Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

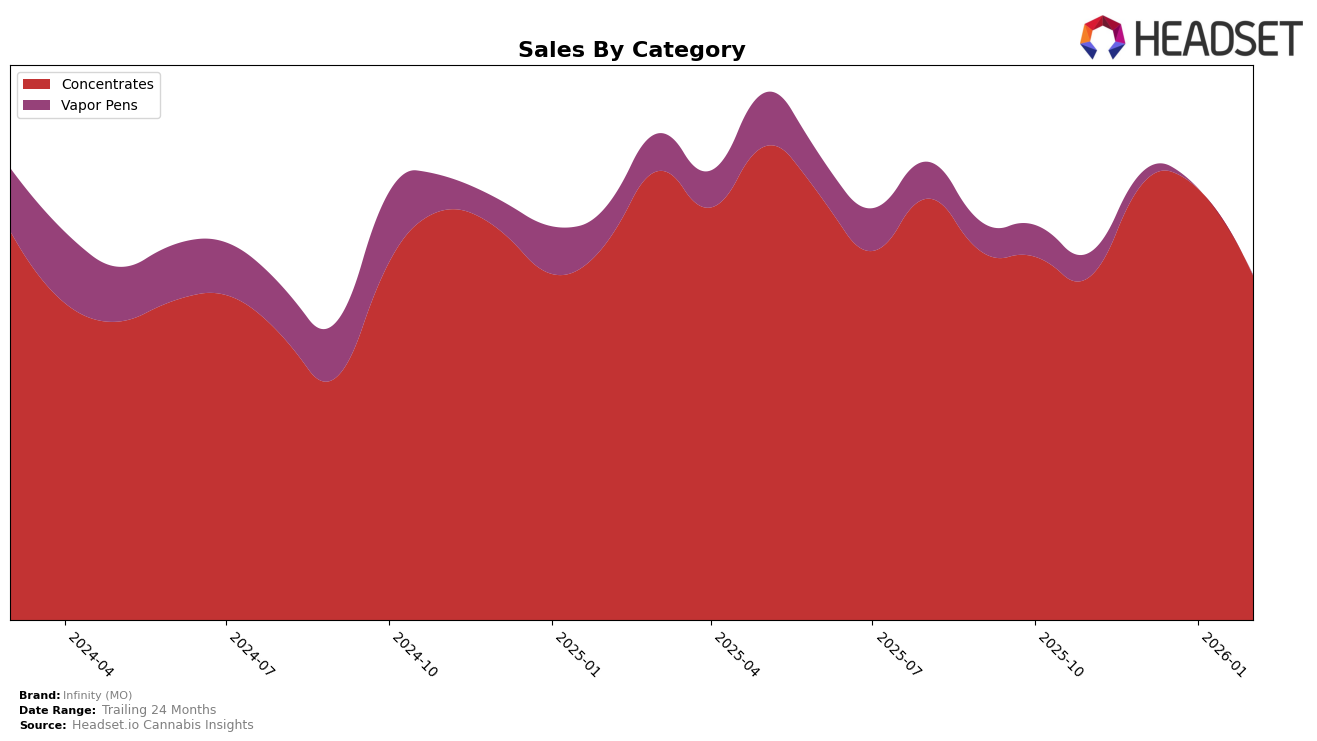

Infinity (MO) has demonstrated a strong performance in the Concentrates category within the state of Missouri. Over the months from November 2025 to February 2026, the brand consistently held a top position, ranking third in the last three months of this period. This stability in ranking suggests a solid consumer base and effective market strategies. Notably, Infinity (MO) saw a peak in sales in December 2025, indicating a potential seasonal demand or successful promotional activities during that time. The brand's ability to maintain its position in the top three highlights its competitiveness and strong presence in the Missouri concentrates market.

In contrast, the performance of Infinity (MO) in the Vapor Pens category within Missouri shows a different trend. The brand did not make it into the top 30 rankings in January and February 2026, which signifies a potential area of concern or opportunity for growth. The decline from 76th in November to 83rd in December 2025 reflects a downward trend that may require strategic adjustments to regain market share. This data suggests that while Infinity (MO) excels in the Concentrates category, there is room for improvement in their Vapor Pens offerings to better compete in the Missouri market.

Competitive Landscape

In the Missouri concentrates market, Infinity (MO) has maintained a stable position, consistently ranking third from December 2025 through February 2026. This stability suggests a strong foothold in the market, although it trails behind Vibe Cannabis (MO), which has consistently held the top rank, and Proper Cannabis, which has maintained the second position. Despite facing fierce competition, Infinity (MO) has shown resilience, especially against Head Change and Vivid (MO), both of which have fluctuated in their rankings. Notably, while Infinity (MO) saw a peak in sales in December 2025, it experienced a slight decline in February 2026, indicating potential challenges in maintaining sales momentum amidst a competitive landscape. This analysis highlights the importance for Infinity (MO) to strategize effectively to close the gap with the leading brands and sustain its market position.

Notable Products

In February 2026, the top-performing product for Infinity (MO) was Grape Cream Cake Cured Wax (1g), maintaining its number one rank for four consecutive months, although its sales decreased to 847 units. Mac Cured Wax (1g) held steady at the second position since December 2025, with a slight dip in sales figures. Lemon Drop Cured Wax (1g) emerged in February as a new entry at the third rank, indicating a strong market reception. Cali Cocktail Cured Wax (1g) followed closely behind at the fourth position, while Tokyo Lights Cured Wax (1g) remained consistent in fifth place for two months. Overall, the rankings show stability for the top two products, with new entries gaining traction in February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.