November 2025. Sour Diesel Distillate Cartridge (1.1g) settled at third, having previously been the top product in October 2025. A new entry, Ace - Limonone No 9 Live Resin Disposable (1g), debuted at fourth place, showing strong initial sales. Grandaddy Purple Distillate Cartridge (1.1g) rounded out the top five, moving up from its fourth position in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.