Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

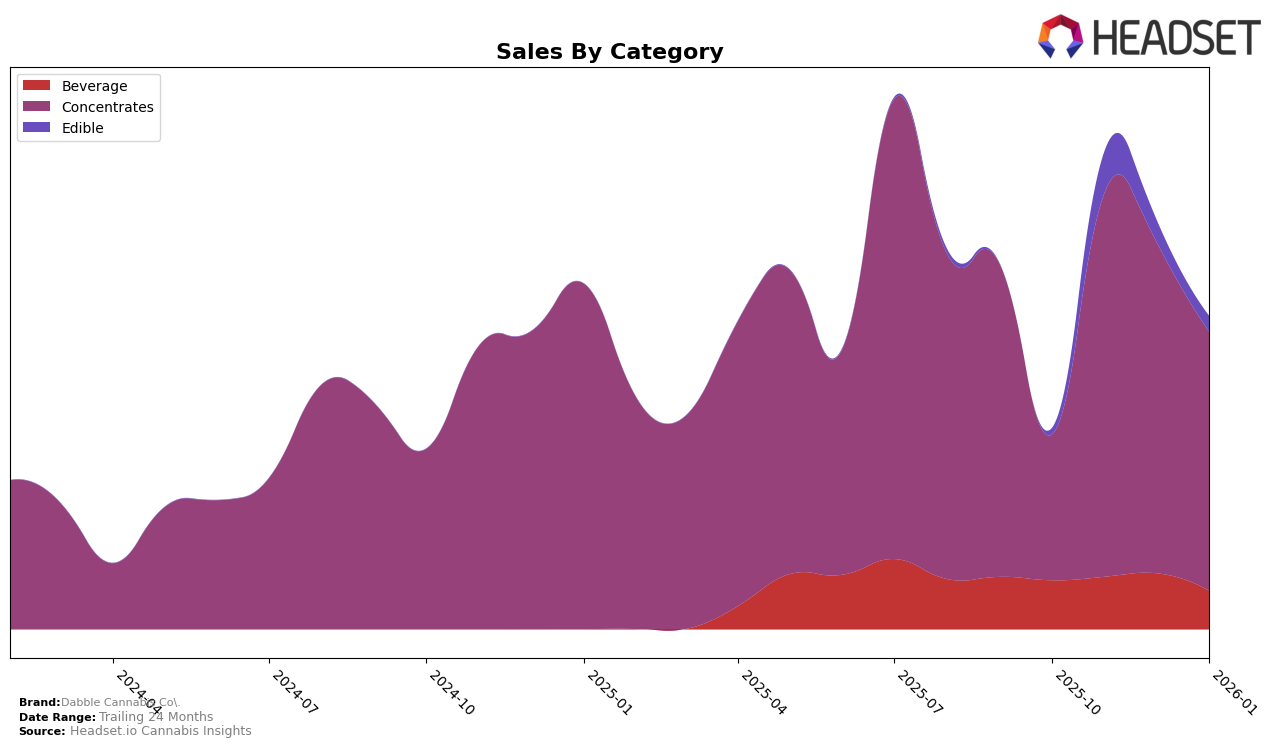

Dabble Cannabis Co. has shown varied performance across different categories in British Columbia. In the Beverage category, the brand experienced a slight decline in ranking, moving from 7th in October 2025 to 14th by January 2026. This could be indicative of increased competition or shifting consumer preferences in this segment. Despite this downward trend in ranking, their sales figures in this category were relatively stable until January, when a notable dip occurred. Interestingly, in the Edible category, Dabble was not ranked in the top 30 in October 2025, but managed to secure a position by November, although they did not maintain a strong presence, falling to 22nd by December.

The Concentrates category in British Columbia has been a stable stronghold for Dabble Cannabis Co., consistently holding the 3rd position from October 2025 to January 2026. This consistency suggests a strong brand presence and consumer loyalty in this category, possibly due to product quality or effective marketing strategies. However, it is crucial to note that while the ranking remained unchanged, sales peaked in November and then saw a decline in the following months. This trend could be worth investigating further to understand the dynamics affecting sales despite a stable ranking position. Overall, while Dabble Cannabis Co. has shown resilience in some areas, there are opportunities for growth and improvement, particularly in the Beverage and Edible categories.

Competitive Landscape

In the competitive landscape of concentrates in British Columbia, Dabble Cannabis Co. has maintained a consistent rank of 3rd place from October 2025 to January 2026. Despite this stability, the brand faces significant competition from Endgame, which has consistently held the top position, and Vortex Cannabis Inc., which climbed to 2nd place in November 2025 and has maintained that position since. Meanwhile, Nugz (Canada) has shown a notable upward trajectory, moving from 8th place in November 2025 to 4th place by January 2026, indicating a potential future threat to Dabble's position. Additionally, Brindle Farms experienced a decline from 1st place in October 2025 to 5th place by January 2026, suggesting a shift in consumer preferences that Dabble could capitalize on. While Dabble Cannabis Co. has maintained its rank, the fluctuating sales figures, particularly the decline from November 2025 to January 2026, suggest a need for strategic adjustments to enhance competitiveness and capture market share from these dynamic competitors.

Notable Products

In January 2026, the top-performing product for Dabble Cannabis Co. was the Strawberry Jam Raspberry Sparkling Lemonade (10mg THC, 355ml) in the Beverage category, maintaining its rank as the number one product for four consecutive months, despite a decrease in sales to 1764 units. The Strawberry Jam Gummies 2-Pack (10mg) emerged as the second-best product in the Edible category, marking its debut in the rankings. The Mexicola Live Hash Rosin (1g) secured the third position in the Concentrates category, showing a notable increase in sales from previous months. The Strawberry Jam Live Rosin (1g) and Dabbleberry Live Rosin (1g) held the fourth and fifth ranks, respectively, both experiencing a slight drop in their rankings compared to earlier months. Overall, the product rankings highlight a strong performance in beverages, with emerging interest in edibles and consistent sales within concentrates.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.