Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

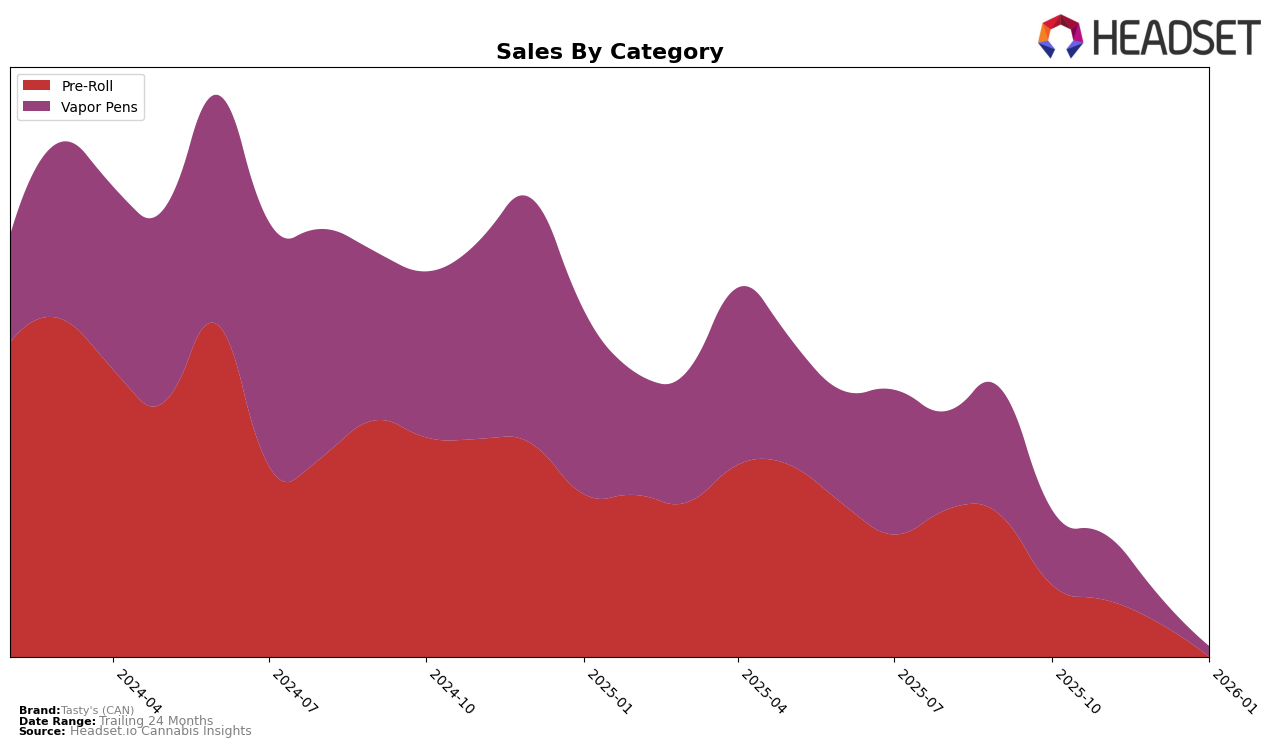

Tasty's (CAN) has experienced notable shifts in its performance across Canadian provinces, particularly in the Pre-Roll and Vapor Pens categories. In Alberta, the brand's Pre-Roll products saw a decrease in rank from 43rd in October 2025 to 71st by January 2026, indicating a declining presence in the top 30. This trend is mirrored in their Vapor Pens category, which fell from 25th to 38th over the same period. In contrast, Saskatchewan shows a more stable performance for Pre-Rolls, maintaining a relatively high rank of 26th in October and November 2025, although dropping out of the top 30 by January 2026. Meanwhile, their Vapor Pens in Saskatchewan remained within the top 30, albeit with minor fluctuations, ending at 30th in January 2026.

In British Columbia, Tasty's (CAN) Pre-Rolls and Vapor Pens have struggled to maintain a strong foothold, with neither category breaking into the top 30 ranks during the observed months. The Pre-Rolls ranked as high as 67th in October 2025 but fell to 86th by January 2026, while Vapor Pens saw a similar decline from 56th to 67th. In Ontario, the brand's Pre-Rolls were unable to sustain a top 30 position, dropping out by January 2026, whereas their Vapor Pens hovered around the 50th mark, peaking at 47th in November 2025 and ending at 51st in January 2026. These movements reflect a challenging market environment for Tasty's (CAN) across these provinces, with significant room for growth and strategic adjustments needed to enhance their competitive standing.

Competitive Landscape

In the competitive landscape of Vapor Pens in Ontario, Tasty's (CAN) has experienced fluctuating rankings from October 2025 to January 2026, indicating a dynamic market presence. Starting at 48th place in October, Tasty's (CAN) improved slightly to 47th in November but then dropped to 53rd in December before recovering to 51st in January. This volatility contrasts with competitors like Glacial Gold, which consistently improved its rank from 58th to 46th, and Phyto Extractions, maintaining a steady position around the 49th mark. Meanwhile, Tweed and Potluck both experienced declines, with Tweed falling from 44th to 54th and Potluck fluctuating between 47th and 52nd. These movements suggest that while Tasty's (CAN) faces challenges in maintaining a stable rank, there is potential for growth if it can capitalize on the declining trends of some competitors and the overall market dynamics.

Notable Products

In January 2026, Tasty's (CAN) saw significant success with its Blue Raspberry Distillate Cartridge (1.2g) leading as the top-performing product, climbing from third place in December 2025. The Peach Infused Pre-Roll 3-Pack (1.5g) maintained strong performance, holding the second rank despite a noticeable drop in sales to 1164 units. Mango Diamond Infused Pre-Roll 3-Pack (1.5g) secured the third spot, showing a consistent upward trend from fifth in October 2025. The newly introduced Strawberry Ice Diamond Infused Pre-Roll 3-Pack (1.5g) entered the rankings at fourth place, indicating a promising potential. Blue Raspberry Infused Pre-Roll 3-Pack (1.5g), although dropping to fifth, remains a staple in the pre-roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.