Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

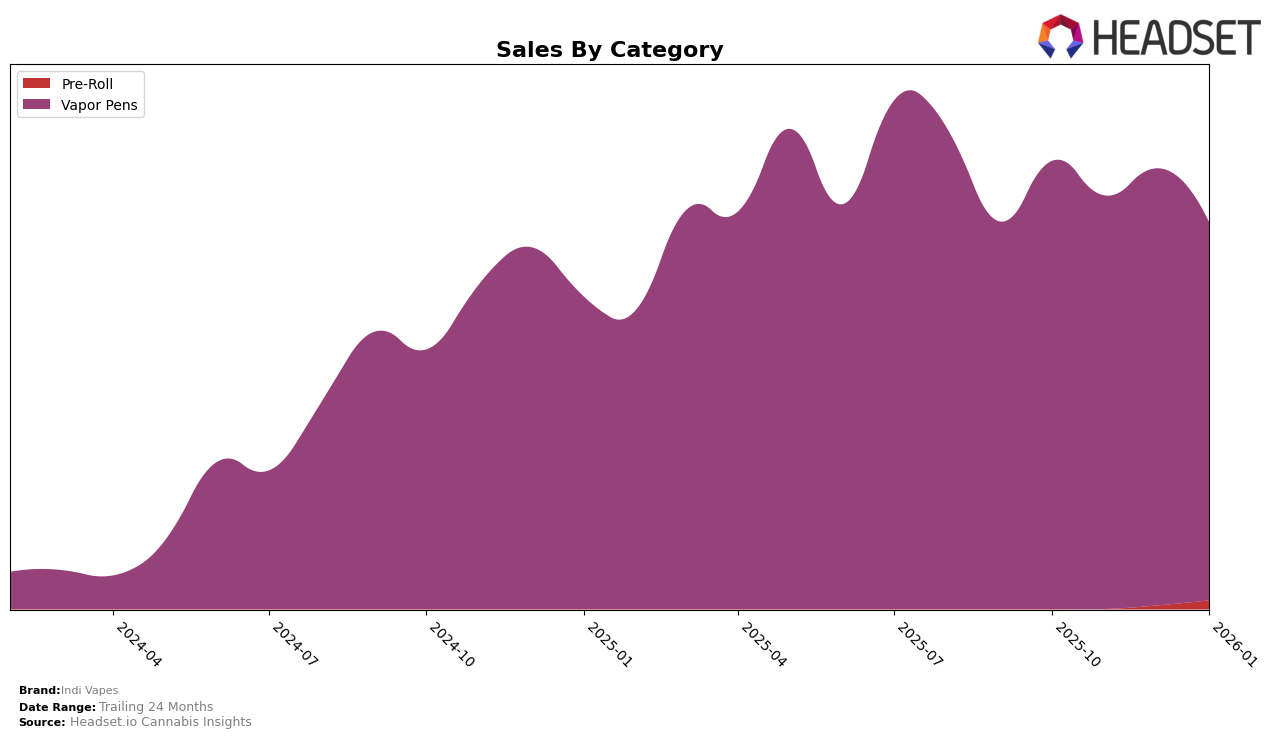

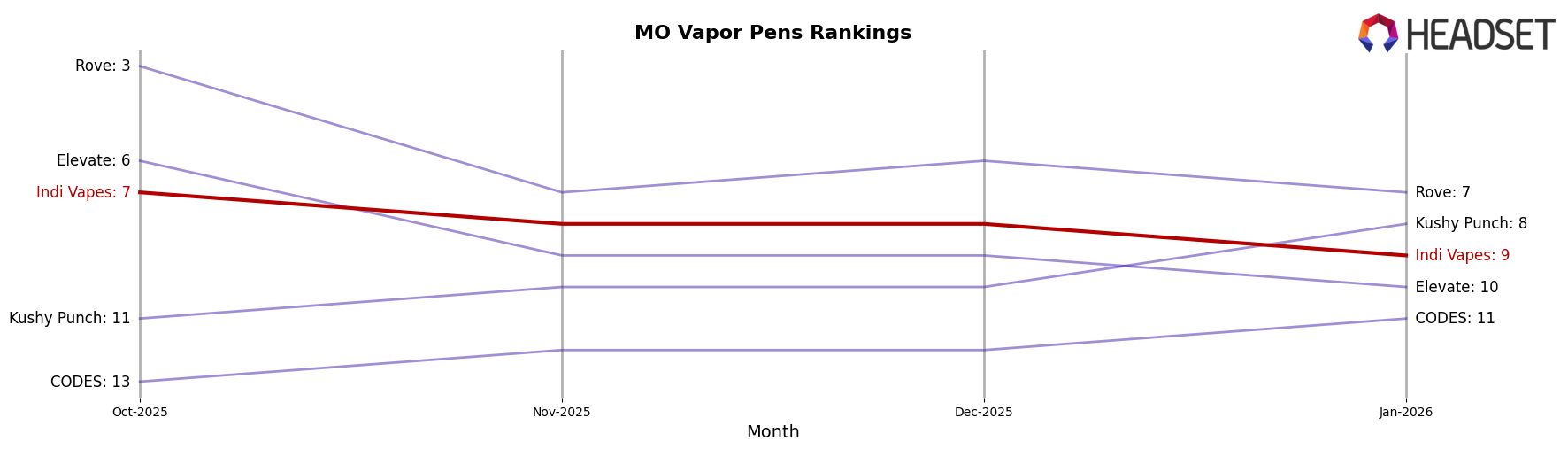

Indi Vapes has shown a mixed performance across its product categories and geographical markets. In the state of Missouri, the brand has maintained a consistent presence in the Vapor Pens category, with rankings fluctuating slightly from 7th in October 2025 to 9th by January 2026. This indicates a stable yet slightly declining position within a competitive market. However, the brand's performance in the Pre-Roll category in Missouri is less promising, as it did not place within the top 30 brands, highlighting a potential area for growth or reconsideration of strategy.

The sales data further underscores these trends, with Vapor Pens experiencing a gradual decrease in sales over the observed period, dropping from approximately $1.4 million in October 2025 to around $1.18 million by January 2026. This decline suggests challenges in maintaining market share or possibly increased competition. The absence of Indi Vapes from the top rankings in the Pre-Roll category could suggest a lack of market penetration or consumer preference in Missouri, presenting a potential opportunity for the brand to explore strategic initiatives to enhance its presence in this segment.

Competitive Landscape

In the competitive landscape of Vapor Pens in Missouri, Indi Vapes has shown a consistent performance, maintaining a rank within the top 10 over the last few months, although it experienced a slight decline from 7th in October 2025 to 9th by January 2026. This shift in rank coincides with a decrease in sales, reflecting broader market trends. Notably, Rove has been a strong competitor, initially holding the 3rd position in October 2025 but dropping to 7th by January 2026, indicating a potential opportunity for Indi Vapes to reclaim higher ground. Meanwhile, Kushy Punch has shown upward momentum, climbing from 11th to 8th, which could pose a challenge if the trend continues. Elevate and CODES have maintained stable positions, suggesting a steady competitive environment. These dynamics highlight the importance for Indi Vapes to innovate and adapt to regain its earlier standing and boost sales in the Missouri market.

Notable Products

In January 2026, the top-performing product for Indi Vapes was the Strawberry Fields Distillate Disposable (1g) from the Vapor Pens category, maintaining its first-place ranking consistently across the previous months with sales reaching 5148 units. Polar Berry Distillate Disposable (1g) rose to second place compared to its fifth-place ranking in November 2025, indicating a positive trend in sales. Fresh Lemon Distillate Disposable (1g) secured the third position, showing a slight improvement from its fifth-place ranking in December 2025. Pineapple Guava Distillate Disposable (1g) remained stable at fourth place, while Peaches & Creme Distillate Disposable (1g) re-entered the top five this month. Overall, the Vapor Pens category continues to dominate the sales chart for Indi Vapes, with minor shifts in product rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.